It’s almost mid-year 2021, and the North American market is in a strong recovery from the COVID-19 pandemic slump. Although bond yields are recovering, five- and 10-year bond yields remain too low under 1.3%, yet there are growing fears of near-term inflation after April prices rose at their fastest pace since May 2011.

Buying into reliable high-income yields remains a reasonable strategy for income investors on the TSX. This is especially so if the income is expected from a diversified portfolio of real estate properties across North America. Real estate values usually rise with inflation, and rentals could adjust too.

There’s one such possible portfolio addition for June.

Nexus REIT: An industrial property powerhouse in the making

Nexus Real Estate Investment Trust (TSX:NXR.UN) is a growth-oriented diversified REIT that owns a portfolio of industrial, office, and retail properties in North America.

The trust has been very active in the property acquisitions market after growing its portfolio from just 66 properties comprising 3.7 million square feet of leasable area by March 2019 to over 82 properties comprising 5.7 million square feet of gross leasable space by the end of April this year.

Portfolio growth is good, but it’s Nexus REIT’s strategic direction that is noteworthy right now.

The trust is fast growing into a predominantly industrial REIT. Its portfolio’s net operating income (NOI) contribution from industrial properties has increased from 61% by March 2020 and is expected to reach 70% after the conclusion of ongoing acquisition transactions.

Industrial REITs are the market’s favourite, and they have been for some time. The market is willing to pay a premium on industrial REITs, and pure industrial property trusts like Summit Industrial Income REIT, Dream Industrial REIT trade at premiums as high as 33% to net book value.

As the contributions from retail and office properties shrink in Nexus’s portfolio, so should be the current 10% discount to the trust’s net asset value.

Given its low debt-to-assets ratio of 45.8% exit March this year, the trust has more room to sustain its acquisitions-led growth spree from a combination of new debt and equity. The more industrial the trust’s portfolio becomes, the better its units may be perceived by investors. More capital gains are possible on NXR over the remainder of this year.

The juicy yield is shrinking fast

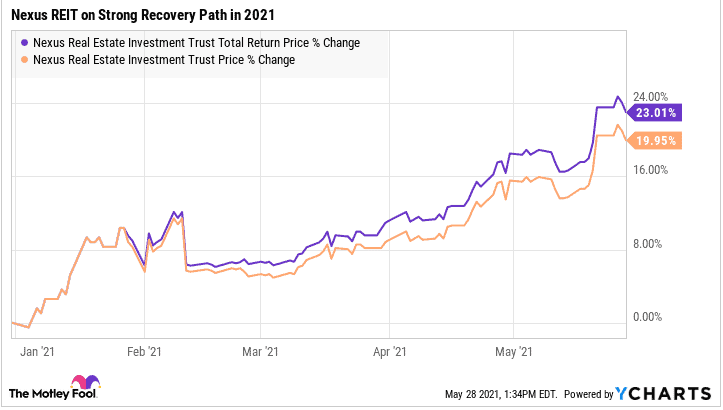

The trust pays a restored $0.053 monthly distribution that yields a juicy 6.8% annually. The yield has already shrunk from over 7.2% early this year due to rising unit prices.

Most noteworthy, the distribution remains safe, as the trust’s adjusted funds from operations payout rate remains reasonable at 87.7% during the past quarter. It may not be the safest distribution in the industry, but I wouldn’t worry about a cut anytime soon. The trust’s retail segment is recovering well from COVID-19 rent-collection challenges. Thanks to growing occupancy rates, new acquisitions, and improved rent collections, analysts expect Nexus’s rental income to grow by 47.4% year over year in 2021.

Most noteworthy, Nexus saw its portfolio occupancy rate increase to 94% by March, up from 93% at the end of 2020. The COVID-19 woes are subsiding fast.

It could pay to add Nexus REIT’s juicy 6.8% yield to an income portfolio in June. Gains could compound better in a Tax-Free Savings Account. Even better, the trust offers a distribution-reinvestment plan, which offers a 4% bonus to participants right now.