Largely, it has been a positive year for investors in Canadian dividend stocks. Government bonds, GICs, and savings accounts are basically earning a negative rate of return after inflation. Consequently, dividend stocks are one of the only ways to earn outsized income on your capital. As earnings season heats up, here are four top Canadian dividend stocks to watch as we enter November.

A leading utility/renewable power stock

Algonquin Power (TSX:AQN)(NYSE:AQN) has been on a pretty sharp decline this year. In October alone, the stock dropped 5%. Last week, Algonquin announced its plans to acquire a regulated power utility business in Kentucky for $3.5 billion. Also, management noted that its earnings outlook will likely hit the low end of its expected range.

While this might have given investors the jitters, it looks like it could be an attractive long-term buying opportunity. Algonquin has a solid history of acquiring underperforming utilities and optimizing them.

Today, Algonquin has a great opportunity to optimize its overall rate base, green its power fleet, and expand its regulated and renewable operations. This Canadian stock is yielding a 4.7% dividend. It trades with a price-to-earnings ratio of only 13. It looks like a real bargain here.

The best Canadian telecom stock

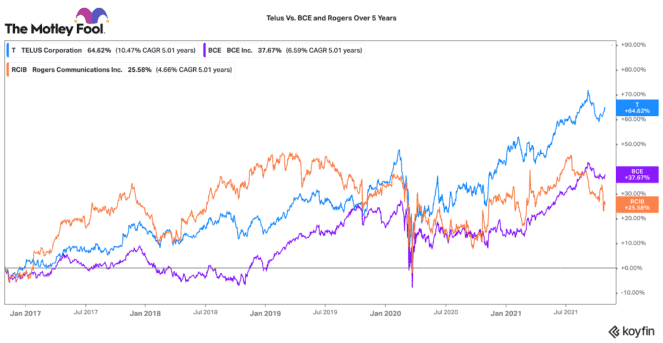

Another top dividend stock to have on your radar is TELUS (TSX:T)(NYSE:TU). Quarter after quarter, it has had market-beating customer additions and strong all-around earnings results. It is set to announce earnings on Friday this week. I think investors can once again expect to be impressed.

TELUS has an industry-leading track record. It has great telecom operations, but it is also building some exciting growth verticals in digital healthcare, agriculture, business services, and security. Over the year, it has been disclosing more financial data on these fast-growing segments.

The more the market knows, the better it can assign higher valuations for these segments. As a result, TELUS still could have more upside. Not to forget, this stock pays a fast-growing 4.5% dividend right now.

A top global infrastructure stock

Keeping the infrastructure theme, Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is one Canadian stock to keep your eyes on. It is set to report its third-quarter results on Wednesday this week. This will be the first quarter where it has owned a controlling interest in Inter Pipeline.

Given the very strong pricing environment for propane and natural gas products, Brookfield should enjoy a strong boost to cash flows from these assets. Likewise, inflation trends should actually be a major tailwind for many parts of its business.

While this Canadian dividend stock is up nearly 25% today, it still pays a solid 3.55% dividend. Chances are pretty good that its dividend will be raised this quarter or next.

A high-yielding Canadian pipeline stock

A back-handed way to play the strength in global energy markets is through Pembina Pipeline (TSX:PPL)(NYSE:PPL). It operates an integrated mix of midstream and transportation assets across Canada and America.

It is set to report third-quarter results on Thursday, November 5. Like Brookfield’s Inter Pipeline assets, I expect it could enjoy a major tailwind from strong natural gas and propane pricing.

During the year, this company reported strength across all its business segments. Oil fundamentals have only improved since then, so I think it is likely management raises its outlook for 2021. For a well-covered 6.15% dividend, Pembina is a cheap Canadian stock to buy now.