While it’s tempting to chase high dividend yields as a strategy for growth, especially with a company like Enbridge (TSX:ENB) that offers a substantial dividend yield of 7.64%, the reality of investment returns can be counterintuitive.

For young investors aiming for growth, focusing heavily on high-yield dividend stocks might not always lead to the expected compounding growth or market-beating returns.

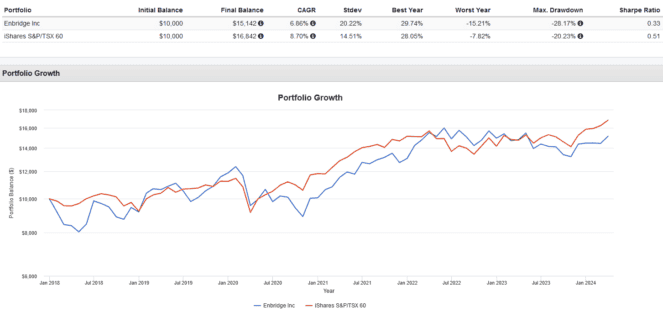

To illustrate this point, let’s examine how a $10,000 investment in Enbridge back in January 2018 would have performed up to now.

The historical data

Looking at the historical performance comparison between an investment in Enbridge and the iShares S&P/TSX 60 Index ETF (TSX:XIU) from January 2018 to early 2024, we can see some clear trends and outcomes.

If you had invested $10,000 in Enbridge during this period and perfectly reinvested all the dividends you received, your investment would have grown to $15,142. This represents a compound annual growth rate (CAGR) of 6.9%, with a higher volatility or standard deviation (Stddev) of 20.2%, indicating larger fluctuations in the investment’s value over time.

Comparatively, the same $10,000 investment in XIU would have grown to $16,842, with a slightly better CAGR of 8.7% and lower volatility (14.5% Stddev), suggesting more stable growth.

Each investment’s best year shows the highest annual return the stock experienced during the period, with Enbridge at 29.7% and XIU at 28.1%. Conversely, the worst year indicates the lowest annual return, -15.2% for Enbridge and -7.8% for XIU.

Max drawdown refers to the largest peak-to-trough decline during the investment period. For Enbridge, this was -28.2% – meaning at one point, the investment value dropped nearly 30% from its peak before recovering. For XIU, the max drawdown was less severe at -20.2%.

The Sharpe Ratio is a measure of risk-adjusted return; the higher the ratio, the better the investment’s return relative to its risk. Here, XIU outperformed with a Sharpe Ratio of 0.51, compared to 0.33 for Enbridge, suggesting that the index provided a better return per unit of risk.

The Foolish takeaway

Chasing high dividend yields does not always equate to better overall returns. In fact, as seen from 2018 to early 2024, you would have experienced lower returns and higher risk with Enbridge – this is a lose-lose scenario counterintuitive to what most investors seek.

The lesson here, especially for beginners, hinges on the theory of dividend irrelevance, which suggests that a company’s dividend policy is not a factor in its valuation. In essence, whether a firm pays out dividends or reinvests its profits doesn’t materially impact the intrinsic value of the company or the wealth of the shareholders.

The rationale is that investors can create their own “dividends” by simply selling some shares if they need cash, rather than relying on company payouts, which come with their own tax implications.

Finally, investing in a diversified fund such as XIU spreads out risk across various sectors and companies, potentially leading to more stable and consistent returns over time without putting all your eggs in one basket, even if the dividend yield is lower.