Although the TSX Index is trading near all-time highs, there are still some pretty attractively priced dividend stocks. Sure, dividend yields are not at the same height they were a year ago at this time. Yet there are opportunities where you can collect between a 3% and 7% dividend yield and some inflation-beating income growth over time. In fact, here are three TSX dividend stocks that are ridiculously cheap right now.

A high-yielding dividend stock

Infrastructure stocks are a solid place to collect reliable passive income. Vital infrastructure is generally highly contracted and produces a very attractive stream of cash flow. One dividend stock that pays a nice, well-covered monthly dividend is Pembina Pipeline (TSX:PPL)(NYSE:PBA). Every month, Pembina pays a $0.21-per-share dividend. That is equal to a 6% annualized yield. If you put $10,000 into this stock, you would earn $50 a month in dividends.

Given the strength in energy markets, Pembina is seeing very strong operational activity. It just released solid third-quarter results. It grew earnings per share year over year by 94% to $1.01 per share. Adjusted EBITDA increased 7% to $850 million.

This stock only trades with a forward price-to-earnings ratio of 16 times. If oil and gas demand (and pricing) remain elevated, 2022 could be an even stronger year. Consequently, Pembina could have excess cash to grow its network and also increase its dividend.

An undervalued dividend-growth stock

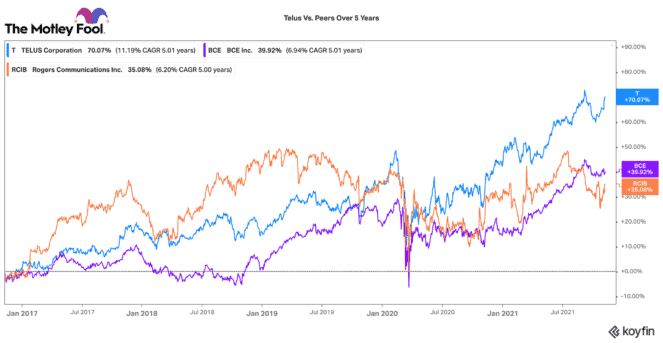

Speaking about infrastructure, everyone today needs cellular coverage and internet. It is almost as essential as water, power, and heat. That is why TELUS (TSX:T)(NYSE:TU) is a great stock for dividend-seeking investors. At $29 per share, it has a dividend yield of 4.5%. That is equal to a $0.3275 dividend per share every quarter.

TELUS has been a top telecom performer both operationally and as a stock. This year, it continues to lead in net customer additions. Strength in its business has allowed it to raise its dividend twice this year already. In total, that equals an 8.6% dividend increase in 2021.

While TELUS telecom business is performing well, it also is building out some strong digital growth verticals. These are not yet fully factored into the stock price. I believe TELUS still remains an undervalued dividend stock today.

A contrarian passive-income stock

Another infrastructure stock that looks pretty attractive right now is Algonquin Power (TSX:AQN)(NYSE:AQN). Certainly, it has not been a pretty year for this stock in 2021. It is down nearly 15% this year. It hit a 52-week low just a few days ago. However, at $17.80 per share, it pays a handsome 4.75% dividend. This dividend stock only has a price-to-earnings ratio of 13! It is trading below is normal valuation range.

There are many reasons this stock is down temporarily. It was hit by the massive winter storm shutdown early in the year. Likewise, wind resources have led to lower-than-average power generation. Yet these factors are all temporary.

The company just announced an acquisition for a regulated utility in the United States. I believe this improves the overall quality of its portfolio and also increases the stability of its earnings over time. This should also help continue its strong track record of high single-digit dividend growth. You have to be contrarian with this dividend stock, but chances are good that it will provide strong total returns ahead.