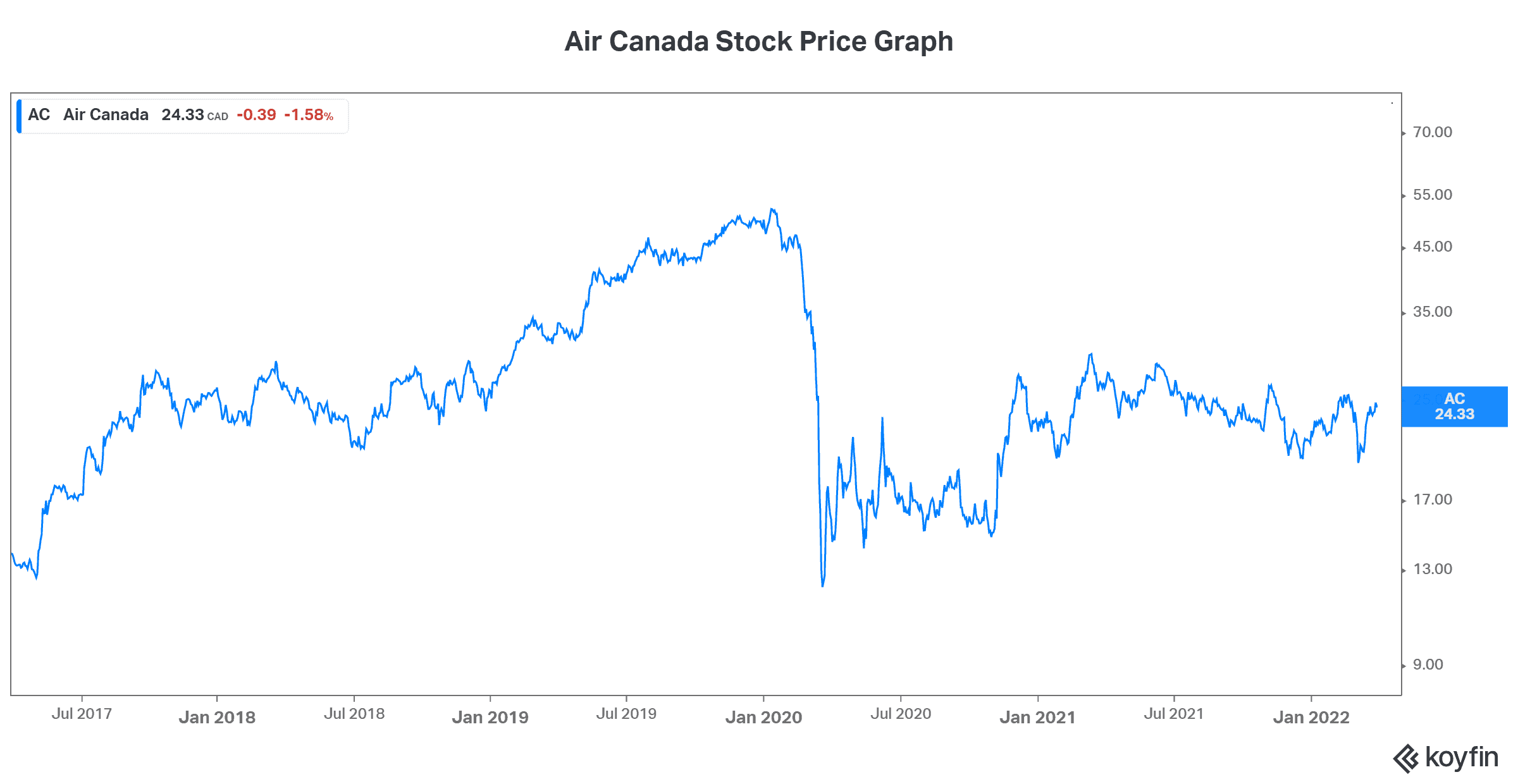

Oil prices have been soaring in the last year. In fact, it’s been the perfect storm, driving oil 82% higher. While this rise has certainly been one of the many things that has taken the market by surprise, it’s also one of the most important factors that we must contend with. So, when considering our economy and the companies within it, this has big implications. In this article, I’d like to discuss the impact that this will have on Air Canada (TSX:AC) as economies reopen.

Will the end of pandemic lockdowns be enough to boost Air Canada stock? Or are there too many headwinds that will get in the way?

Oil prices soar, taking Air Canada’s operating expense with them

In 2019, when the crude oil price averaged below $60, aircraft fuel represented 22% of total operating expense. If 22% of your operating expense rises 82%, as oil did in the last year, that’s hugely negative. It’s great that Air Canada’s advance bookings are showing real strength, but what will the bottom line look like?

Air Canada’s management is as on top of this as it can be. At this week’s investor day, management outlined a very well-thought-out and comprehensive plan. Their goals include diversification, cost cutting, and driving efficiencies, which will help mitigate the impact of rising oil prices today. They also include tapping new markets. For example, Air Canada will continue to expand internationally and to invest in its cargo business.

With this, Air Canada expects that by 2024, it will be back to 90% of its pre-pandemic capacity. Essentially, management is assuming that by 2023/24, business will mostly be back to what it was. But things will also be very different. How different they will be is a matter of debate.

Business travel: Air Canada stock is counting on it

Before the pandemic, business travel was a big driver of traffic and revenue. It was the norm for many, as it was the only way to conduct business from a distance. At Air Canada’s investor day, management put out their forecasts. These forecasts are quite optimistic and include key assumptions about business travel. In fact, management is expecting that it will be 70-85% of pre-pandemic levels in 2023. Moreover, they’re assuming that by 2024, it will be mostly back to pre-pandemic levels.

I question this, however. I think it’s tempting to say that businesses will go back to their pre-pandemic ways. But this misses out on all the lessons learned. Many have marveled at the ease and cost-efficient ways that technology has allowed things to be done. I mean, most companies are struggling to some degree under the weight of rising oil prices and inflation. Also, wasn’t this ease and efficiency one of the many benefits that was touted when technology and the internet were advancing? How can we ignore the cost savings of avoiding travel? And how can we ignore the employee benefits of a less-hectic life?

Back in November 2020, Bill Gates made a prediction that more than 50% of business travel would go away permanently. He said that “now that it’s not the gold standard to say you flew all the way over to sit in front of me, and now that you can do the virtual connection, it will be a very high threshold for actually doing that business trip.”

In response to this risk, Air Canada is diversifying and investing in its leisure and cargo segments.

Oil prices today are not the only factor causing inflation

As we know, the crude oil price is only one of many areas that is seeing inflation. It seems like everything these days is more expensive. So, Air Canada has a tough road ahead, as it deals with this, along with all of the other risks. With all expense categories being hit by inflation, management has embarked on aggressive cost transformation, cutting costs and driving efficiencies.

Motley Fool: The bottom line

The crude oil price rising is making Air Canada’s post-pandemic life a lot more complicated. The road ahead will be difficult, even as traffic and revenue rebounds. Oil prices today are clearly a big problem for Air Canada stock.