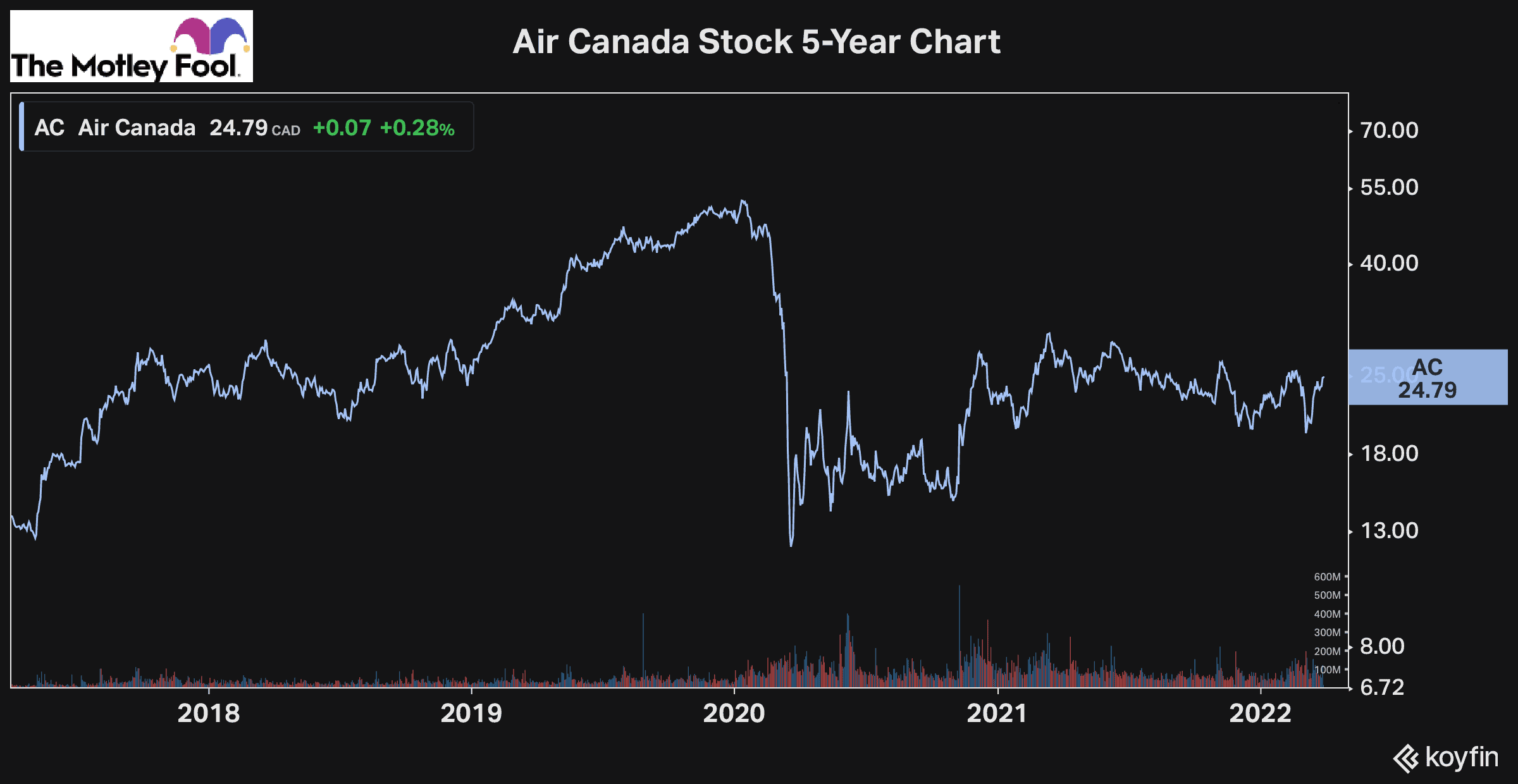

At the start of 2022, it looked as though this might finally be the year that Air Canada (TSX:AC) and its stock price could see a full recovery.

After nearly two years of the pandemic severely impacting Air Canada’s operations, it was evident that 2022 would be the year we see several pandemic restrictions either dropped altogether or significantly relaxed.

So it was one of the stocks to keep an eye on as a potential recovery stock to buy. However, with the war in Ukraine now, Air Canada stock faces a new headwind. In addition to these types of events often impacting airline stocks, higher fuel prices will be a longer-term headwind Air Canada has to deal with.

We already saw the price of Air Canada stock fall significantly at the start of the war. However, it has quickly recovered from that. So going forward, while the stock still faces some challenges, it’s in a much better position today.

Therefore, you may be wondering whether Air Canada stock can reach a price of $40 per share in April as it continues to recover. Let’s look at what it would take for that to be possible.

Can the price of Air Canada stock hit $40?

Currently, Air Canada stock has a share price of roughly $25, which gives it a market cap of roughly $8.9 billion. It also gives the stock an enterprise value (EV) of approximately $16.6 billion. At its current value, it has a forward EV to EBITDA ratio of nine times.

This makes Air Canada already fairly valued. By the numbers, you could argue it’s actually slightly overvalued, but because of its situation and recovery potential, the stock can warrant a slightly higher valuation, in my opinion.

However, whether the stock can rise to $40 in the short term is another story. While it will certainly have momentum as it starts to make progress and its operations return to normal, with the stock already fairly valued, $40 is a bitch of a stretch.

At $40 a share, Air Canada stock would have a market cap of roughly $14.3 billion and an EV of almost $22 billion. To put that into perspective, prior to the pandemic when the company was in good shape, Air Canada had a market cap of $12 billion and an EV of only $16.3 billion.

How is this possible? Because Air Canada, through no fault of its own, was so badly impacted by the pandemic, it had to issue tonnes of new debt, as well as dilute shareholders in order to raise cash.

So it’s clear that no matter what momentum the stock does gain in the short run, its upside will be capped by its valuation, and the chances of it hitting $40 a share in April or at all in 2022 are very slim.

Bottom line

It’s worth noting that the average analyst’s one-year target price is a little over $30. However, while these estimates are likely a little conservative, they’ve also priced in the recovery that Air Canada is expected to see this year.

So while there may be some upside in the share price today, there are certainly plenty of other Canadian stocks to buy now that could offer a better potential reward for the level of risk you have to take on.