I don’t think Warren Buffett needs any introduction. Quite simply, he is arguably the most successful investor and stock picker in history, with a long track record of outperforming the market handily.

Rather than trying to find undervalued stocks, Buffett has advised that the masses keep it simple and just invest passively in an S&P 500 index fund.

Buffett’s portfolio

In a 2013 letter to Berkshire Hathaway shareholders, Buffett indicated that upon his passing, the trustee of his estate will invest 90% of his wife’s inheritance in a low-cost Vanguard S&P 500 Index Fund, and the other 10% in short-term U.S. treasury bonds. That’s quite a departure from Berkshire’s portfolio of hand-picked value stocks!

Make no mistake, this is a risky portfolio that can have volatile movements along with the rest of the market. More risk-averse investors may prefer a higher allocation to bonds or use long-term bonds to mitigate equity risk. However, the portfolio does quite well for investors with a long time horizon.

Javier Estrada, professor of finance at the IESE Business School in Barcelona, Spain, found that Buffett’s 90/10 asset allocation actually holds up quite well for retirement. Looking at rolling 30-year intervals, Estrada found that Buffett’s portfolio had a low failure rate of 2.3%, which was comparable to the traditional 60/40 portfolio.

Which ETFs should you use?

Some caveats to be aware of before we begin: it is recommended you hold this allocation in an RRSP (to avoid foreign withholding tax on U.S. distributions), and use Norbert’s Gambit as a cheap method of converting CAD to USD to buy U.S. listed exchange-traded funds (ETFs) with.

For the equity portion, my recommendation is Vanguard S&P 500 Index ETF (NYSE:VOO). For the bond portion, my recommendation is Vanguard Short-Term Treasury Index Fund ETF (NYSE:VGSH). Both ETFs have extremely low management expense ratios (MER) of 0.03% and 0.04%, respectively.

As mentioned earlier, the ETFs should be held in a 90/10 stock/bond allocation, with dividends reinvested and the portfolio rebalanced annually. VOO will be driving most of your returns, allowing you to match 90% of the S&P 500’s total return, while VGSH reduces volatility slightly and allows you to park some cash to buy dips with.

How has it performed?

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

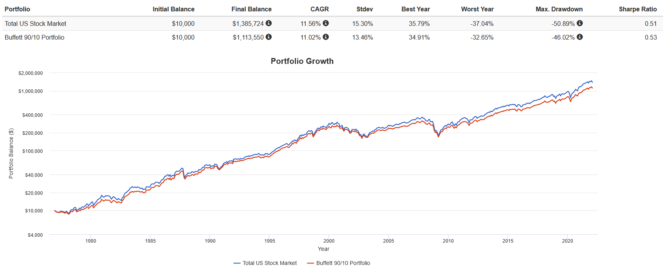

That being said, from 1977 to present, the Buffett 90/10 portfolio had a lower total return versus the total U.S. stock market (CAGR of 11.02% vs 11.56%), but also lower volatility (standard deviation of 13.46% vs 15.30%), lower drawdowns (max drawdown of -46.02% versus -50.89%), and an overall higher risk-adjusted return (Sharpe ratio of 0.53 versus 0.51).

Overall, this is an extremely cost-effective and easy-to-implement portfolio. Personally, I would prefer more of an allocation to long-term U.S. treasuries, small-cap stocks, and international stocks for lowered volatility and improved risk-adjusted returns. Then again, who am I to argue against Buffett’s advice?