Bank of Montreal (TSX:BMO)(NYSE:BMO) kicked off earnings season for the banks yesterday. In a nutshell, it was a pretty phenomenal report. Adjusted net income soared almost 80%. Return on equity rose nicely, and CEO Darryl White spoke of even better things to come going forward.

Canadian bank stocks soldier on to new heights

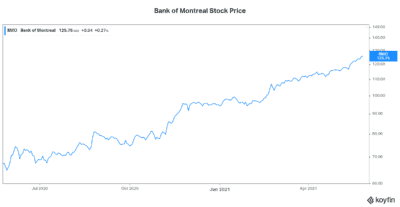

Bank stocks have really soared to new heights since the pandemic hit, which was unexpected. In contrast, we feared that sharply rising loan losses would hit the banking system hard. BMO stock, for example, has soared more than 30% in 2021 to new all-time highs.

Today, Canadian banks are in the best shape yet. Not only have bank stock prices soared to all-time highs, but their financial strength is indisputable. Let’s take a look at what’s shaping up to be another strong earnings season for Canadian banks.

BMO stock: A solid earnings result takes it higher

Expectations for the Bank of Montreal’s earnings this quarter were high, albeit the bank easily beat them. Net income increased 77%, adjusted EPS doubled and loan loss provisions were stable. In fact, they were better than stable, as BMO reported a recovery on provisions of performing loans.

The loan loss situation today is therefore not as bad as the banks had feared. Canadians made it through the pandemic relatively well. Fiscal stimulus and government support made all the difference. In fact, not only did the consumer make it through, but many are even thriving. Deposits are up at BMO, reflecting highly liquid consumer balance sheets.

Bank of Montreal expects strong GDP growth in 2021

According to Bank of Montreal management, the economic recovery is set to accelerate this year and next. This is the result of “fiscal stimulus, pent-up demand, and elevated household savings.” So we are undoubtedly entering a period of strong growth. BMO is expecting a 6.5% growth rate in U.S. real gross domestic product (GDP) in 2021, which would be the strongest expansion in 37 years. In Canada, the expectation is for 6% GDP growth.

Is GDP growth already reflected in stock prices?

I’ve already touched on the fact that Canadian bank stocks like BMO stock are trading at all-time highs. This is a reflection not only of their strength but also of rampant optimism. After a year-and-half of fear, stress, and uncertainty, it’s little wonder. People want to feel optimistic. But are they bidding stock prices up too high?

I mean, let’s say that the banks will report phenomenal results in 2021. That’s great. But if the expectations that are priced into bank stocks are even more phenomenal, they will go down. The return on any given stock is a function of its valuation. If its valuation reflects an even better future than what the reality will be, the stock will falter.

Bank earnings season continues this week, with TD Bank and Royal Bank expected to report as well.

The bottom line

In summary, I think the key takeaway here is that Canadian banks are thriving. We have seen this in Bank of Montreal’s Q2 results. We’ll see more of it when the other Canadian banks report. The economic recovery is taking shape. Confidence is high and activity is rising. This has implications not only for banks but also for all economically sensitive companies.