Let me guess! You’re probably here because you want income and your investments to be diversified right away. You’re exploring investments in Canadian dividend ETFs, but you’re not sure which one(s) to pick. What are the differences between the ETFs? Which is the best?

Let’s take a tour of three Canadian dividend stock ETFs. Conveniently, they all pay monthly cash distributions.

A Canadian high-dividend-yield ETF

Vanguard FTSE Canadian High Dividend Yield Index ETF (TSX:VDY) “seeks to track … a broad Canadian equity index that measures the investment return of common stocks of Canadian companies that are characterized by high dividend yield,” as explained on the Vanguard website. It also points out that exposure can include large-, mid-, and small-cap stocks across any industry. On a closer look, almost 94% of the fund is in large caps. This makes sense, because large, established businesses that are consistently profitable usually pay out stable dividends.

Because the fund takes a passive approach to follow an index, its management expense ratio (MER) of 0.21% is low. The VDY ETF yields about 3.8% and is decently popular with approximately $1.5 billion of net assets. Notably, its top holdings include the Big Five Canadian banks, which make up approximately 45% of the fund. Other top 10 holdings include Enbridge, TC Energy, BCE, Canadian Natural Resources, and Manulife. The latter group adds up to close to 25% of the fund. Consequently, its top 10 holdings make up about 70% of the fund.

Another high-yield ETF in Canada

Made available by BlackRock, iShares S&P/TSX Composite High Dividend Index ETF (TSX:XEI) is also another popular high-yield ETF with net assets of more than $1.5 billion. Its top 10 holdings are a little different. Suncor Energy and Nutrien take the top sixth and ninth spots, respectively. Its other top 10 holdings, not surprisingly, include Enbridge, the Big Four Canadian banks, BCE, and TC Energy, all of which are top holdings in VDY.

XEI’s top 10 holdings form about 48% of the fund. The dividend ETF has 76 holdings in total. BlackRock designed the XEI ETF to be a “long-term foundational holding, ” and rates the ETF as medium risk. The ETF yields about 3.9%. Additionally, its MER of 0.22% is competitive with VDY.

A Canadian dividend ETF with more management

BMO Canadian Dividend ETF (TSX:ZDV) provides a yield of about 4.1%, the largest of the three Canadian dividend ETFs. Many of its top 10 holdings are familiar to us by now. They include the Big Five Canadian banks, the two energy infrastructure stocks, Enbridge and TC Energy, and big telecom BCE. These have all appeared above. The two that are new are TELUS and Canadian National Railway.

The ZDV ETF’s top 10 holdings make up roughly 45% of the fund. Because the BMO dividend ETF “considers the three year dividend-growth rate, yield, and payout ratio to invest in Canadian equities” and rebalances every year, its MER is higher than the other two at 0.39%.

The Foolish investor takeaway

The top holdings of the three Canadian dividend ETFs are very similar. So, it’s not exactly diversifying if you buy them all. Since costs eat into our long-term returns, it would be wise to choose a low-cost one.

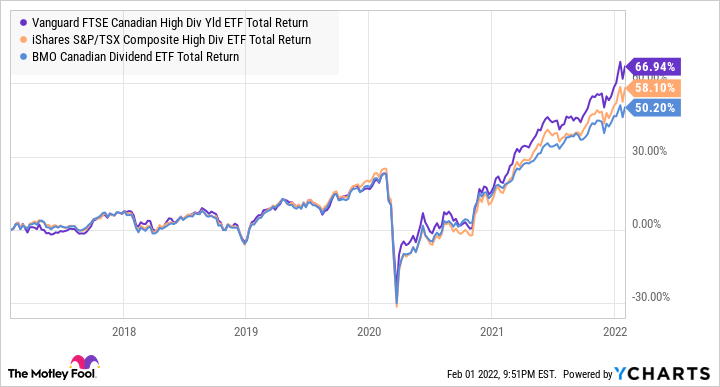

Although the Canadian dividend ETFs move in tandem, coincidence or not, VDY, the lowest-cost one right now, has delivered the best returns on multiple time frames, including over one, three, five, and 10 years.

VDY, XEI, and ZDV Total Return Level data by YCharts

If you’re looking to diversify, perhaps consider a dividend ETF that’s south of the border — for example, Vanguard High Dividend Yield ETF trades under the ticker NYSE:VYM. The ETF has outperformed VDY over the last five and 10 years.