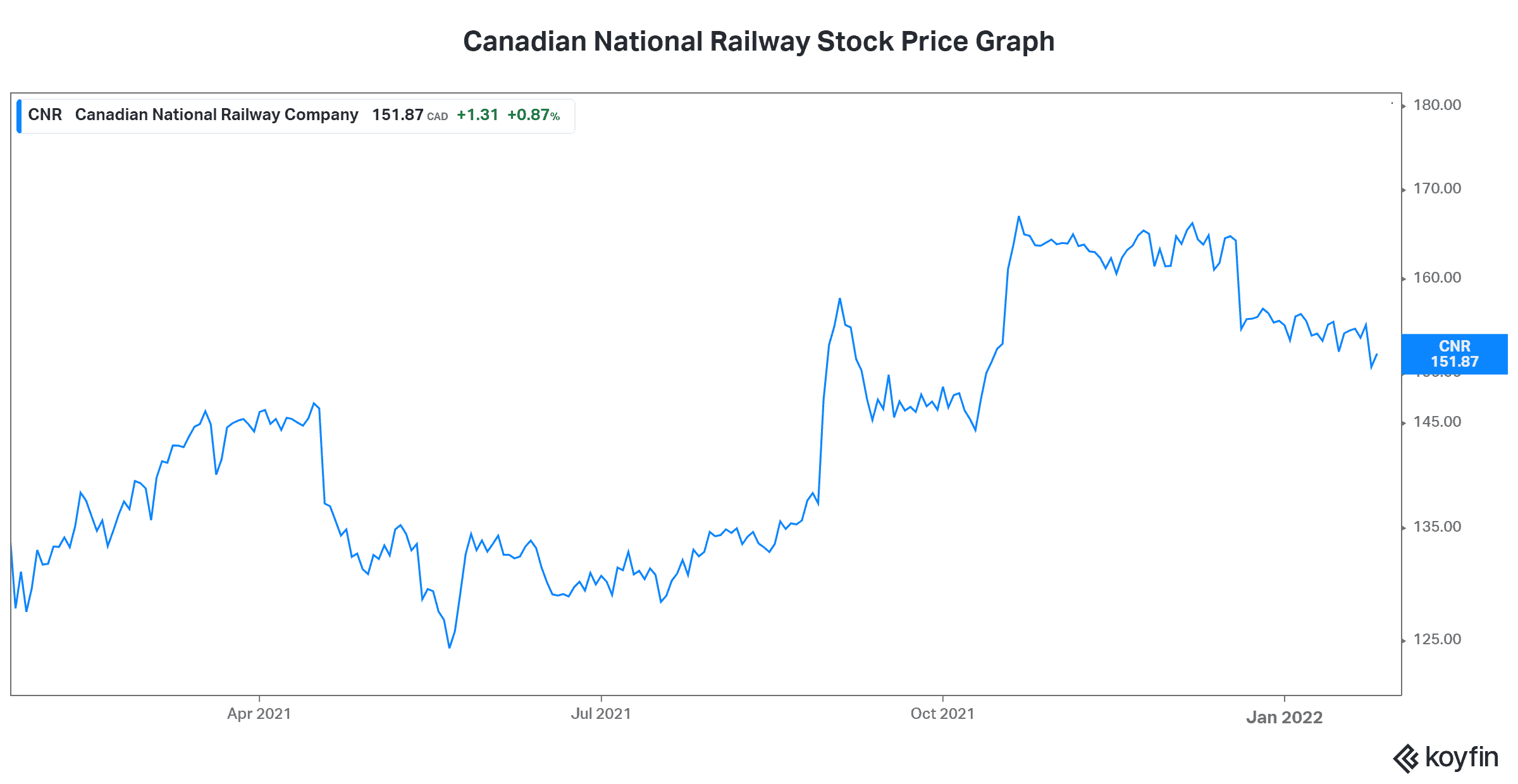

Canadian National Railway (TSX:CNR)(NYSE:CNI) has many things going for it — the least of which is its history as an exceptional dividend stock. It is, in fact, a king among dividend stocks. CN Rail is the great enabler of the Canadian economy. It has its toes in almost every big industry. In this Motley Fool article, I hope to give you a glimpse of some of the biggest Canadian opportunities for CN Rail today. Along with this, I list other companies that will also benefit from these opportunities.

Without further ado, here are the three dividend stocks I’d buy.

Canadian National Railway stock: A dividend stock with a bright future

The Canadian railways transport more than $250 billion of goods annually. These goods come from a diversified list of sectors — for example, the resource sector (grain crops), crude oil, manufactured products, and consumer goods. CN Rail has a strong position within this ecosystem. It’s the backbone of the economy. Its wide moat and dominance in its industry, along with continued strong results, make CN Rail stock very attractive.

Dropping volumes at CN is something that many analysts have been concerned about. This prompted some to decrease their target prices on the stock earlier this year. But CN Rail’s strong results, which are a reflection of strong pricing and cost cutting, have now led to a wave of upgrades. In the midst of all of this, we’ve also gotten a glimpse of what’s to come — for CN Rail as well as Canadian industry. We can expect these opportunities to results in massive industries and rising dividends.

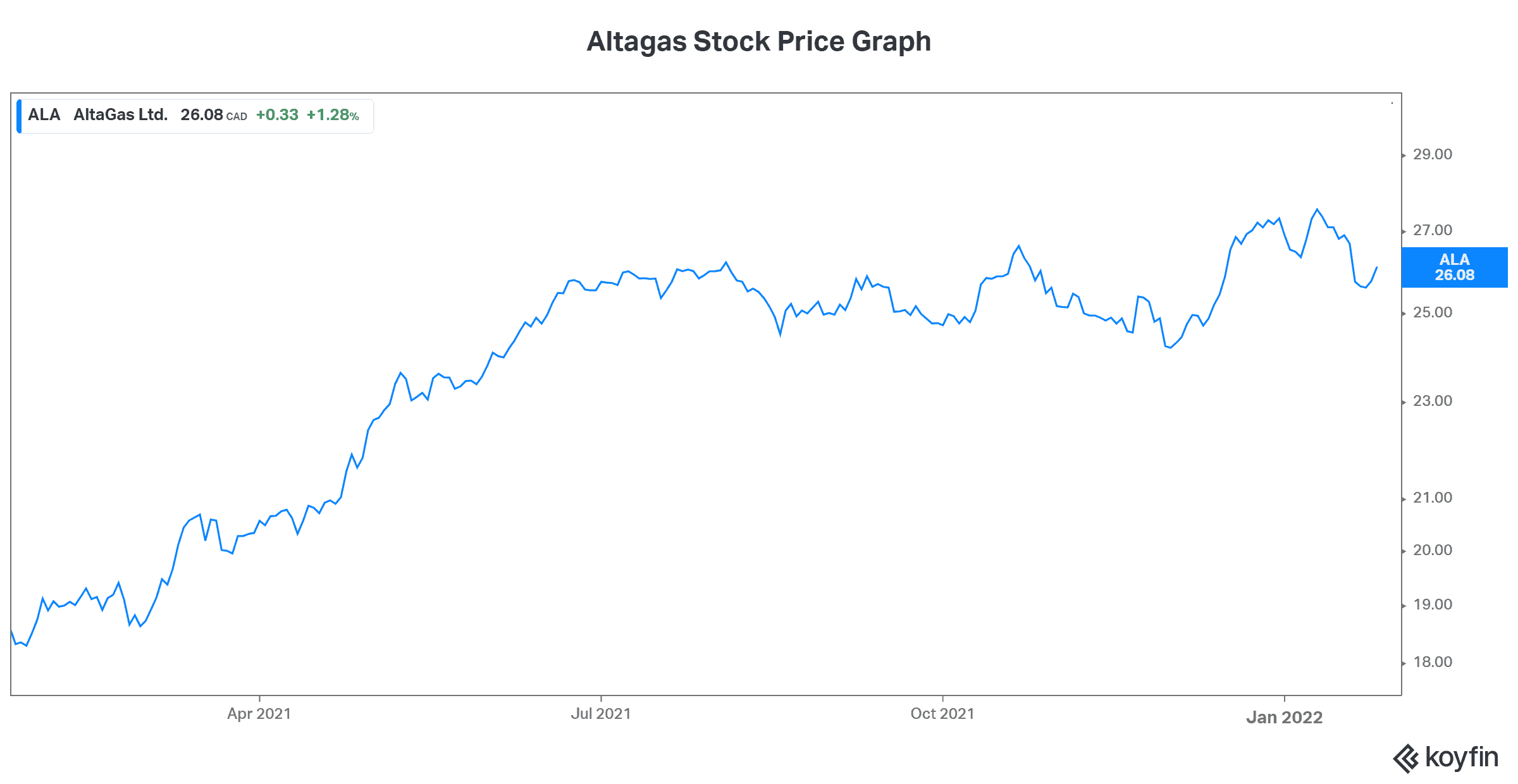

Massive investment in ethylene and natural gas by-products benefitting CN and AltaGas stock

Propane, butane, and ethylene are by-products of natural gas processing. In recent months, AltaGas (TSX:ALA) has really scaled up its propane and butane export facilities. This massive investment, in turn, is giving CN Rail more volumes to transport. With the help of CN, AltaGas is responding to the booming Asian demand for propane and other by-products. Considered a cleaner energy source, propane is meeting Asia’s demand for cleaner energy to power its homes and its economy. In fact, record volumes are being exported to Asia. And the demand shows no signs of stopping.

If you’re an investor in AltaGas stock, or if you’re looking for dividend stock ideas, take note. CN Rail’s management is talking about this export business as one of Canada’s big opportunities. AltaGas is in the heart of this booming industry. Like CN Rail, it’s a dividend stock that has strong fundamentals on its side. AltaGas stock is currently yielding an attractive 4%.

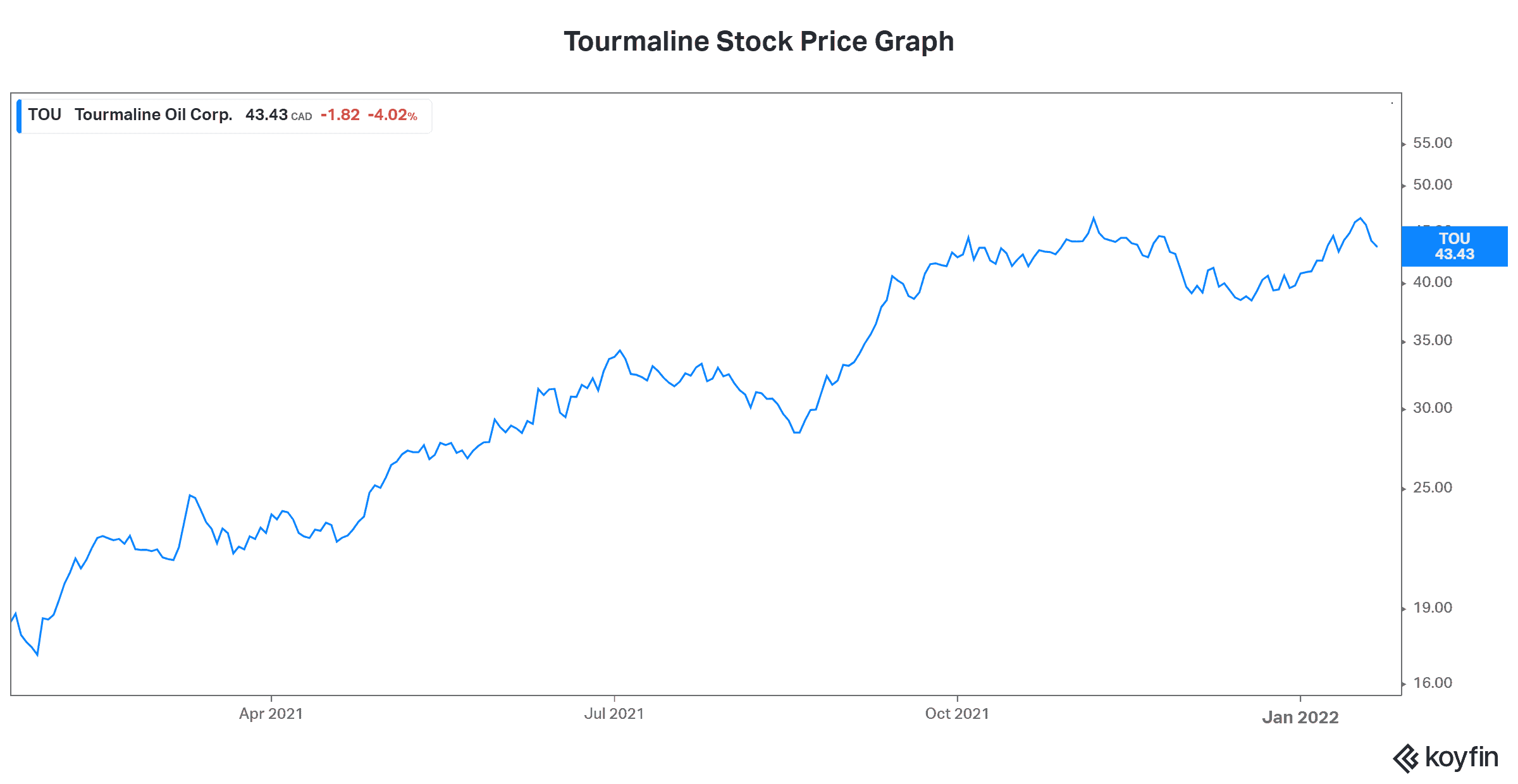

LNG Canada: An opportunity set to pay high dividends

Liquified natural gas (LNG) has been talked about a lot in the last decade. Today, it has gone from a dream to much closer to reality. In fact, it’s already a growing business. It’s one that Canada may have been slow to get into, but the next few years will see big increases in investment and business activity. To export natural gas, it needs to be turned into its liquid form, LNG. This reduces its volume and makes it possible to ship overseas. LNG Canada will do this work and then export Canadian natural gas to Asian markets. This is spawning a new mega-growth industry. It’ll benefit the transporters (CN Rail) and the natural as producers.

For example, Tourmaline Oil (TSX:TOU) is already benefitting from strong natural gas demand. With the full start-up of LNG Canada, this explosive demand will soar even higher. Tourmaline is one of the best high-dividend stocks today. Last week, the company announced an 11% dividend increase and another special dividend. This special dividend was $1.25 per share, and it follows the $0.75-per-share special dividend announced late last year.

Motley Fool: The bottom line

Canadian National Railway stock continues to be one of the best dividend stocks. It has its foot in virtually all of Canadian industry. In fact, it’s a barometre for general economic conditions, and it’s essential to the functioning of the Canadian economy. Today, it’s booming, along with the other high-dividend stocks mentioned in this article.