Royal Bank of Canada (TSX:RY) is one of the best Canadian bank stocks to buy and hold until retirement. It compares favourably to the bank sector. Let’s look at what makes RBC stands out.

RBC is Canada’s largest lender

RBC offers diversified financial services, including personal and commercial banking, wealth management services, insurance, business banking, and capital market services. The bank is concentrated in Canada, with additional operations in the United States and other countries. The bank derives two-thirds of its revenues from Canada, with the remainder being distributed primarily between the United States and the Caribbean. RBC is the largest lender of the country.

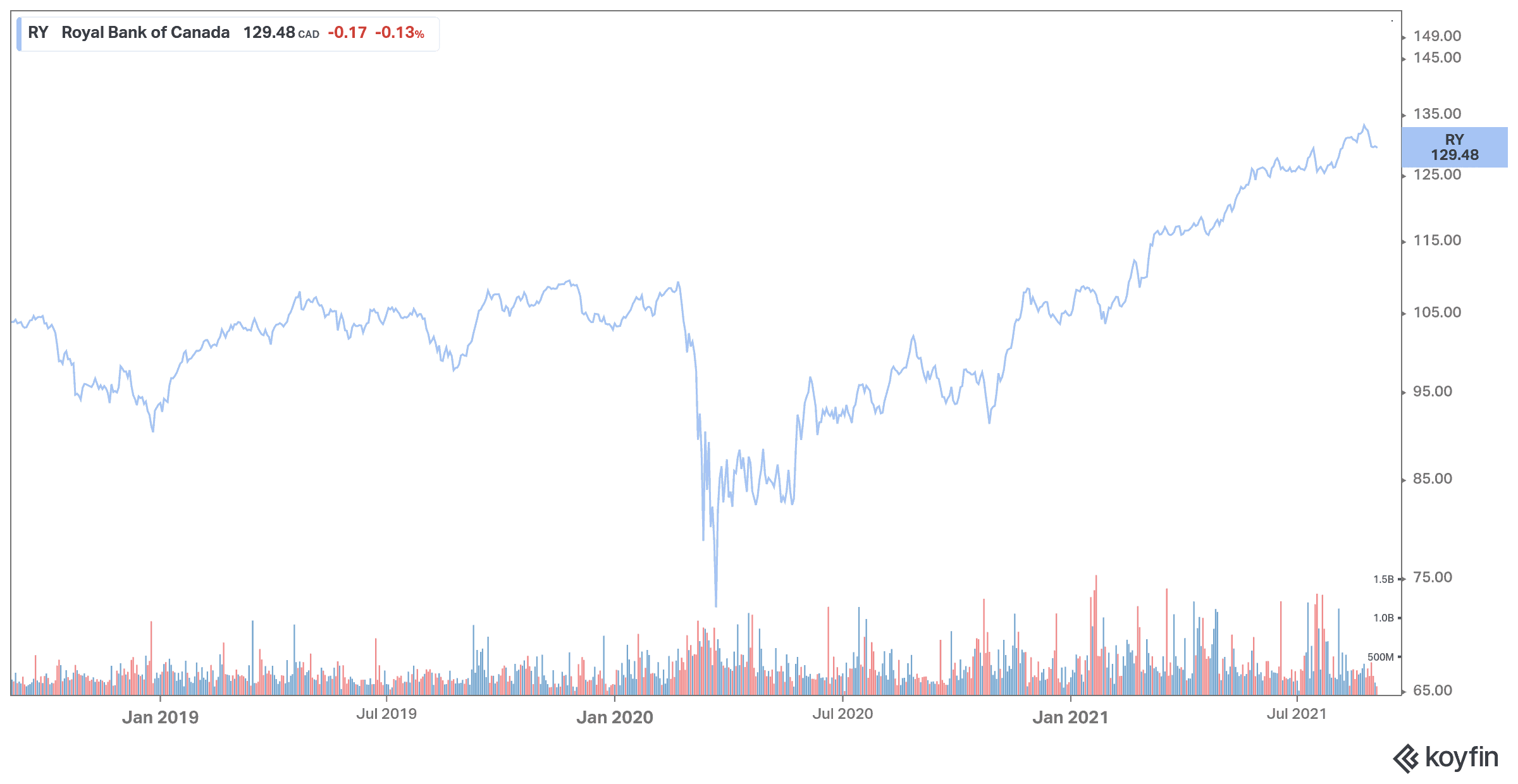

The Canadian bank has generated some of the best returns for shareholders in the banking sector. Its CAGRs over one year, five years, and 10 years are 37%, 13%, and 13%, respectively.

RBC has done an impressive job expanding its non-banking industries and running efficient banking operations. The bank will likely remain one of Canada’s leading banks for years to come, even as a more difficult macroeconomic environment puts pressure on earnings growth over the medium term.

A regular player in its retail and commercial banking operations in Canada, Royal Bank also remains a major player in global financial markets, which should continue to be a significant contributor to the bottom line.

Coming out of the downturn caused by the pandemic in 2020, the bank made 2021 a year of recovering profitability and lower-than-expected credit costs.

Strong third-quarter earnings

RBC posted strong earnings for the third quarter and beat estimates like the other Canadian big banks.

Revenue totaled $12.8 billion in the third quarter, down from $12.9 billion in the prior-year quarter. Analysts expected revenue of $12.21 billion. Net income came in at $4.3 billion ($2.97 per diluted share) for Q3 2021, up 34% from Q3 2020 net income. On an adjusted basis, the Canadian bank earned $3.00 per share. Analysts expected RBC to report an adjusted EPS of $2.69 in the three months ended July 31.

One of the main reasons for the increased profit is that RBC released $540 million in credit loss reserves during the quarter. These funds had previously been set aside to cover loans that were likely to default.

Profit from Personal & Commercial Banking amounted to $2.11 billion in the quarter, up 55% from a year ago. Wealth Management profit increased 31% to $738 million, while Capital Markets profit rose 19% to $1.13 billion, thanks to record Corporate and Investment Banking revenue.

Fee income remained particularly good for wealth-related transactions and investment banking, while trading and brokerage fees declined slightly.

Earnings per share are expected to increase by 41.3% to $11.26, which is slightly less than the other big banks.

A Canadian Dividend Aristocrat

Royal Bank is a Canadian Dividend Aristocrat with a strong history of dividend growth. It last increased its dividend by 2.8% in February of last year. RBC pays a quarterly dividend of $0.79 for an annual dividend of $3.16. The dividend yield is currently 3.8%, which is similar to Toronto-Dominion Bank. The bank increased its dividends to over 7% CAGR over the decade. With a current payout ratio of around 44%, Royal Bank has kept it in a 40-50% range for the past five years, which also means enough room for future growth.