Bitcoin and the whole cryptocurrency industry have been hot again lately, leading many of the crypto stocks to be big gainers the last week. Since July 30, HIVE Blockchain Technologies (TSXV:HIVE) is up by more than 23%. And even though HIVE has been rallying rapidly, the stock is still worth a buy today.

You may be thinking that you missed out and are going to wait for a pullback to buy the shares again. And while you may not want to take a full position at the new higher price, for that exact reason — in case of a pullback — you’ll want to at least take an entry position.

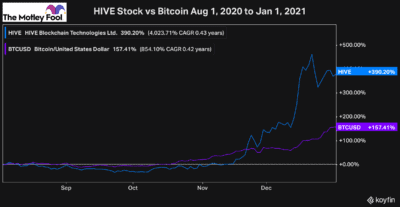

We have seen in the past just how much cryptocurrencies and the stocks exposed to them can rally.

Last fall, after HIVE and the crypto industry had been trading flat for a few months, they both began to rally significantly. Had investors decided to wait for a pullback, though, they would have missed out on some significant growth, as that correction, unfortunately, never came.

By the end of the year, it had gained more than 350% and is yet to trade even close to that cheap any time since.

So, I’d consider taking a position in crypto stocks today. Here are three reasons why you’ll want to invest in HIVE specifically.

Cryptocurrency should only continue to get more popular

Despite a few months of these digital coins trading flat or even losing value, the cryptocurrency industry has continued to go through massive innovation.

In addition to coins like Ether being upgraded, significant innovation in decentralized finance continues to attract new users and create a tonne of new long-term potential for the sector.

Furthermore, with the new infrastructure bill just signed in the United States, it looks like more regulations are coming, which could continue to give cryptocurrencies more legitimacy and has also contributed to a rally in crypto stocks.

This natural growth of popularity in cryptocurrency and blockchain technology could take years. But the sooner you invest, the better opportunity you have to grow your capital.

So, I’d be looking to take a position in HIVE stock today before it continues to get more expensive.

Mining stocks have more potential today after the crackdown in China

Another reason why HIVE stock is worth an investment is due to the crackdown on mining in China.

Mining has always been a high-potential industry to invest in. However, recently, these stocks have become even more attractive after the crackdown on mining in China.

In the cryptocurrency industry, everyone is competing against each other to be the fastest to mine new blocks. So, with a large portion of the competition out of the way, stocks like HIVE should be able to see more production.

In addition, HIVE has been investing heavily in upgrading its computing power and its mining capacity. It’s poised to see some major growth, especially if this rally in Ether and Bitcoin continues.

HIVE stock has exposure to Ether

Lastly, and one of the most important reasons why HIVE is a buy today is because it’s one of the few crypto stocks offering exposure to both Ether and Bitcoin.

Ether has always been one of the highest-potential cryptocurrencies to invest in, and it only continues to get more attractive.

The recent upgrades should help address concerns users have had for years, and already, we are seeing Ether prices rise faster than Bitcoin.

So, the fact that HIVE mines Ether and holds a lot on its balance sheet will see the stock benefit significantly from a prolonged rally in Ether.

That’s why if there was any crypto mining stock to buy right now, there’s no question that HIVE is the top choice.