Alright, I get it. Every investing headline these days has revolved around the soaring price of commodities, in particular, oil. Investors are understandably looking to weight their portfolios toward an asset that does well in today’s inflationary environment, and that happens to be oil.

However, short of buying barrels of light sweet crude (good luck), most retail investors resort to exchange-trade funds (ETFs) that attempt to track the price of oil. The key word here is “attempt.” In practice, these funds often don’t perform exactly as most would imagine in the long term.

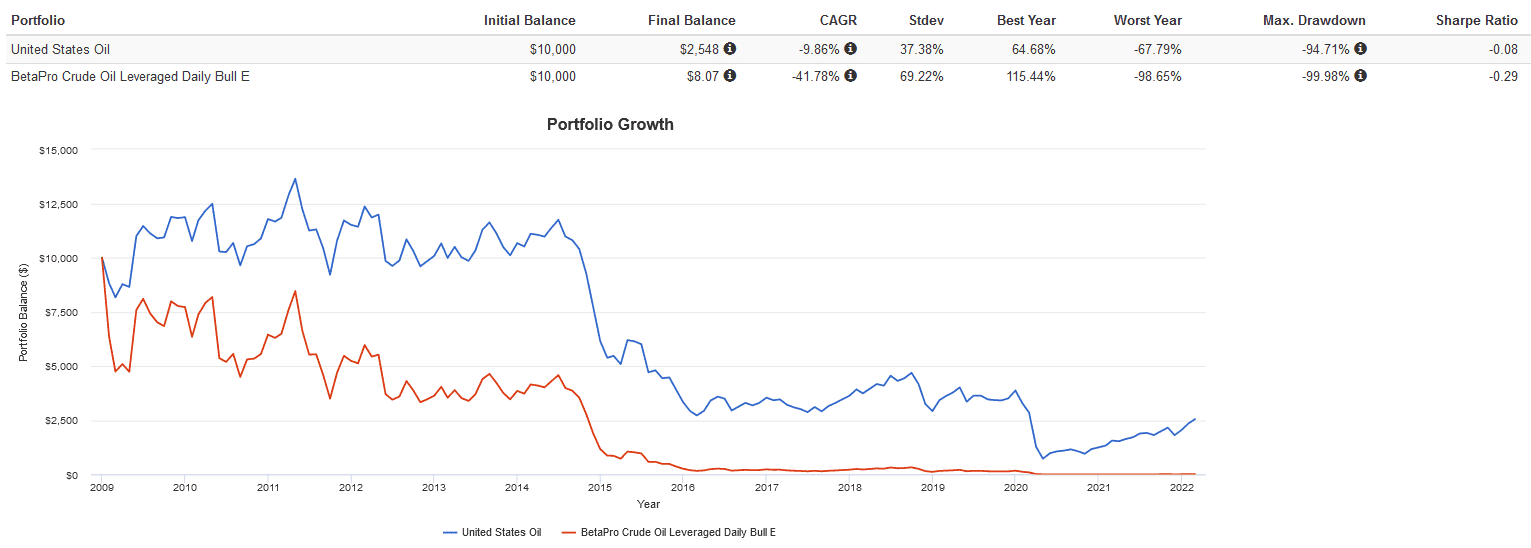

In fact, check out these charts for the Horizons BetaPro Crude Oil Leveraged Daily Bull ETF (TSX:HOU) and the United States Oil Fund (NYSE:USO) to see how they actually perform in the long run.

Ouch. Novice investors should absolutely avoid these products. They are not meant for a long-term, buy-and-hold investing (our philosophy here at The Fool), have high fees, and rely on the use of complex financial derivatives called futures. Still not convinced? Keep reading!

Dude, where did all my money go?

In short, a phenomenon called “contango” ate it. Both USO and HOU don’t hold physical barrels of oil, but rather invest in a set of derivatives called futures contracts.

The key thing to note here is that futures contracts expire. To stay in operation, both HOU and USO have to continually sell futures that are about to expire, and buy new ones. This is called “rolling.”

For example, USO must continually roll its March 2022 expiry WTI crude oil futures contracts, by selling them and purchasing those that expire later in April 2022.

Contango occurs when the price of the futures contract is above the spot price of the underlying commodity, causing futures expiring further in the future to be more expensive.

Due to this, USO loses money by having to sell the expiring futures contracts for cheap, while being forced to buy further dated futures contracts at a higher price. This causes the share price to decay.

Add to this high management expense ratios (0.83% for USO, 1.36% for HOU) the use of daily resetting two-times leverage in HOU (which causes significant volatility slippage), and frequent reverse splits, and you have an investment that is almost guaranteed to trend downwards in the long run.

But wait, it gets worse!

So we’ve established that contango causes more oil futures ETFs to lose value slowly over time, making them unsuitable for a long-term hold. But can savvy investors use it for day-trading? Suppose you were able to predict commodity trends and swing trade. Would HOU or USO work?

The answer is “rarely.” Remember, HOU and USO don’t track the spot (live) price of oil – they track the futures price a month or more out. This has historically caused HOU and USO to underperform the daily price of oil significantly, called tracking error. Novice traders often fall prey to this.

Because of this, it is entirely plausible for oil to skyrocket, yet the value of USO and HOU to remain flat or even tank due to the pricing of their futures contracts differing from the spot price. What’s the point in owning an asset that doesn’t accurately track what you want it to?

Not all hope is not lost though

If you’re still keen on investing in oil, there is a good substitute – an ETF that holds the stocks of Canada’s top oil and gas companies. Enter the iShares S&P/TSX Capped Energy Index ETF (TSX:XEG).

XEG offers targeted exposure to 22 companies in the Canadian energy sector. The fund will cost you a management expense ratio of 0.61% to hold, which is expensive for an ETF, but typical for a thematic fund and much less than HOU or USO.

Best of all, XEG accurately tracks the performance of its underlying stocks, all of which are influenced by oil prices. There’s no contango or volatility decay to worry about here!

For this reason, a good short-term play could be tilting your portfolio toward the energy sector, and an ETF like XEG is a great low-cost and simple way of executing that.