There are so many energy stocks to choose from. But of course, they’re not all equal. In this Motley Fool article, I would like to discuss an overlooked, undervalued gem of an energy stock. Enerplus (TSX:ERF)(NYSE:ERF) has significant exposure to some of the most prolific unconventional resource plays in the U.S. This includes the Bakken resource in North Dakota and Montana and the Marcellus shale oil in Pennsylvania. And now this position has been expanded. In short, Enerplus acquired complementary assets at cyclical lows. This means there has been significant value creation. It also means that this year, Enerplus stock will explode onto the scene.

Operational and financial excellence pay off for Enerplus stock

Enerplus has always been a top-quality company. It’s always been run with the utmost standards in operational and financial discipline. Therefore, cash flows at Enerplus have always been strong. Now that we’re in a cyclical upswing, this is even truer. With oil and gas prices soaring, cash flow growth will really return with a vengeance. Most investors are not prepared for this. In my view, they’re underestimating this energy company. In turn, they’re underestimating this energy stock.

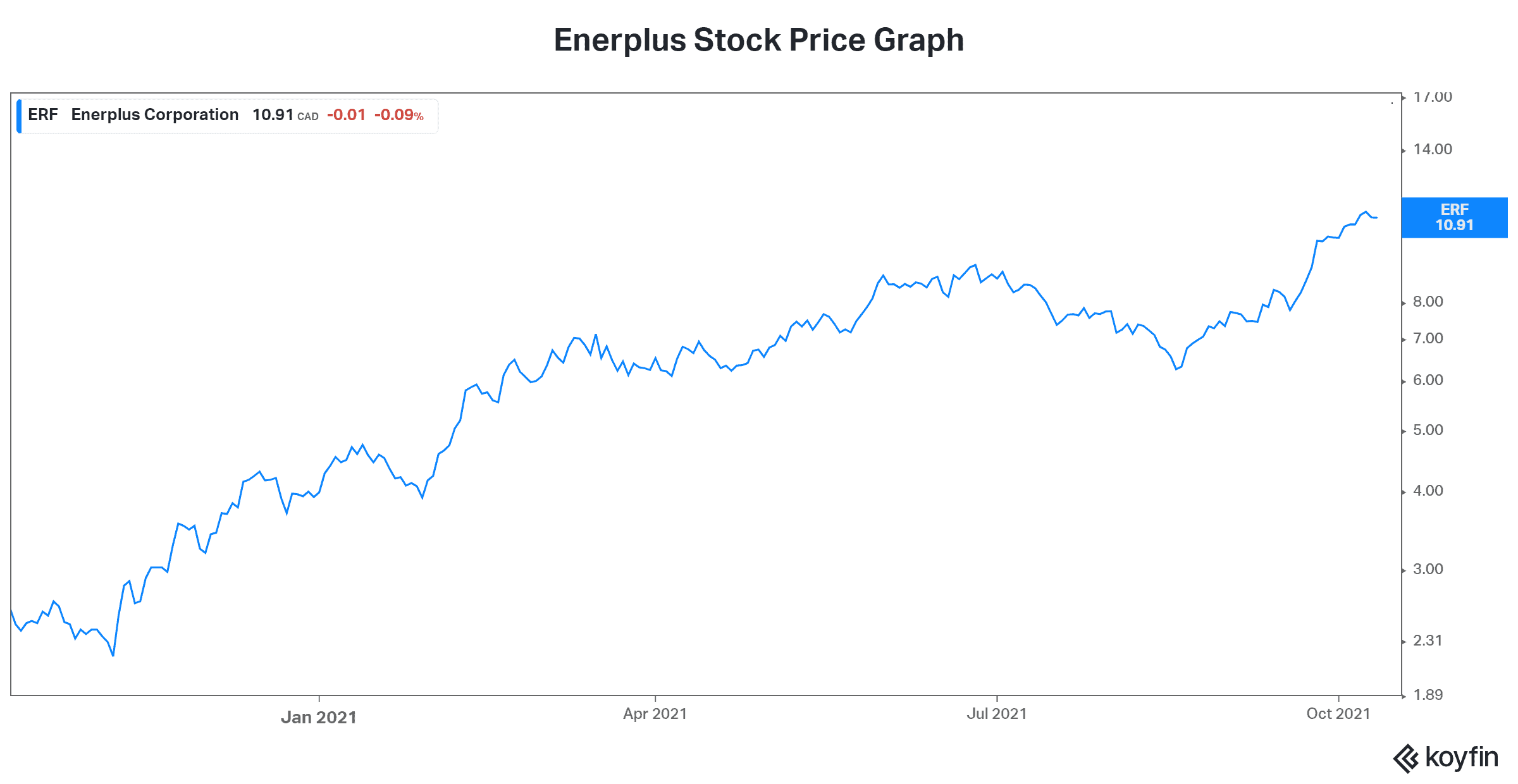

But that’s good news for investors who are searching for undervalued stocks. Because today, Enerplus is as undervalued as they come. Thankfully, this status does not come with the typical challenges of underperformance. In fact, Enerplus is an undervalued gem with exceptional operational performance. It’s starting to be recognized, but there’s certainly more to come. So far in 2021, Enerplus stock has soared 175%.

Strategic acquisition in the first half of 2021 takes this energy stock to another level

Let me take you back to the beginning of 2021 for a second. Back then, oil prices were trading at approximately $53. Today, oil is more than 50% higher. People are even debating whether $80 could possibly be the new “normal” for oil prices. Some people are even thinking we may be headed toward $100 oil. How much has changed since then? Everything.

Enerplus went on an acquisition spree in early 2021, bringing debt levels higher. It’s also what will create long-term shareholder value. In short, a company that acquires in cyclical lows almost always creates significant value. In Enerplus’s case, this has created an undervalued and overlooked stock that’s ready to break out.

The point that I want to drive home is simple: for Enerplus to acquire in January took foresight and courage. In the process, significant shareholder value has been created. The company’s acquisition was made at very low multiples. Compared to today, these multiples were dirt cheap, creating tons of value.

This energy stock will benefit from a step change increase in production and cash flow

So this acquisition is driving significant growth at Enerplus. In short, Enerplus’s 2021 production has been growing by almost 30%. And cash flows are following suit. In fact, cash flow from operations is currently growing by more than 160%. This double whammy of higher commodity prices along with higher production is taking Enerplus stock higher. And we can expect this to continue.

The bottom line

Enerplus stock is one of the most overlooked and undervalued energy stocks out there today. To sum up the investment thesis on Enerplus stock is simple: multiples are low, cash flows are soaring, debt is falling, and dividends are rising. It’s simply a recipe for success.