Imperial Oil (TSX:IMO)(NYSE:IMO) is one of the biggest and best oil stocks in Canada. Not only does it have a long track record of history, but it also has a massive business with operations that are vertically integrated.

While it’s not uncommon to find small growth stocks outperforming the market, and by quite a significant margin, when a massive business like Imperial Oil, with a market cap of $25 billion outpaces the market, it’s worth noting.

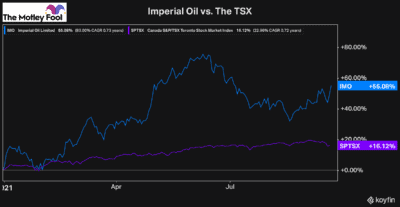

Imperial Oil stock is up by 55% year to date vs. the TSX, which has gained just 16%.

You may be wondering why it is that Imperial Oil’s stock has outperformed the market by so much in 2021 and whether it can continue this impressive performance going forward.

Why Imperial is outperforming the TSX this year

As we started 2021, many industries had already recovered significantly from the pandemic. One of the few industries that was left to recover was energy.

However, soon after 2021 started, and vaccines started being delivered around the world, the global economy started to improve again, and the demand for energy has skyrocketed since.

It’s important to remember that when the shutdowns were announced, much of the demand for energy was temporarily lost.

Nobody was driving or travelling, and factories were shut down, which ultimately led to the negative oil prices back in April of 2020. So, with the energy industry finally recovering, not only did the price of oil gain significantly, but so did the demand for oil.

This increase in commodities prices and recovery in the demand for oil led Imperial to report production levels that were over 12% higher in the second quarter of 2021 than they were in 2020.

Not only that, but the revenue for the second quarter was a more than 100% increase over the same quarter last year.

So, it’s clear just how much Imperial Oil stock has gotten a boost from the recovery in the energy sector. But does that make the stock a buy today?

Is Imperial Oil stock a buy today?

To decide whether Imperial Oil stock is a buy today, we have to look at both the company’s outlook going forward and its value in its current state.

At the moment, the company looks like it has recovered most of its value. For a massive integrated energy stock like this, one of the best metrics to look at how the market is valuing it is the enterprise value to EBITDA ratio (EV/EBITDA).

Imperial has a long-term average EV/EBITDA ratio of just over seven times. And currently, its EBITDA/EV as of the second quarter was roughly 7.1 times — right in line with its long-term average. So, at this price, and with the current earnings numbers we have, Imperial Oil stock looks to be fairly valued.

However, if the company can continue to recover and grow its earnings, the stock could continue to gain. In fact, that looks like what analysts are estimating. Because while its trailing EV/EBITDA ratio is above seven times, its forward EV/EBITDA ratio is just 4.5 times.

This suggests analysts continue to believe that Imperial can recover and improve its earnings. So, if you believe the stock has more recovery potential, it could be a great investment today.

Currently, the average target price from analysts is over $44 — a roughly 30% premium from today’s price. However, of the nine analysts covering the stock, only one has it rated a buy, with the other eight calling Imperial stock a hold at the moment.

So, if you’re considering an investment in Imperial stock, I’d pay attention to its operations over the coming quarters. If the stock can continue to improve its earnings, it could be in for another massive rally.