The recent pullback in Canadian stocks is creating some attractive buying opportunities for the New Year. Stocks on the TSX were getting a bit inflated. The recent market volatility is mostly healthy. Frankly, if you are sitting on some cash, it presents an attractive opportunity to pick up some high-quality stocks while they are better priced.

Of course, there is a lot to worry about when investing in the stock market. Today, we have rising Omicron COVID-19 cases, rising inflation, rising interest rates, and rising geo-political risks (Russia/Ukraine). Certainly, these are all risks to monitor.

Worry less by owning high quality businesses

Yet, the great thing about owning high-quality businesses is that they are very resilient. High-quality stocks have great balance sheets, smart management teams, innovative business models, and long-term growth tailwinds.

While there is always lots to worry about, a long-term investing approach alleviates the day-to-day and month-to-month stock market worries. If you want to think long-term and buy before the New Year, here are three Canadian stocks that look like attractive buys for the long-run.

A top Canadian dividend stock

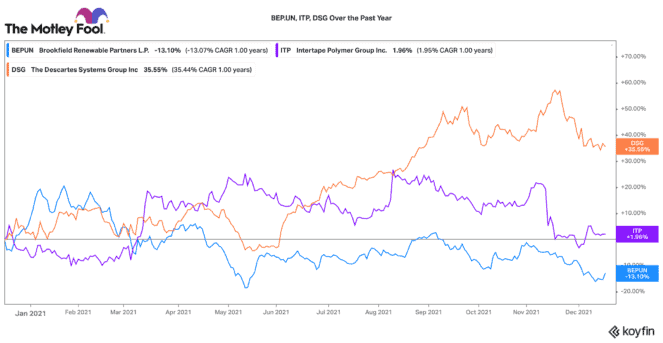

Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP) stock has pulled back 20% year to date. Certainly, this stock probably got ahead of itself in 2020. However, the recent decline is making for a good long-term buying opportunity. Renewables will continue to be a world-changing trend for many years.

With 21,000 megawatts (MW) of green power under management, Brookfield Renewables is one of the largest pure-play renewable power stocks in the world. It has 35,000 MW of renewable development projects in the works as well. That should help fuel a decade of growth ahead.

This has been a great Canadian dividend stock for years. Today, it pays a 3.6% dividend. However, it has grown that dividend by a compounded annual growth rate (CAGR) of 6% for the past nine-years. For nice mid-teens total returns for years to come, this is an attractive stock here.

A top value stock

Intertape Polymer Group (TSX:ITP) is not a well-covered Canadian stock. However, for a combination of value, income, and growth it looks very interesting today. Since August, its stock is down 16%.

Intertape is a leading manufacturer and distributor of tapes, wraps, and packaging solutions. Over the past few years, the company has been investing heavily in production diversity, efficiency, and capacity. The investments have paid off. Intertape has been delivering record growth and profitability in 2020 and 2021. Its e-commerce solutions have been a major growth driver.

This stock trades with a forward price-to-earnings (P/E) ratio of 10. It also pays an attractive 3.4% dividend. If you believe e-commerce trends will continue to rise, this is a great Canadian stock for value and income right now.

A top Canadian growth stock

If you believe supply chain issues could persist for a long time, one Canadian stock that benefits is Descartes Systems (TSX:DSG)(NASDAQ:DSGX). It operates one of the leading logistics technology platforms in the world. The company has seen organic growth rise in 2021 as businesses flock to it to better manage their supply chain and logistics processes.

Given the crucial nature of its software, the company captures high recurring revenue rates. Likewise, it enjoys very high +40% EBITDA margins from its services. The company is yielding a lot of free cash every quarter. It has $171 million of cash, zero debt, and a lot of options on how to invest in growth going forward.

This Canadian stock is not cheap, but it has pulled back 13% from all-time highs. For a very high-quality tech stock primed for long-term growth, this is a top stock for 2022.