I love Canada’s stock market, because we have so many solid, big-name players to pick from to form the core of our portfolios. From banking to oil and gas to utilities and even tech, there’s no shortage of well-established, long-lasting companies to pick our stocks from. Some of these stocks, I would even be okay with holding forever, given how resilient their business model is — the so-called wide-moat advantage.

What makes a moat wide?

Wide-moat stocks are those that can maintain their market dominance, whether that be through low prices, low costs, or high demand for their services/products over a long period of time. Sources of a wide moat often include things like government protection and bailouts (think utilities) or a lack of competition (think of oligopolies like telecom or banks).

We want wide-moat stocks, because they reduce one of the main risks of stock picking: that an individual stock pick can go into decline or even bankruptcy in the long run. We want companies that possess such a durable competitive advantage over time that they can fend off upstart rivals for decades on end.

Buying the stocks of these companies, especially if they have a good history of dividend payouts and increases can help compound our portfolio for massive long-term gains. For this reason, a wide moat should be one of your top considerations for a safe, long-term stock pick.

Just like in Monopoly, owning the railways is smart

You might not realize it, but Canada’s century old railway industry is a prime example of a wide moat at play. The two dominant companies, Canadian Pacific Railway (TSX:CP)(NYSE:CP) and Canadian National Railway (TSX:CNR)(NYSE:CNI) operate in a duopoly with no competition.

It would be incredibly difficult for a competitor to find the financing, infrastructure, government backing, and labour to create a new transportation system rivaling what CP and CNR have established over decades.

Essentially, CP and CNR have a lock on the transportation of goods around the country. Even during recessionary conditions, the railways are still profitable, because there is often no better alternative for cross-country bulk logistics solutions.

As a result, these companies have some of best financials out there. CNR currently boasts a 44.10% operating margin, 32.80% profit margin, ROA of 10.30%, ROE of 23.10%, and ROI of 11.20%. CP does even better with a 48.30% operating margin, 39.20% profit margin, ROA of 12.60%, ROE of 37.10%, and ROI of 14.90%.

While neither company boasts an attractive dividend by yield, we need to consider more factors beyond that. Both companies have consistently increased their dividends over decades, with CNR most recently posting a 7% increase in January 2021 and CP a 14.5% increase in July 2020. The current low yields of 1.58% and 0.82% are more due to the steady increases in share prices of both stocks, which both sit fairly high right now.

The Foolish takeaway

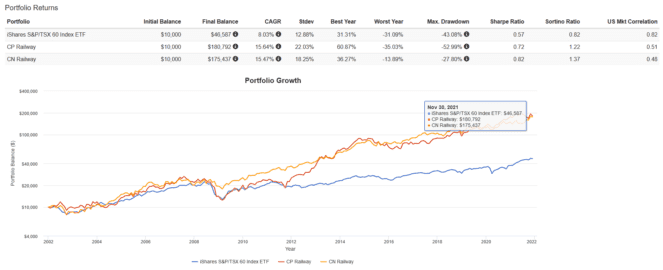

To put it simply, both railway companies are some of the best long-term picks out there and have consistently beat the benchmark index. For reference, I plotted the performance of CNR and CP vs. the iShares S&P/TSX 60 Index ETF from December 31, 2001, to present on Portfolio Visualizer:

With dividends reinvested, both stocks outperformed the index on an absolute return basis (CAGR of 15.64%/15.47% vs. 8.03%) and risk-adjusted basis (Sharpe of 0.82/0.72 vs 0.57). An initial investment of $10,000 would have netted you over $175,000 with either CP or CNR compared to just $46,587 with the index.

That being said, past performance is not an indication of future performance. If CP and CNR can maintain a wide-moat status, this outperformance may continue. However, if either are disrupted by an upstart rival, mismanaged, or make poor financial decisions, this can change. Nevertheless, at this point in time, both stocks appear to be excellent long-term core holdings for a Canadian investment portfolio.