Canadians love dividend stocks, and I totally understand why. Our stock market is filled with great banking, insurance, energy, utilities, and telecom stocks that have offered high yields, a long history of consistent payouts, and ever-increasing dividend payments.

That being said, managing a portfolio of 15-30 dividend stocks can be tiring and tedious. Manually rebalancing them, reinvesting dividends, and keeping up with each company’s news can be daunting to prospective investors.

ETFs to the rescue

The good news is that various fund providers such as BlackRock have exchange-traded funds (ETFs) that do all the hard work for you. These ETFs hold a basket of dividend stocks according to various criteria. By purchasing a share of these ETFs, you own a slice of that basket.

I’ll be pitting iShares S&P/TSX Composite High Dividend Index ETF (TSX:XEI) against iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (TSX:CDZ), comparing them in terms of holdings, fees, and performance.

Both funds are very popular among Canadian investors and offer exposure to a portfolio of dividend stocks. However, their construction differs significantly and warrants a closer examination.

Holdings

Let’s examine XEI first. XEI seeks long-term capital growth by replicating the performance of the S&P/TSX Composite High Dividend Index. The focus here is on high current yields, generally those above 3%.

XEI has a total of 76 underlying holdings, the top 10 of which include Canadian Natural Resources, Suncor Energy, Enbridge, TC Energy, Toronto Dominion Bank, Royal Bank of Canada, Bank of Nova Scotia, BCE, Telus, and Bank of Montreal. The yield is currently 3.65%.

On the other hand, CDZ opts to replicate the S&P/TSX Canadian Dividend Aristocrats Index. CDZ only holds quality stocks that have increased ordinary cash dividends for at least five consecutive years.

CDZ has a total of 86 underlying holdings, the top 10 of which include Canadian Natural Resources, Smartcenters REIT, Enbridge, Keyera, Pembina Pipeline, Power Corporation, Canadian Imperial Bank of Commerce, Fiera Capital, BCE, and Great-West Lifeco. The yield is currently 3.38%.

Winner: CDZ for better diversification. CDZ has more holdings and less concentration in the banking and energy sectors, which are cyclical and prone to under-performance.

Fees

When choosing a dividend ETF, you should also examine the management expense ratio (MER). Aside from the quality of the underlying holdings (a non-issue here), the fee is a source of drag.

CDZ has an MER of 0.66%, while XEI has an MER of 0.22%, which are both low compared to the average Canadian mutual fund. For a $100,000 investment portfolio, this means an annual fee of $660 for CDZ, and $220 for XEI.

Winner: XEI for having fees one-third that of CDZ. Over time, the much higher MER of CDZ can really compound to result in large opportunity costs.

Performance

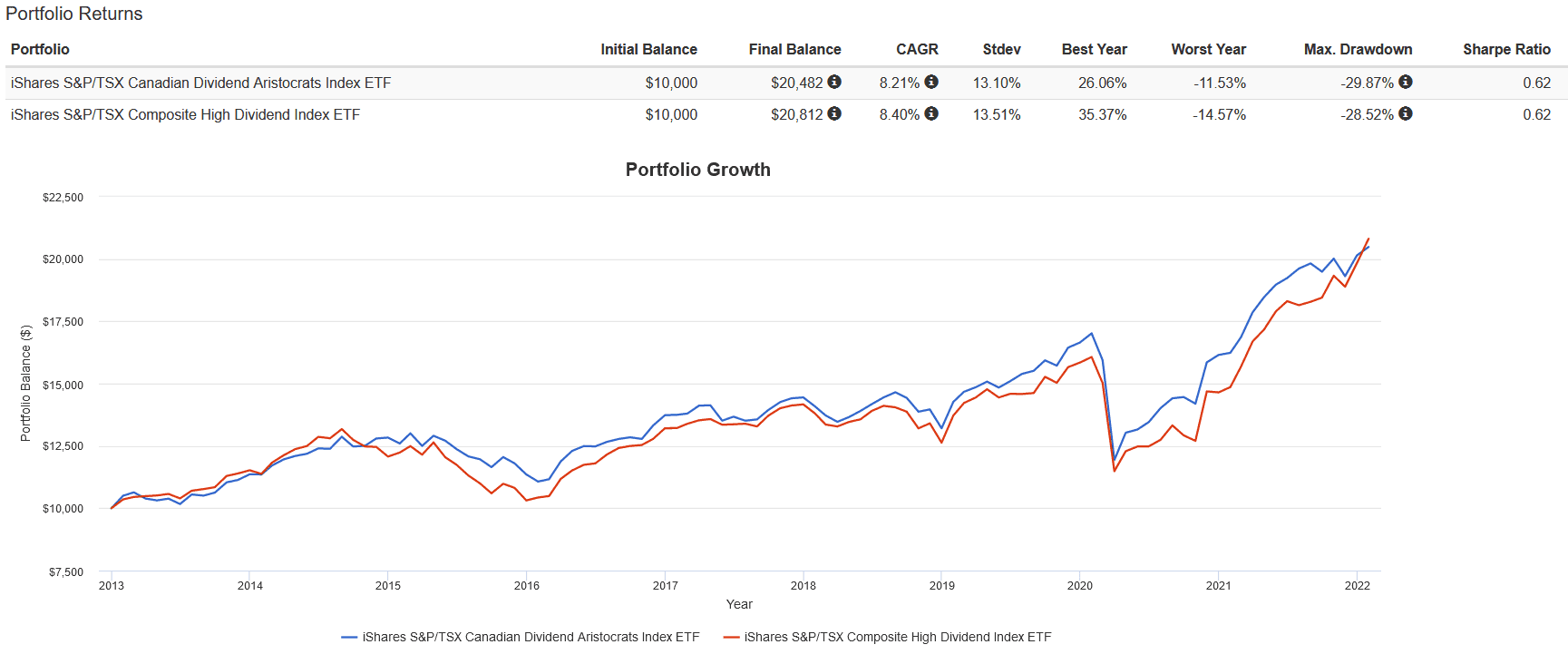

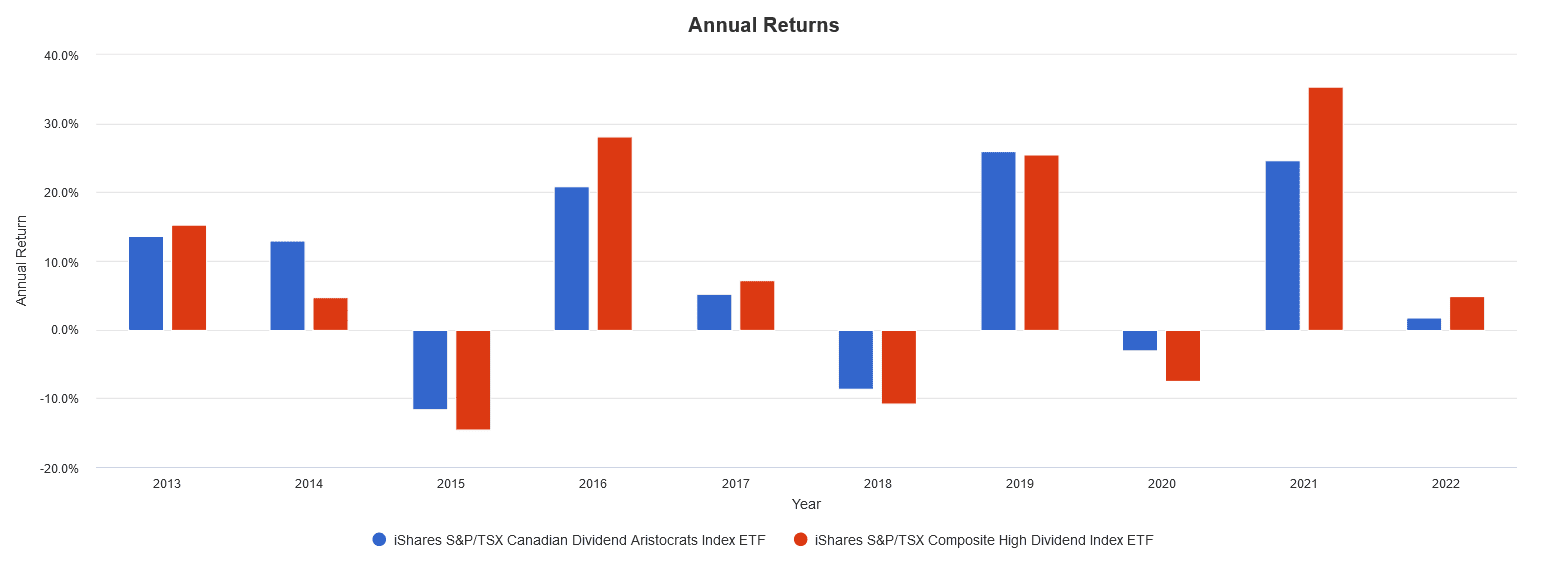

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

From 2013 to present, with all dividends reinvested, both CDZ and XEI were neck and neck with similar returns (CAGR of 8.12% vs 8.40%), risk (volatility of 13.10% vs 13.51%), drawdowns (max loss of -29.87% vs -28.52%), and risk-adjusted returns (identical Sharpe ratio of 0.62%).

Recently, XEI pulled ahead slightly due to the out-performance of the energy sector in 2021, which makes up a higher proportion of its underlying holdings compared to CDZ.

Winner: Tied. Aside from times where one fund beats the other for a bit, I expect CDZ and XEI’s long-term performance to be virtually identical by all metrics.

The Foolish takeaway

Both CDZ and XEI hold a stable and profitable portfolio of Canadian dividend stocks. It comes down to what you prefer for a dividend-growth portfolio — high current yields or consistent dividend increases?

If I had to pick one, I would go with XEI due to the lower MER. Over time, I expect this to help it pull ahead slightly compared to CDZ, despite the higher concentration in energy and financial stocks.

Regardless, BlackRock has done an excellent job with both ETFs. Canadian dividend growth investors should seriously consider making either of these the core of their portfolios.