Real estate is one of the best industries to invest in, because it’s highly defensive. Over the long run, it offers tonnes of opportunities for growth. And the best sub-sector of real estate is residential. Naturally, finding a top Canadian stock to buy that offers exposure to the residential real estate market is one of the best investments you can make for your portfolio.

For years, residential real estate stocks have grown well. A surging Canadian housing market driven by several factors has been a significant tailwind for these stocks, leading many in the industry to perform well. Now, as they face more headwinds, it’s crucial to be a lot more selective and buy the very best Canadian stocks. The best businesses will always continue to grow and find ways to operate in the new environment.

If you’re looking to invest in the high-quality real estate sector industry, though, there are plenty of Canadian REITs to consider. So, here’s why InterRent REIT (TSX:IIP.UN) is my top real estate stock to buy and hold forever.

A track record of top-notch execution

For years, InterRent has delivered impressive performance thanks in large parts to the investments it’s made both to expand its portfolio but also to upgrade its existing assets.

InterRent’s ability to consistently make disciplined investments and find value is what’s driven the REIT to put up truly impressive numbers and is why it’s a top Canadian real estate stock to buy.

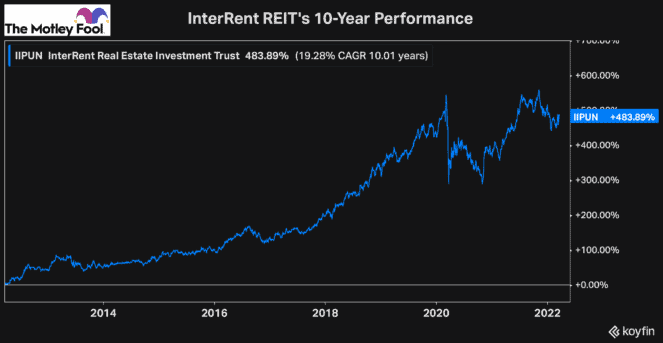

Over the last five years, it’s delivered investors a total return of 143%, or a compounded annual growth rate (CAGR) of 19.5%. And over the last 10 years, that total return has been over 480% or a CAGR of 19.25%.

And while you could argue that the Canadian housing market has been strong over that period, a 480% total return in just a decade is extremely impressive.

How does InterRent create so much value?

So, how has the company achieved such incredible and consistent growth? A perfect example of how InterRent generates value with its simple and repeatable strategy is highlighted in its recent investor day presentation, where InterRent demonstrated its repositioning of its Britannia Portfolio in the Ottawa area.

Since the acquisition in mid-2015, which cost $28.1 million, InterRent has invested an additional $8.5 million for a total cost of $36.6 million.

Meanwhile, that portfolio is worth $77.4 million today, meaning InterRent has created over $40 million of value or a more than 100% return in just six-and-a-half years. InterRent does this time and again, which is why it’s one of the top real estate stocks to buy and hold forever.

That’s not all, though. When InterRent acquired those 286 suites, it was charging an average rent of $880 per month. Today, thanks to the upgrades and investments in the portfolio as well as the surging Canadian housing market, the average rent per suite is nearly $1,300.

InterRent’s Britannia Portfolio is just one example. From 2016 to 2019, InterRent spent $165 million acquiring 750 suites. In 2020 alone, it spent $270 million to acquire 880 suites. And in 2021, it increased its investments in expanding its portfolio.

And on top of the acquisitions that it’s made, InterRent also has several development opportunities. InterRent is certainly one of the best ways to gain exposure to the Canadian residential real estate industry and is my top real estate stock to buy and hold forever.

The top Canadian real estate stock is a buy while it’s still undervalued

Considering the impressive quality InterRent has, the returns that it’s earned investors, and the fact that its strategy is simple and repeatable, it’s an excellent investment to buy and hold forever.

But when you also consider that it’s sold off significantly recently, and its average analyst target price of $20 is a more than 20% premium to today’s price, it’s one of the top Canadian real estate stocks you can buy today.

Plus, in addition to all the growth potential in the price of the REIT’s units, InterRent is also a Canadian Dividend Aristocrat, as it increases its distribution to investors each year.

If you’re looking to gain exposure to the high-quality residential real estate industry, InterRent is the top Canadian stock to buy now.