Well, Cineplex (TSX:CGX) stock has sure pleased its shareholders in 2021. This comes after a crazy year of struggling due to the coronavirus pandemic in Canada. In fact, it was so bad that the entertainment company’s very survival was in question. But let’s fast forward. Today, the reopening is in full swing. What will become of Cineplex’s stock price?

Is it still a buy after rallying more than 45% already in 2021?

Cineplex stock: Rising from the ruins

The last two years have been nothing short of chaotic for Cineplex. Its fortitude was tested. Its strategy was challenged. Certainly, management had to go into survival mode. Cineplex weathered the coronavirus storm in Canada by reducing costs and, of course, taking advantage of government support.

Today, theatres across the country are open. While the landscape has changed, the fact remains that Cineplex is Canada’s leading entertainment company. It has an increasingly diversified business. And it benefits from one of the best management teams out there.

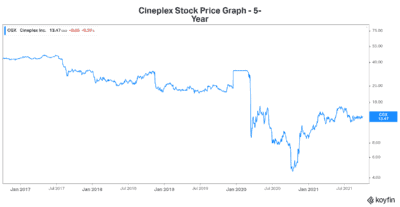

Just before the pandemic hit, Cineplex’s stock price was trading above $33. And in 2017 it was trading above $50. This does not guarantee that the stock will get back up there. But it does illustrate the upside that exists if the company plays its cards right. At this time, Cineplex stock remains ultra-cheap. In fact, its price is trading at a mere 18 times pre-coronavirus pandemic earnings. Remember, Cineplex was always a good business. Strong cash flows and its predictable, recurring business made it so.

Reopening 2021: Cineplex is set up to benefit immensely

After a year and a half of lockdowns and stay-at-home orders, people are ready to get out again. While some habits have surely been changed forever, others have persisted. In short, even though we have gotten used to movies at home, we are still social animals. We need the escape away from home. So, whether we’re talking about movie theatres or games rooms, people will return to these social settings. I’m convinced of this.

If you’re not sure, all you have to do is check out Cineplex’s latest results and conference call. In a nutshell, movie watchers are returning in droves. In fact, the first fully open weekend in July was the busiest since March 2020. As of this summer, Cineplex was running at over 50% of 2019 attendance. In the second quarter of 2021, Cineplex continued to reopen its theatres and entertainment venues. As of July 13, all venues were open from coast to coast. The strong attendance already seen will be built upon as more people are vaccinated. This will provide increasing comfort for a return to theatres and gaming venues. As we approach the end of the year, Cineplex management expects attendance to rise to 80% of 2019 levels.

In short, Cineplex stock is definitely still a buy today, despite its incredible run-up in 2021. The coronavirus pandemic in Canada is in the end stages. Therefore, we can increasingly expect an easing of restrictions and greater attendance. Soaring cash flows are just a heartbeat away. A soaring Cineplex stock price is not far behind.

Motley Fool: The bottom line

In summary, despite the rally in Cineplex stock, it’s still a buy today. The recovery has only just begun. Yet investors are still skeptical of Cineplex. This is part of what’s keeping Cineplex stock so undervalued. It’s what has given us the opportunity to buy at cheap valuations to participate in the additional upside that’s yet to come.