Canadian stocks continue to ride a wave of momentum as we enter November. Even though the S&P/TSX Composite Index is up over 20% in 2021, it keeps pushing higher. The reality is that global inflation trends are helping buoy Canada’s plentiful energy, materials, and financial stocks upward. Despite such strength, there are still some significant bargains that patient long-term investors can swipe up in November. Here are three that are trading on sale right now!

A top Canadian income stock

Algonquin Power (TSX:AQN)(NYSE:AQN) is one of Canada’s best and most diversified utility stocks. Around 70% of its assets are made up of regulated utilities. The remainder of its business comes from developing and managing renewable power assets. Yet, this Canadian stock has been on a significant decline this year.

Largely, this stock is down because it announced a massive acquisition of an American power and transmission utility. It requires Algonquin to issue equity and take on a bit higher level of debt. Likewise, the company reduced its 2021 outlook due to weak wind power resources.

Yet, at $17.90 per share, it is trading just above a 52-week low. Today, this Canadian stock trades with a price-to-earnings (P/E) ratio of just 13 with a dividend yield of over 4.7%. That is above its historic norm. For a stable, reliable income stock with some long-term growth, you won’t get a better bargain than Algonquin Power today.

A leading Canadian blue-chip stock

Magna International (TSX:MG)(NYSE:MGA) has seen a steep drawdown this year and has been down 12% since May. While I never recommend buying a falling knife, this is where the idea of patience and long-term thinking comes into play.

Magna has particularly been hit by global supply chain challenges. Indeed, the lack of semiconductors is holding up its vehicle production capacity. Yet, Magna is an exceptional blue-chip Canadian stock. Including dividends, it has delivered a 110% return for shareholders over the past five years.

The coming five years could be even better. Magna is particularly well-positioned to be a leading supplier and manufacturer of electric vehicles (EV) and EV components. This stock only trades with a P/E of 11 today. Buy this cheap stock at the low end of the cycle and you could be rewarded in the long run for your patience.

A very cheap growth stock

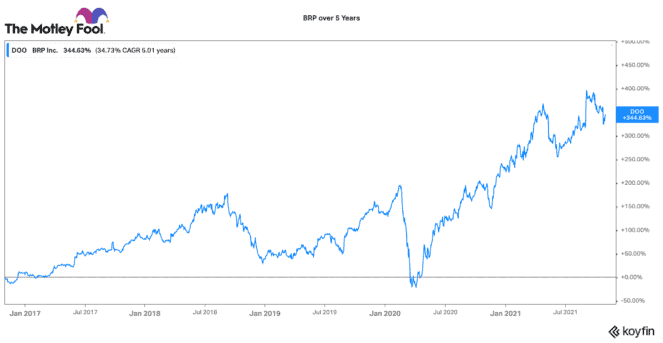

With the Canadian stock market at all-time highs, it can be hard to find a stock that is fast-growing, but still cheap. Well, it might be your lucky day. Not only is BRP (TSX:DOO)(NASDAQ:DOOO) cheap at 10.8 times earnings, but it has returned over 340% to shareholders over the past five years.

Very strong demand for all-terrain vehicles, boats, and snowmobiles coming out of the pandemic has helped this business hit record results in 2021. Like Magna, it is expected to face some headwinds from the global supply chain crunch.

Yet, BRP has a great management team and innovative products. One of its recent new ventures is in electric off-road vehicles. This could open up a whole new opportunity with eco-friendly customers across the world. With a market cap of just $8.8 billion, this Canadian stock still has lots of room to grow. The short-term dips can be great long-term value opportunities for shrewd, patient investors!