Dividend stocks are precious to Canadian investors. There is something about getting a monthly or quarterly cheque (or deposit) that just makes us feel good. However, it is not always about finding the highest-yielding dividend stock.

It is also about owning Canadian stocks that have good balance sheets, strong management teams, tailwinds supporting foreseeable cash flow growth, and the opportunity to raise their dividend. Here is a top Canadian stock that represents all these aspects. You can buy this stock, tuck it away, and own it for just about forever.

Algonquin Power: A tuck-away Canadian dividend stock

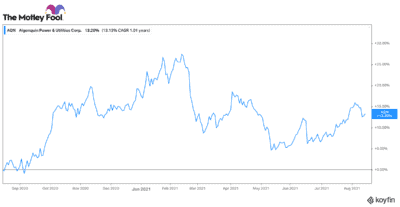

If you looked at the year-to-date stock chart of Algonquin Power (TSX:AQN)(NYSE:AQN), it doesn’t look too impressive. Its stock is down 6.4% since the start of the year. Frankly, it has been a tough year for Canadian renewable stocks in general.

Early this year, market sentiment moved away from renewables towards cheaper, more cyclical traditional energy stocks. Likewise, some of Algonquin’s assets were hit by the American Midwest extreme cold weather event. Consequently, Algonquin took some charges that will slightly impact earnings in 2021.

Reasons to be optimistic about green energy

Yet there are reasons to be very optimistic about this Canadian stock. I believe sentiment will shift back towards the renewables space. In 10 years, society will demand more power than it does today. Consequently, a massive investment in utility infrastructure and green power solutions is necessary. This need can be filled by great businesses like Algonquin.

70% of Algonquin’s business is made up of regulated electric, water, and natural gas utilities. If the Biden infrastructure plan is implemented, it could provide major incentives for Algonquin to further expand its utility enterprise.

Not only that, but Algonquin has been working quickly to “green its fleet” and replace the last of its coal-fired assets with green power assets. As a result, the company’s green efforts should be recognized by regulators and customers as a preferred utility partner of choice.

This Canadian stock had strong second-quarter results

In its recent second quarter, Algonquin put into service 1,400 megawatts (MW) of renewable energy projects. Today, it operates or owns interest in over 4,000 MW of green power. Consequently, it is on track to meet its target of 75% renewable power by 2023.

Bringing these projects online was a major boost to earnings this quarter. Revenues increased 54% to US$527.5 million. Adjusted EBITDA increased 37% to US$244.9 million. Adjusted net earnings per share increased 67% to US$0.15.

Solid five-year growth plan

This growth is demonstrating the strength of Algonquin’s $9.4 billion capital plan. So far, it has deployed $3.1 billion into this capital plan. Over the next four years, it is hoping to expand its rate base by a compounded annual growth rate (CAGR) of 11.2%.

Likewise, this Canadian stock could see adjusted net earnings per share could also expand by an 8-10% CAGR. This is not even including Algonquin’s 3,400 MW greenfield renewable power development pipeline. While these projects are longer dated for completion, they will be a nice “cherry on the cake” over and above the predicted earnings growth.

Dividends should keep rising

All in all, this Canadian stock is very well positioned to grow cash flows and consistently increase its dividend for many years to come. For the past 10 consecutive years, Algonquin has grown its dividend payout by at least 10% a year.

Today, it pays an attractive 4.4% dividend. If you consider Algonquin’s long-term green tailwinds, a strong development pipeline, and its solid outlook, this Canadian stock looks primed for some solid, risk-averse total returns for many years to come.