Passive income is one of the secrets to building wealth. It’s easy and takes little work. The only thing you have to do is decide which dividend stocks to buy. This is where I come in. I want to help you find the best dividend stocks that will support your passive income goals. They must be stocks that have reliable and growing dividends. Also, they must be companies that have a competitive advantage and that can maintain this advantage. In short, they must be here to stay for a very long time – in other words, reliable.

Without further ado, here are three dividend stocks that can bring you reliable monthly passive income without much work on your part.

Fortis for passive income: the good old reliable

Fortis Inc. (TSX:FTS)(NYSE:FTS) is a leading North American regulated gas and electric utility company. This is a business that’s highly defensive. Hence, Fortis is a company that’s also highly defensive. This characteristic has afforded Fortis with the ability to consistently and reliably raise dividends over many decades. In fact, its dividend has grown for 48 years. What a track record! It’s just the kind of thing we like to see from our stocks that we rely on for passive income.

Going forward, Fortis expects continued dividend growth. It’s currently yielding 3.54% and its dividend keeps growing. Actually, the company expects a 6% annual dividend growth rate through 2025.

BCE: This dividend stock rules the telecom world

BCE Inc. (TSX:BCE)(NYSE:BCE) is Canada’s largest telecom company. Its world-class wireless and fibre networks are leading Canada into the next generation of connection. In short, BCE’s competitive advantage is real and is driven by its extensive reach and dominance. It’s also driven by its financial strength.

This telecom giant currently yields a generous 5.44%. This yield is extremely high given the low-risk, high-quality company that we have in BCE. It’s what solidifies it as one of the best dividend stocks in Canada and for your reliable passive income needs.

Northwest Healthcare Properties REIT: yielding 5.74% for a steady passive income stream

I like Northwest Healthcare Properties REIT (TSX:NWH.UN) because it’s a leading owner/operator of global health care properties. The health care sector is a lucrative one with an unmistakable growth trend. Essentially, the population is aging in developed nations, which means that people will require more health care. This trend is driving greater investment as well as improved health care.

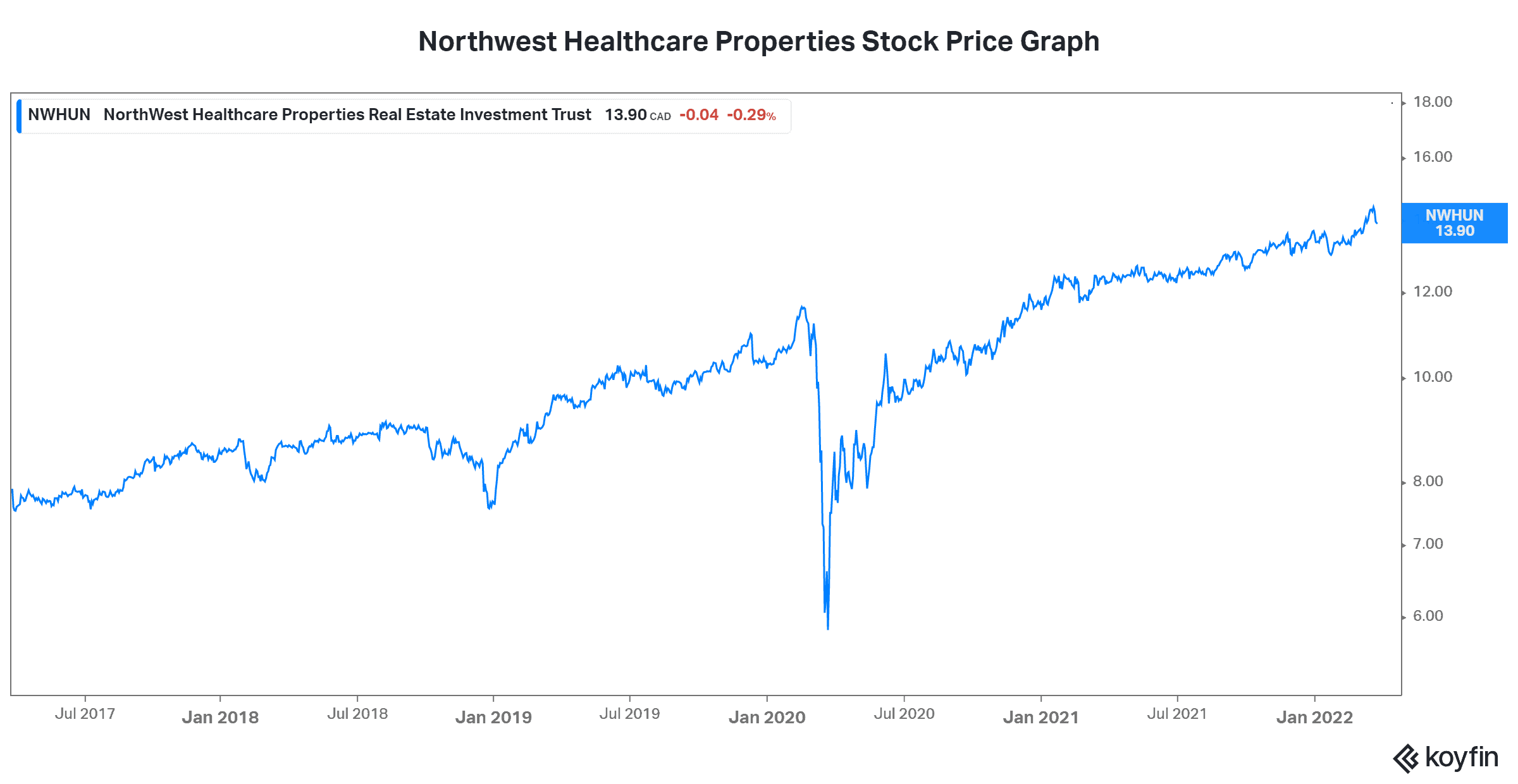

So Northwest has built up a lucrative global portfolio of health care properties. This has not been an easy feat. It’s taken a lot of financing and a lot of debt, but the reward is huge and long-lasting. Northwest has a dividend yield of 5.74%. It’s a dividend yield that has been very reliable, although it has not grown recently. Yet, Northwest Healthcare’s net asset value has consistently grown, meaning that this company is creating value. In turn, its stock price has also consistently grown. Northwest has returned 30% in capital gains in the last five years, all while providing a dividend yield of up to 8% during this time.

Lastly, Northwest’s revenue stream is inflation-protected, which is a key benefit in current times. With inflation rising steadily, it’s good to know that it won’t eat away at the company’s revenue and bottom line.

Motley Fool: the bottom line

Passive income can be achieved through very little work, yet it’s so valuable. Consider these dividend stocks, three of the best in Canada, to get you started. I hope that it will help you to build a passive income stream that will last a lifetime.