Stable passive income and capital preservation are crucial for those near or in retirement. Canadians only get so much from their pension and old age security plan, so having additional streams of income is important. Passive income can come from a rental property, a small business, mutual funds, bonds, or stocks.

Stocks are a great source of passive income

These days, bonds, savings accounts, and GICs are basically earning a negative return after inflation. Rental properties and small businesses can be a ton of work and a major headache if you aren’t absolutely sure what you are doing. Hence, I think stocks are a great way to earn passive income.

Generally, with equities, you do have to think long-term and be willing to invest through some volatility. Yet, over time, stocks can provide a great mix of passive income and capital gains. Here are three dividend stocks that you can buy now, collect stable dividends, and sleep easy at night.

Fortis: A top regulated utility

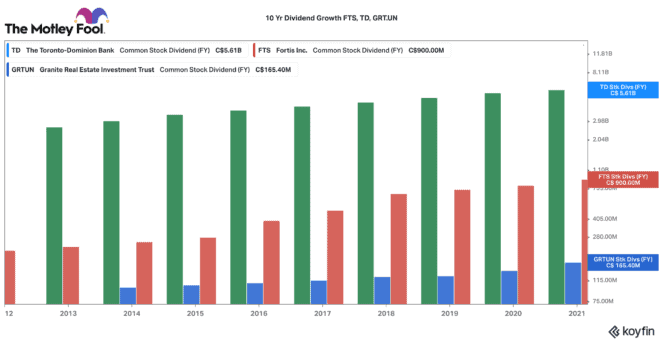

Fortis (TSX:FTS)(NYSE:FTS) is one stock that is not going to double your money overnight. However, this $26 billion company will give you a nice 3.81% dividend yield and some steady inflation-beating dividend growth for years ahead. Why am I pretty certain about that? Well, it has raised its dividend annually for 48 consecutive years.

Fortis operates a crucial set of regulated power and gas transmission assets across North America. These are essential assets that should have significant growth as the economy becomes more electrified.

Fortis has a plan to grow its rate base by 6% per year for the coming five years ahead. Passive income investors can expect the dividend to grow at a similar steady 6% pace.

TD Bank: A top financial for passive income

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) has been in business since 1955. Over that time, it has built one of the largest retail banking franchises in Canada and the United States. Somehow, that longevity gives me comfort.

Banks like TD look fairly well-positioned today. The economy is recovering from the pandemic, consumers have a lot of excess cash, and interest rates should rise. All of these factors are positive for banks because they capture higher interest margins when rates rise.

As Canada’s second-largest bank, TD has a market cap of $170 billion. It’s solid, well managed, and very well-capitalized. Today, it yields a 3.4% dividend. However, now that regulators have released pandemic-related capital restrictions on financial stocks, TD is primed for a substantial dividend hike soon. This is a stock to tuck away and collect the growing passive income for years ahead.

Granite REIT: Better than a rental property

If you are interested in real estate but don’t want the hassle of managing your own properties, Granite Real Estate Investment Trust (TSX:GRT.UN) is the passive income stock for you. Granite provides infrastructure-like real estate for the manufacturing, e-commerce, and distribution industries.

It operates these properties across Canada, the United States, and Europe. It is a great stock to get diversified exposure to institutional-grade industrial properties. This REIT has a high-grade collection of tenants, very long-term leases, and one of the best balance sheets in the industry.

With a market cap of $6.5 billion, it actually trades at a discount to its American industrial peers. It pays a nice 3% dividend. This is paid out monthly. Granite just raised its dividend by 3.3% this year. It has grown its dividend every year for the past nine years and I think that will continue at an elevated rate going forward.