Investing in your RRSP is always a good thing to try to do, and it’s never too late to start. Regular deposits into your RRSP account can add up to significant savings over the years. It can also take advantage of dollar-cost averaging and compounding. Still, deciding which stocks to add to this account may be daunting. Yet it’s totally worth investing your time on. Top stocks don’t scream out for our attention — we must find them.

Without further ado, here are three top stocks you should consider adding to you RRSP account. Retirement planning doesn’t have to be so difficult.

RRSP investing: Dollar cost averaging and compounding

Consider how difficult it can be to time the market. Even the smartest professionals struggle with this. It’s simply not an easy thing to do. This is because there are countless factors that can move the market — interest rates, inflation, consumer spending, are only a few. Then add to this the whole concept of investor psychology, and we have a complex problem. We can get it right sometimes, but it’s best to use the concept of dollar cost averaging to support us.

The idea behind dollar cost averaging is simply entering the market to buy stocks at regular time intervals. This captures the “average” price of a stock and ensures that if the long-term trend is up, you will participate in it.

Similarly, this also helps with compounding of returns. Compounding is simply “the ability of an asset to generate earnings, which are then reinvested or remain invested with a goal of generating their own earnings.” This has a hugely positive impact over time, so the earlier you invest, the better. This is just good retirement planning.

So, the top stocks that I think you should consider for your RRSP are all leaders in their respective industries. It’s a diversified list of quality stocks in booming industries.

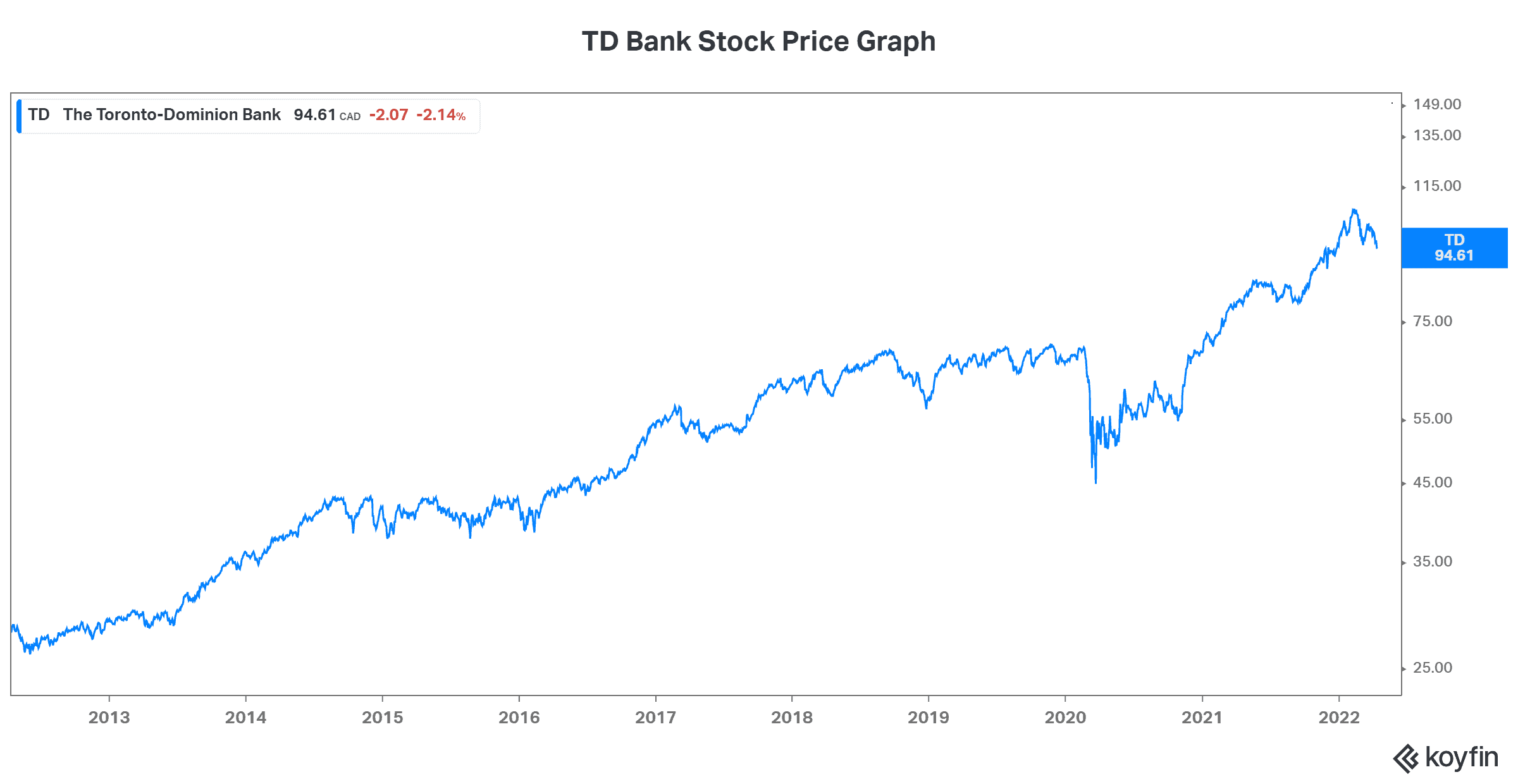

A bank stock for your RRSP that’s second to none

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is one of Canada’s top two banks. In fact, it’s also one of North America’s top five banks. This position that TD Bank finds itself in is the result of its long-standing strategy that focuses on growth as well as risk controls.

At this time, TD Bank stock is yielding 3.7%. It’s been a reliable bank and stock for decades. As part of an RRSP portfolio, it can be viewed as an anchor. It’s a great business that has done well in most economic environments. While inflation and possibly economic weakness may be in our future, on the flip side, the bank will benefit from rising interest rates.

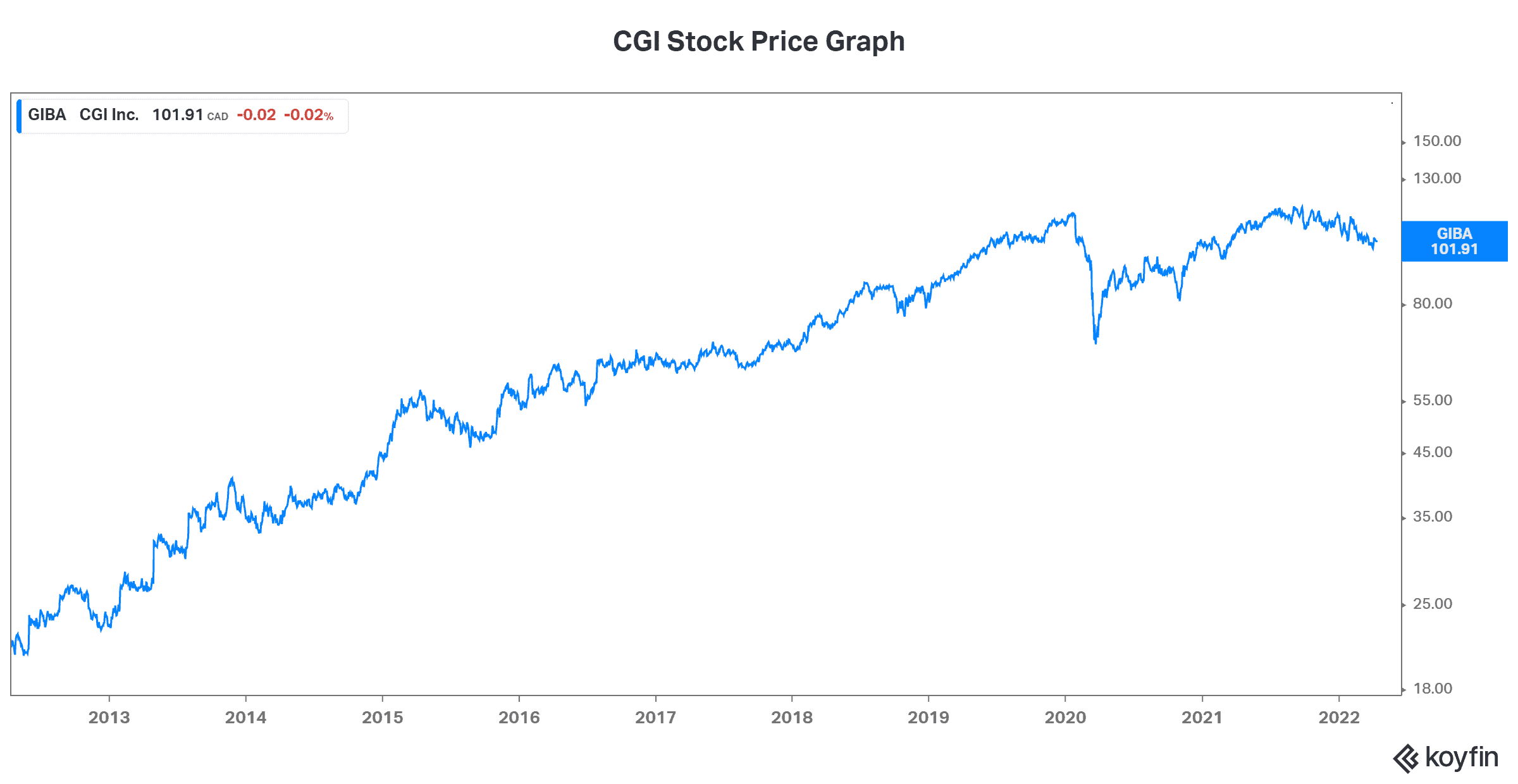

A tech stock

In my view, no RRSP portfolio is complete without tech exposure. I would therefore recommend that you consider CGI (TSX:GIB.A)(NYSE:GIB). CGI is a $22 billion IT and business consulting services firm. It started in Quebec but now it has a global presence and scale.

CGI’s strategy has always been a “build-and-buy” strategy. For a long time, management’s target has been to double in size every five to seven years. This is a lofty goal. But historically, CGI has been able to achieve this. Today, the IT services industry remains highly fragmented. Therefore, there are many acquisition opportunities that CGI can work its magic on. CGI has an exceptional track record of successful acquisitions, adding tonnes of value to the company.

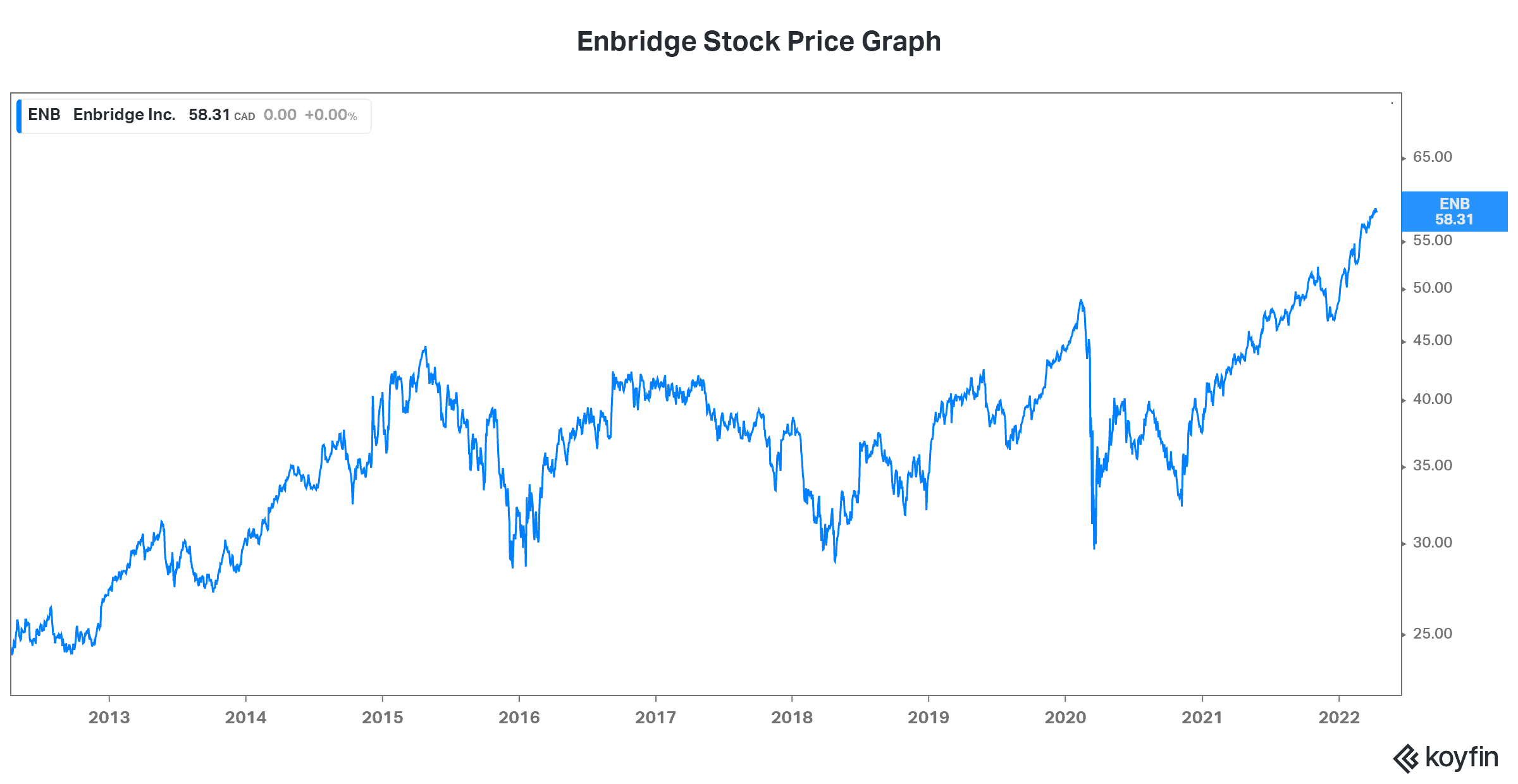

And an energy stock for retirement planning perfection

What can I say about Enbridge (TSX:ENB)(NYSE:ENB)? This energy infrastructure company is an integral part of North America’s energy grid. It has been for a long time, and it will continue to be for a long time in the future. But Enbridge has been caught up in negative sentiment for a while now, causing the stock to languish and its dividend yield to remain elevated at 6% — a perfect RRSP stock for retirement.

You see, Enbridge has a strong business, with cash flows soaring. Oil and gas will be needed for many years still. Nevertheless, Enbridge is also investing in renewable energy. Therefore, this stock will be around for years to come.