As we’ve seen time and again, when Canadian stocks trade undervalued, it’s crucial to buy them quickly while you can take advantage of the discount.

Whether it’s a market pullback, when stocks across the board are falling, or a single sector that’s being impacted, often when a high-quality company trades cheap, it doesn’t stay that way for long.

Savvy investors are looking for attractive opportunities every day. So, if you wait too long, you risk missing out on the discount in these stocks altogether.

We saw this last year when the entire market corrected at the start of the pandemic. Investors soon bought up all these stocks at incredible valuations.

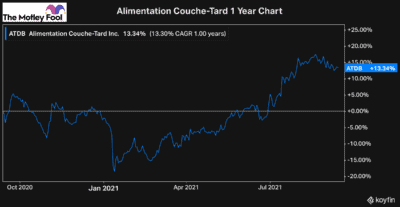

Even earlier this year, when Alimentation Couche-Tard, a top Canadian growth stock, was trading undervalued, me and many of my fellow Fools recommended investors buy the stock, and many soon took advantage of the discount.

As you can see by the chart, Couche-Tard has now rebounded fully from its selloff in January and continues to grow higher than where it was a year ago. It’s these high-quality opportunities that you have to take advantage of when they present themselves.

So, if you’re looking to buy an undervalued stock today, here are two of the best to consider.

A top Canadian wine maker

If you’re looking to buy an undervalued stock, one under-the-radar company is Andrew Peller (TSX:ADW.A). Andrew Peller is a producer, marketer, and retailer of wine and other alcoholic beverages.

Not only are its brands some of the most popular domestic products you can buy, but the company’s operations are vertically integrated well, giving the stock a tonne of potential to continue growing and improving its margins.

While it started as a wine company, Andrew Peller has grown rapidly over the years, mostly through strategic acquisitions.

As of recently, though, the company has opened up a number of its own retail stores, which creates a tonne of opportunities for growth. Furthermore, it has created a tonne of new products from ciders to liqueurs.

It’s done this, as it’s looked to take advantage of a growing trend in the alcohol sector that is seeing a shift in consumer preferences.

Andrew Peller is perfectly positioned to continue growing with the sector and dominating the domestic space. Recently, though, it’s faced some issues with its margin, but it’s addressed this by disposing of non-core assets.

So, with the stock trading down roughly 30% from its 52-week high and in a much better position to grow its operations, it’s definitely one of the top undervalued Canadian stocks to buy today.

An undervalued real estate stock to buy now

In addition to Andrew Peller, another Canadian stock to buy that might even be more undervalued is Boardwalk REIT (TSX:BEI.UN).

Boardwalk is a residential REIT with properties located all across Canada. This is an industry where it’s tough to find Canadian stocks to buy that are trading at fair value, let alone undervalued. However, Boardwalk’s unit price has been impacted for some time, as investors have been concerned about its portfolio in Alberta.

The Albertan economy has been impacted for years, which has resulted in vacancy rates that are higher than the rest of the country. And Boardwalk happens to have over half its portfolio in the Calgary or Edmonton areas.

However, much of this risk is overblown in my view, and Boardwalk is trading way too cheap to stay at this level for long. Not only is it one of the cheapest REITs in residential real estate, but it’s one of the cheapest in Canada altogether.

The stock is currently trading under $49, while its net asset value at the end of the second quarter was almost $60. In addition, it pays a dividend that yields 2%, so you can collect extra cash flow while the stock appreciates in value.

If you’re an investor looking to buy an undervalued Canadian stock in this market environment, there aren’t many left to consider. However, Boardwalk is one that’s offering investors an excellent opportunity.