With February fast approaching, our focus naturally turns to RRSP investing. This is a good time to make note of the RRSP deadline. It’s also a good time to review our RRSP contribution limits for the 2021 tax year. An RRSP is a great way to save for retirement. All contributions are tax-deductible and your money can grow tax-free. So, maximizing your contributions is a great goal as we work to secure our financial futures.

This leads us to many questions. What should we buy for our RRSP? Should we focus on bonds, stock, mutual funds, or ETFs? What has the best chance of helping us grow our money quickly without taking on too much risk? The answer will depend somewhat on the investor. But in this article, I would like to introduce you to a tech stock that could help you turn a $10,000 RRSP contribution into $50,000.

A top Canadian tech stock to anchor your RRSP

Tech stocks have been really volatile in the last two years. They shot up to the moon during the pandemic. More recently, they’re coming cratering down. So where should we turn to get exposure to the very promising and lucrative tech sector? Surely, our RRSP needs it.

Well, I’m turning to the largest and most successful tech company in Canada. CGI Inc. (TSX:GIB.A)(NYSE:GIB) is a $23 billion IT and business consulting services firm. One of the most exciting things about CGI is that it’s integrating artificial intelligence into the world’s companies and governments. Robotic process automation (RPA) is the automation of high volume, repeatable tasks. CGI brings software that has artificial intelligence to replace humans and bring more efficiency to the table.

So CGI is helping to digitize the world. Governments, banks, and corporations, large and small, are jumping on the bandwagon. This is a trend that’s here to stay, and CGI has a prime position. The company has grown to what it is today from nothing in 1976. It’s well-known for its cutting-edge products and services. Also, it’s trusted for its expertise. This has resulted in the company securing countless clients from all areas and industries of the world.

CGI stock: buy it before the RRSP deadline and hold it for the long haul

CGI’s strategy has always been a “build and buy” strategy. For a long time, management’s target has been to double in size every five to seven years. This is a lofty goal. But historically, CGI has been able to achieve this. Today, the IT services industry remains highly fragmented. Therefore, there are many acquisition opportunities that CGI can work its magic on. CGI has an exceptional track record of successful acquisitions, adding tons of value to the company.

So CGI’s most recent results show that we have every reason to believe in continued strength for this tech stock. It has great cash flow and earnings numbers, which have been beating expectations. And it trades at a mere 19 times earnings. Its growth profile and its solid operations make it a top tech stock. I can easily see how a $10,000 RRSP investment in CGI stock can turn into $50,000 in time. This is a 400% rate of return – tax-free!

m

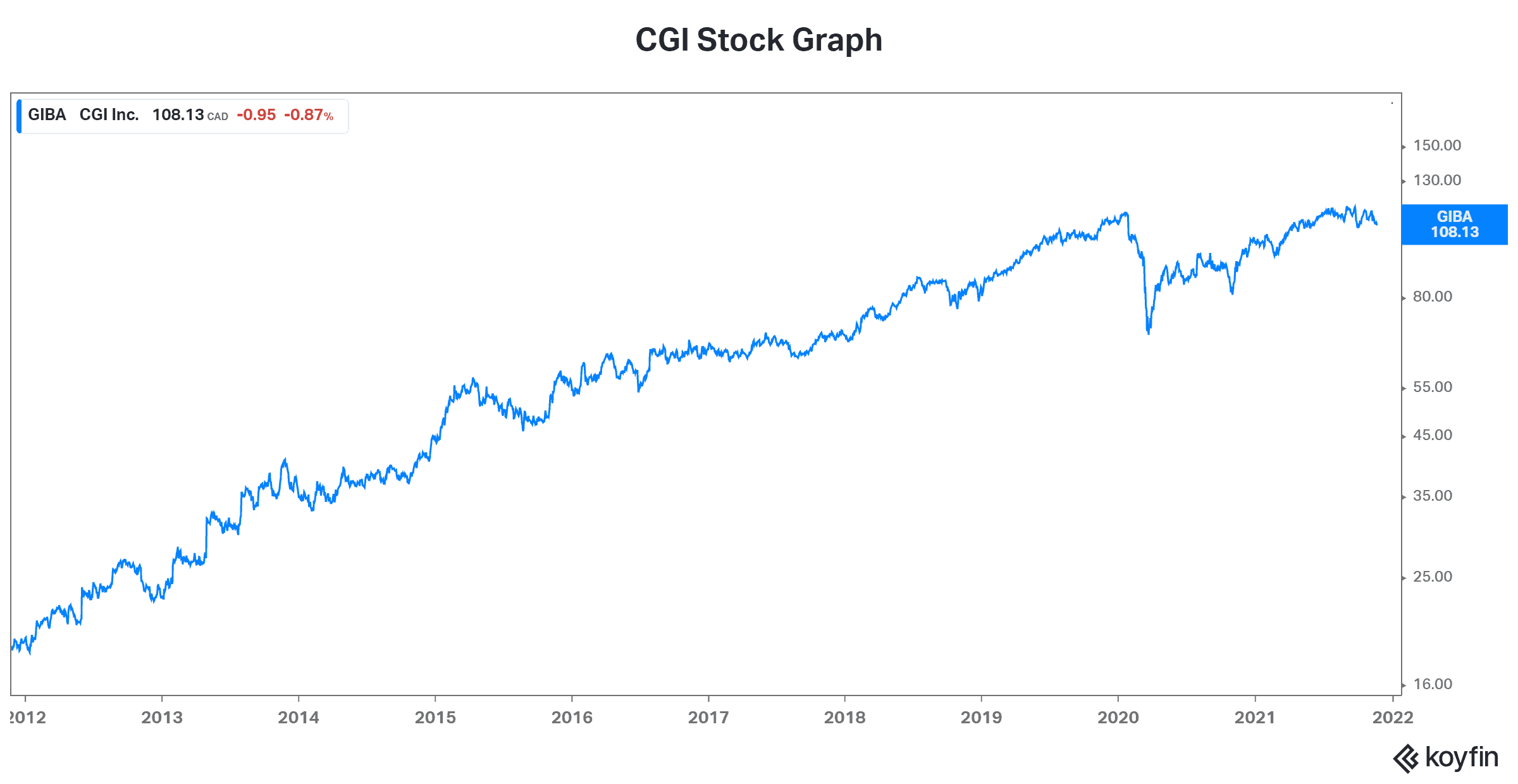

But the beauty in this tech stock is also its stability. Take a look at the stock price graph. It’s the picture of growth and stability. If you invested $10,000 in CGI stock in 2004, it would now be worth $126,000. We can also see the stability of CGI’s stock price. This is worth a lot, because our RRSPs hold our future. We want to protect the downside as much as score big upside.

Motley Fool: the bottom line

RRSP investing doesn’t really come with a manual. Start by maximizing your contributions right up to your RRSP contribution limit. And get it in before the RRSP deadline. Then invest in top stocks like CGI stock to grow your money and maximize your odds of successful retirement planning.