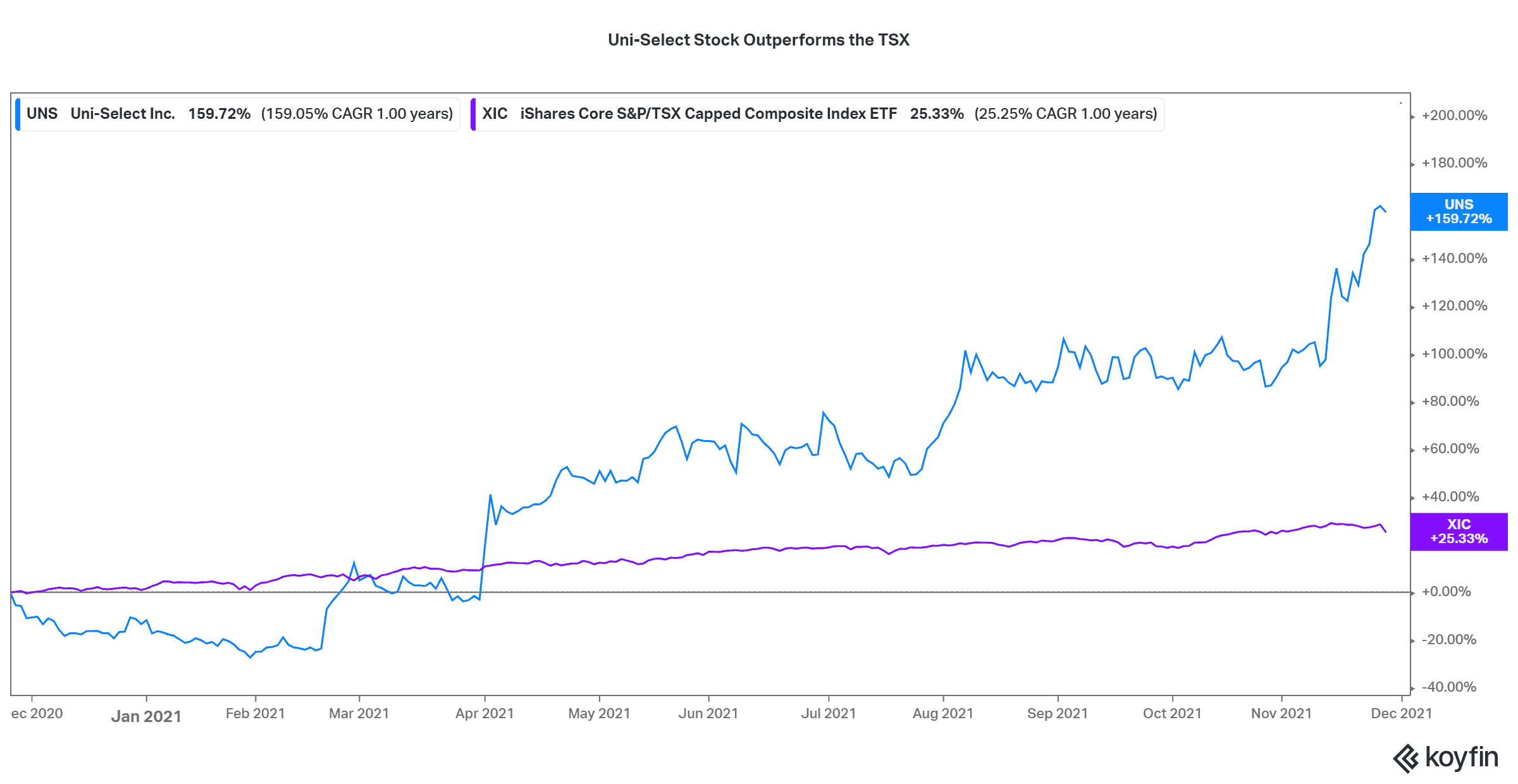

Canadian auto-parts and refinish accessories retailer Uni-Select (TSX:UNS) is one TSX stock that has flown under the radar so far this year. Uni-Select’s stock price has surged by a strong 159.72% so far in 2021. Shares could rise some more given the strong momentum the COVID-19 recovery play exhibits going into December.

Why is Uni-Select stock rising?

Uni-Select distributes automotive parts and spares, paints and related refinish products. Its brands include the Canadian Automotive Group, The Parts Alliance U.K. (which is rebranding to GSF Car Parts), and FinishMaster (U.S.).

Store reopenings as the COVID-19 pandemic subsides and price increases have been a key recovery driver for Uni-Select’s business. UNS reported an impressive 7.8% revenue growth for the third quarter to $426 million — an achievement which was primarily driven by organic demand growth.

Since the company broke its spell of consecutive quarterly losses in September 2020, the business has looked better with sequential improvements in key financial metrics.

Most noteworthy, the company generated over $153 million in free cash flow over the past 12 months, which compares favourably with $10 million free cash flow generated during 2019 (a pre-pandemic period).

Key metrics are aligning well for Uni-Select, as a new management team continues to refocus the business, deleverage operations and recording material savings on debt-servicing costs and interest payments and strengthen UNS’s balance sheet. UNS replaced its CEO, CFO and several key managers in 2021.

During the third quarter of this year, Uni-Select reported earnings before tax and unusual items of $20.1 million. Such profitability levels were last seen back in September 2017.

Moreover, the company’s total net debt-to-adjusted EBITDA ratio declined from 4.2 in September 2020 to just 2.34 by September this year. Lower leverage could mean lower investment risks for Uni-Select stock investors, as the business becomes financially more flexible and debt holders loosen their grip on the business.

UNS stock resilient as TSX falls

News of a new COVID-19 variant, named Omicron, triggered a trader panic on Friday. However, in a strong show of resilience and unphased momentum, UNS stock held ground, even as the S&P/TSX Composite Index slumped by 2.25% for the day.

Uni-Select stock shed just 0.94% during Friday’s rout. Shares could hold their valuation ground going into 2022.

Insiders loading up on Uni-Select stock

Uni-Select appointed Brian McManus as the new CEO in April this year, before he assumed the added role of executive chair of the board in June. A new chief financial officer was also installed this year, and some changes were made to the company’s directorship.

In a strong show of confidence and belief in the company’s turnaround and the long-term outlook for UNS stock, CEO and Chairman Brian McManus spent nearly $125,000 in purchasing Uni-Select stock this month.

Brian had earlier forked out over $2 million buying UNS stock in August. The August purchases have already rewarded him with an 18% return in just three months.

Another key insider, company CFO Antony Pagano, has been buying shares too. Since August, Antony has spent more than $300,000 buying UNS stock. His most recent purchase was recorded on November 23.

Investors love it when the key decision makers buy their own company’s stock. Chefs who eat their own cooking command a great deal of trust.

Key risks to watch on the surging TSX stock this quarter

Uni-Select management team was cautiously optimistic about the business’s operating results for the fourth quarter. Like most retailers and other businesses, the company is also exposed to the global supply chain crisis.

It’s still possible that operations could be harmed by any resurgence of COVID-19-related lockdowns.