First, the bad news. Air Canada (TSX:AC) is still in a world of hurt. Air Canada stock and its recent earnings report weren’t full of great news. Not only did the company burn through an average of $14 million of cash per day during the last quarter, but it also expects that to continue through the summer. On top of that, Air Canada stock is likely to put a lot of its recent $5.9 billion government aid package towards refunds.

So why on earth would investors like me believe Air Canada stock is one of the best stocks to buy right now. Beyond that, that it could be one of the stocks that will double in 2021? Let’s dig in and find out why.

Short-term outlook

Investors are pretty bearish when it comes to the next few months for Air Canada stock. The company is an internationally-focused airline. The company reported that a mere 22% of its 2019 capacity was used for domestic Canadian flights and only 20% for U.S. trans-border capacity flights.

Beyond that, its previous strategy of flying U.S. nationals on long-haul international routes with Canadian layovers now doesn’t apply. So what makes it one of the best stocks to buy right now?

In the short term, vaccines. The Canadian government is well on the way to reaching 75% of Canadians receiving the first dose of the COVID-19 vaccine by the summer. It’s even moving up second doses of the vaccine so that many will reach it before September.

This is a critical month for Air Canada stock. The company will want to allow travellers to travel for the holidays when it could see an enormous increase in revenue. A travel plan is expected any time now, and that could see shares in the company sky rocket before even September hits. So the vaccines are an enormous part of Air Canada stock and its recovery plan. This alone could make this one of the stocks that will double in 2021.

Future outlook

But the second long-term reason this stock could double this year is its finances. Air Canada stock managed to actually head into the COVID-19 crisis in better financial shape than many of its peers in the U.S. and beyond! True, it had and has billions in debt, but this was set to be managed through its investments. And that still applies.

So instead of focusing on its former business model, Air Canada stock is likely to shift focus toward domestic flights through its low-cost Rouge carrier. Meanwhile, it has also expanded to be a cargo carrier as it waits for worldwide vaccine distribution to return to long-haul leisure traffic.

Frankly, it’s unlikely the company will simply give up on this model. While this might mean the company will keep lower capacity longer until international travel demand increases, business travel and leisure travel are likely to recover to pre-pandemic levels. Once a vaccine is available, people will want to travel.

Why? In a word: saving. Canadians aren’t alone in using the pandemic to save and pay down debt. We are now entering a Roaring ’20s era where Canadians have money to blow and they want to spend it on travel. Leisure flights will be in high demand as long as travellers are vaccinated.

In fact, Air Canada stock management will be doubling its available seats next quarter, and that is only likely to increase from there. Meanwhile, it expects that not everyone will want a refund and hopes many will ask for travel vouchers instead. As well, long-term growth will remain stable from the acquisition of its popular Aeroplan frequent flyer miles rewards.

Bottom line

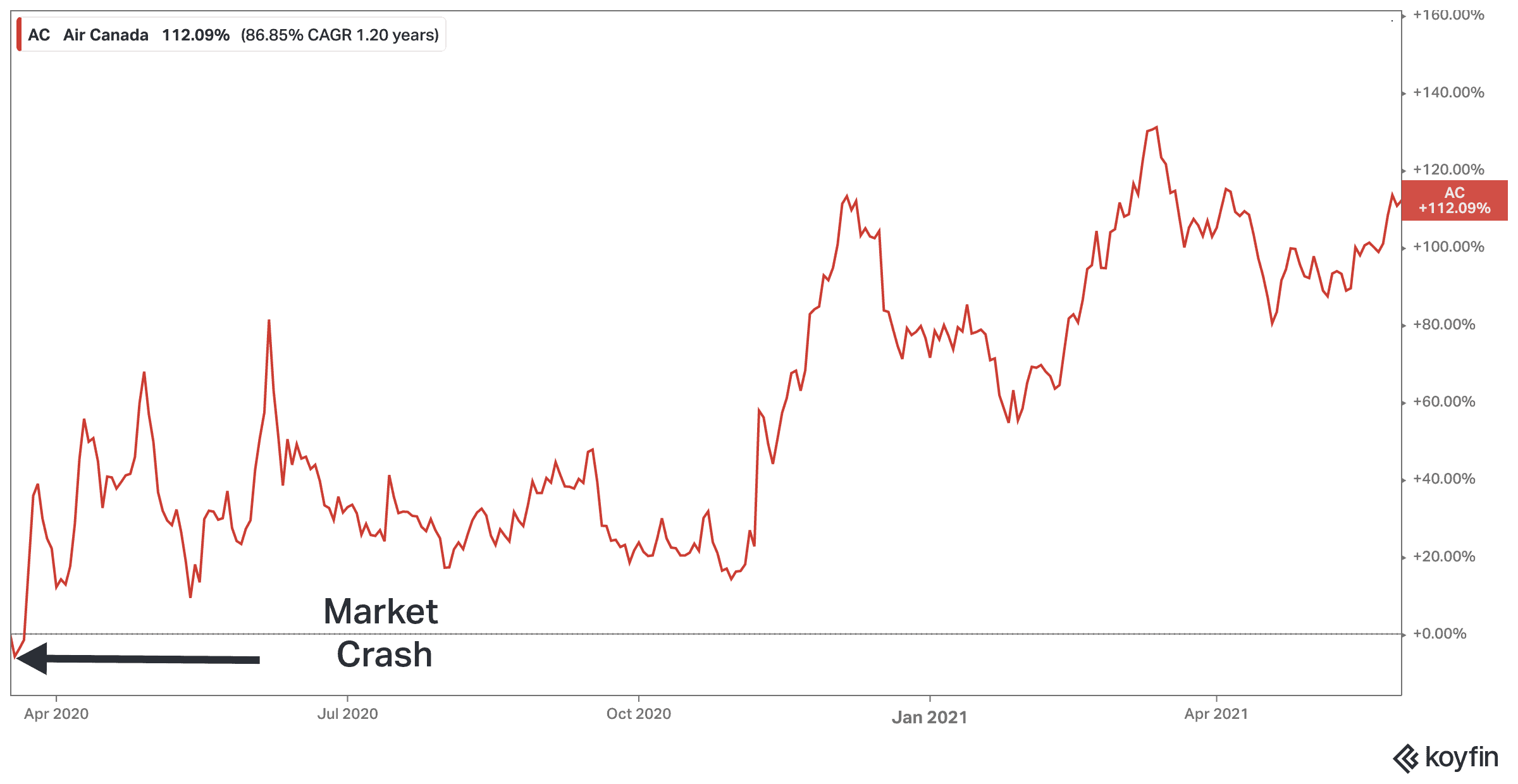

Air Canada stock is one of the best stocks to buy right now because of its short- and long-term path to growth. Its stability before the pandemic means it will see a significantly shorter recovery than its U.S. peers. As consumers become more comfortable with travelling during COVID-19, demand will increase. Shares are already up 71% this year alone. It’s therefore not a stretch to believe this is one of the stocks that will double in 2021.