If you just started investing in the previous year, chances are that you’ve had it rough recently. A portfolio full of high-performing pandemic tech stocks has cratered recently, with some down over 50% from all-time highs.

If you’re nursing those losses and looking for a way of investing more sustainably for the long term, this article is for you. It turns out, there is a free lunch in investing, and it’s called diversification

We can define diversification as the act of spreading out your risk, so you’re not holding all your eggs in one basket, so to speak. Over time, diversification helps to reduce risk and boost returns.

But what does that entail? What should investors buy and hold in their investment portfolio to become truly diversified? Let’s look at the three factors I think are most important.

Diversify across asset classes

Asset classes are categories of investments you can include in your portfolio. Well-known ones include stocks and bonds, such as the famous 60/40 portfolio, but can also include alternative assets, such as precious metals, commodities, and real estate investment trusts (REITs).

We want to diversify across asset classes because they don’t always move together. The beauty of asset class diversification is that a portfolio of risky, volatile assets that aren’t too correlated will actually have better risk-adjusted returns than one that only holds one asset. In a way, each asset offsets the other.

For example, an investor holding long-term treasury bonds during crashes in 2001 and 2008 saw a positive return, whereas the stock market plummeted. Recently, when stocks and bonds both dropped as a result of pending interest rate hike and high inflation, gold and oil soared. A good portfolio balances its source of risk between different assets.

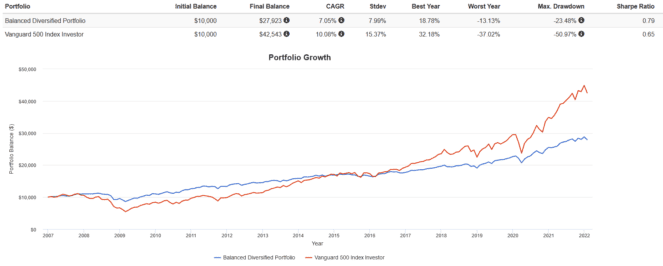

Below I’ve included a backtest of a diversified portfolio containing 50% stocks, 30% treasuries, 10% gold, 5% commodities, and 5% REITs versus the S&P 500. Notice the superior risk-adjusted return and lower max drawdowns.

Diversify across geographies

Investors often maintain a home-country bias, where they overweight domestic stocks in their portfolio relative to their true world market cap weight. A Canadian investor usually has anywhere from 30% to 50% of their portfolios in Canadian stocks. U.S. investors usually have anywhere from 70% to 100% of their portfolios in U.S. stocks.

While a modest home-country bias reduces currency risk, volatility, and improves tax efficiency, too much can lead to concentration risk — that is, the risk that your country does poorly. The world’s stock markets are cyclical, with various countries taking turns outperforming and then lagging.

From 2000 to 2010, the U.S. experienced a lost decade, where the return of the S&P 500 failed to beat Treasury Bills. During this time, Canadian stocks and emerging markets stocks did well. Over the next decade, from 2010 to 2020, we saw the opposite, with U.S. stocks going on a tear. A good portfolio holds different markets at their true weight.

Below, I’ve included a backtest of the U.S. versus international stock market. Notice how each one takes turns outperforming depending on the time period.

Diversify across risk factors

A risk factor is a source that explains stock market returns. The most well known of them is market beta, which is simply exposure to the stock market. By investing in stocks, you have exposure to market beta, which compensates you for the riskiness of stocks with a higher return versus bonds and other assets.

Beyond market beta, there are other factors that explain excess returns (alpha) generated over time. These include factors like value and size. Because value stocks are riskier than growth stocks, and small-cap stocks are riskier than large-cap stocks, we expect them to pay a greater risk premium over time.

Investors aware of this can position their portfolios to outperform by overweighting (tilting) these stocks. In particular, small-cap value stocks pay the most outsized risk premiums out there. These factor risk premiums have been pervasive over decades and statistically significant, even with large-cap growth outperforming recently.

Below, I’ve included a backtest of U.S. small-cap value stocks versus the S&P 500. Notice the massive outperformance over time, with a better CAGR and higher risk-adjusted returns.