We’ve all heard the usual spiel on how to generate passive income: buying and renting out real estate, investing in bonds, holding dividend stocks, etc. These ideas are great and all, but by no means should investors limit themselves. Looking elsewhere for unconventional passive-income opportunities can be immensely rewarding, and today we’ll be going over one of those opportunities: Turo.

Renting your car out with Turo

Turo is a peer-to-peer car-sharing marketplace, where, unlike a traditional car rental agency, you can rent your car out in lieu of a fleet. You can think of Turo as AirBnB, but for vehicles instead of housing. Currently, Turo operates in only four Canadian provinces: Ontario, Alberta, Nova Scotia, and British Columbia.

You can create a free account and list your car on the platform as a host within minutes. Being a host means you essentially operate your own mini car-rental business on the Turo Platform in an independent contractor type of arrangement. Once you have registered, simply set a price and availability and wait for the bookings to flow in. Once a renter makes a booking and you accept, you are responsible for coordinating with them for pickup and dropoff.

Do I need any qualifications?

Turo has some basic requirements before a vehicle can be listed. These include a set of universal and geographic specific requirements. For Canada, vehicles must

- Be registered and located in the provinces of Alberta, British Columbia, Nova Scotia, Ontario, or Quebec;

- Be no more than 12 years old;

- Meet our insurance requirements;

- Have a fair market value of up to $75,000 in British Columbia;

- Have a fair market value of up to $105,000 in Alberta, Nova Scotia, Ontario, and Quebec;

- Have fewer than 200,000 kilometres;

- Have a clean title;

- Have never been declared a total loss; and

- Not display dealer plates.

How does insurance work?

Handing the keys of your beloved vehicle off to a stranger can be nerve-wracking. Fortunately, Turo offers insurance coverage to its hosts that covers the cost of damages or accidents. Drivers can choose from three levels of coverage when they list their car on Turo:

- Premier Plan: $2 million liability and $0 deductible.

- Standard Plan: $2 million liability and $500 deductible.

- Minimum Plan: $2 million liability and $3,000 deductible.

The premiums charged on each plan will vary depending on your vehicle’s make and model.

How much could I earn?

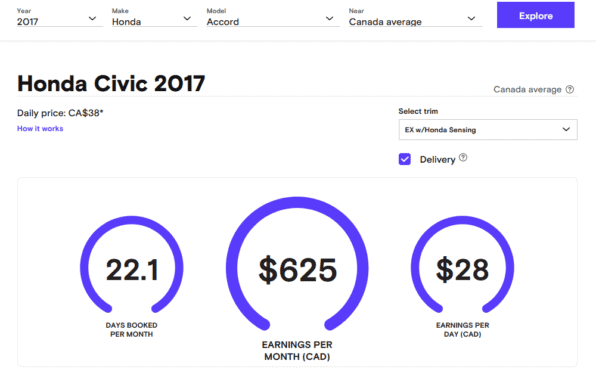

That’s the question everyone looking for passive income wants to know! As a host, you can get a rough estimate of your gross earnings using Turo’s “Carculator.” The below image shows the average earnings per month for a 2017 Honda Civic Canada wide to be $625 for 22 days booked per month ($28/day).

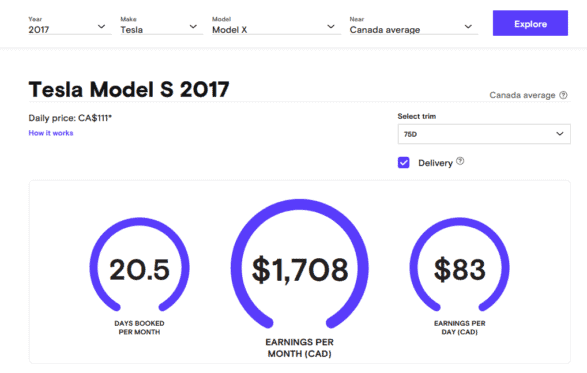

By listing higher trim, newer, or luxury marque vehicles, you could earn significantly more. If you’re lucky enough to own a 2017 Tesla Model S, the average earnings Canada wide could be a whopping $1,708 for 20 days booked per month ($83/day). That could easily cover a month’s car payment, plus your personal insurance costs!

The Foolish takeaway

If you have a car you don’t use much and don’t mind renting out, you can use Turo to create a consistent flow of cash via a safe, reputable platform. In my opinion, renting as a host on Turo is best suite for individuals with high car payments or electric/hybrid vehicles. The passive income from renting your car can help offset lease/finance payments significantly, and using a electric/hybrid vehicle can keep gas costs down to a minimum.

Keep in mind that because hosts on Turo work as independent contractors (much like Uber drivers), you shoulder the responsibility for paying vehicle maintenance costs, self-employed CPP deductions, and income taxes. These costs, along with Turo’s insurance premiums, should be factored into your net earnings estimates. Regardless, Turo can be an excellent way of turning your depreciating car into a source of consistent passive income.