Beginner investors: are you nervous to take the leap? The stock market in the midst of a deep correction. So, this nervousness is probably greater than ever. But what if I told you that now is actually a good time to start investing? For anyone who’s interested in dipping their toes in the stock market, this article will be worth your time. Because I have three top stocks for beginner investors — stocks such as BCE (TSX:BCE)(NYSE:BCE) stock and Fortis (TSX:FTS)(NYSE:FTS) stock. Start your journey off right.

But I’d like to start by going over three concepts that all investors should remember. The first is that “cash is king.” A company that generates positive cash flows is in good shape.

The second is that financial strength is of utmost importance. A solid balance sheet has liquidity — some cash for a rainy day and relatively low debt levels.

Lastly, a long-term predictable growth pathway is key. I mean, of course, we want to maximize our upside. But we also need to minimize our downside. This is important for all investors, but especially beginner investors.

So, without further ado, here are the three stocks that check all the boxes. They’re cheaper than they were a little while ago. Yet, they’re pillars of stability. Beginner investors should consider them.

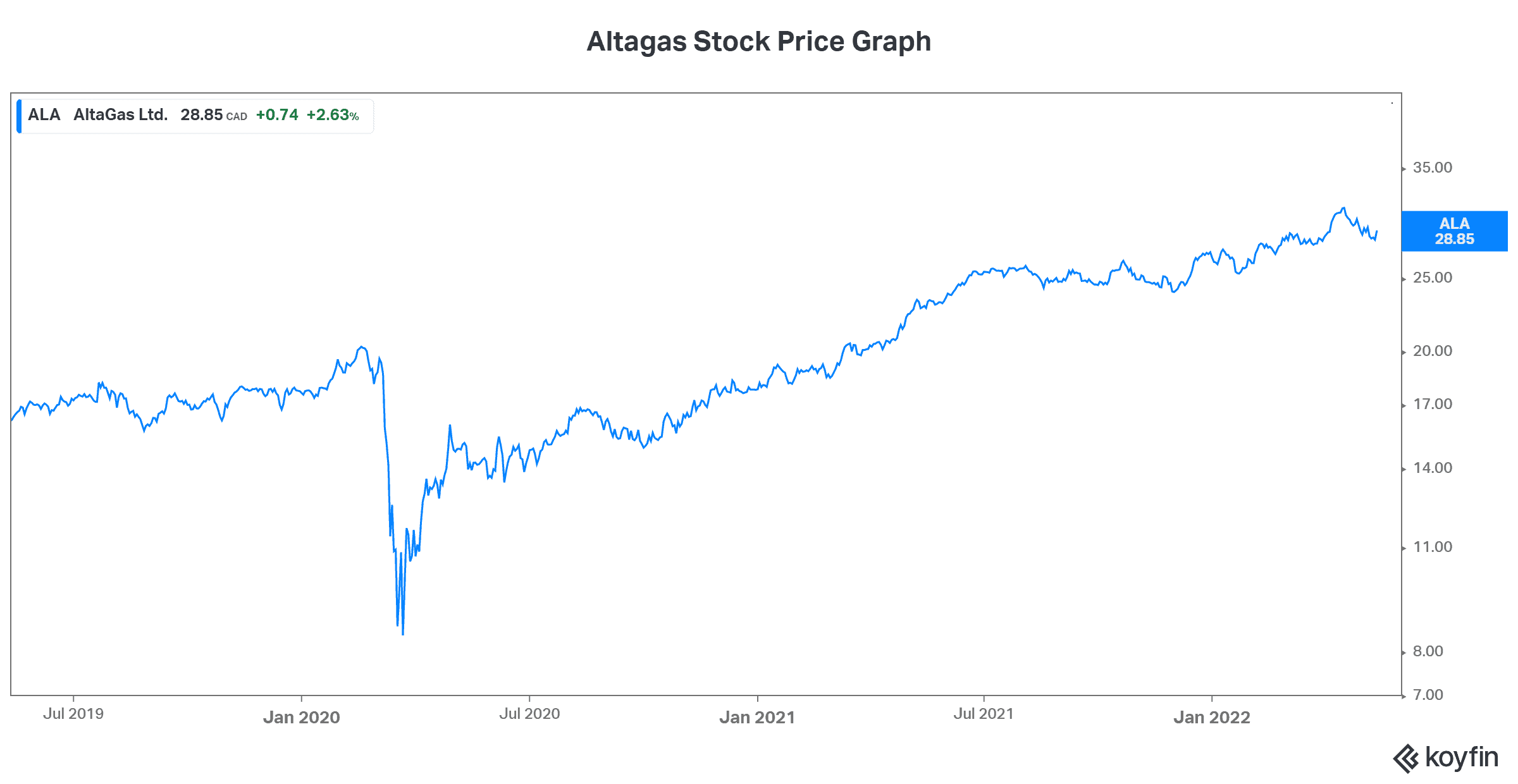

AltaGas: One of the best stocks with a bright future

AltaGas (TSX:ALA) is an energy infrastructure giant with a strong position in two distinct areas. The first is the utilities business. This business is a stable one with consistent, steady growth. It’s the part of AltaGas’s business that’s regulated and defensive. The other business is the midstream business. This is the business with the rapid growth.

In the first quarter of 2022, free cash flow at AltaGas increased 21% to $505 million. This was a reflection of the company strong and steady utilities business as well as strong global demand for its natural gas by-products. In fact, global exports rose 16% in the quarter to a record 88,000 barrels per day of liquified petroleum gas.

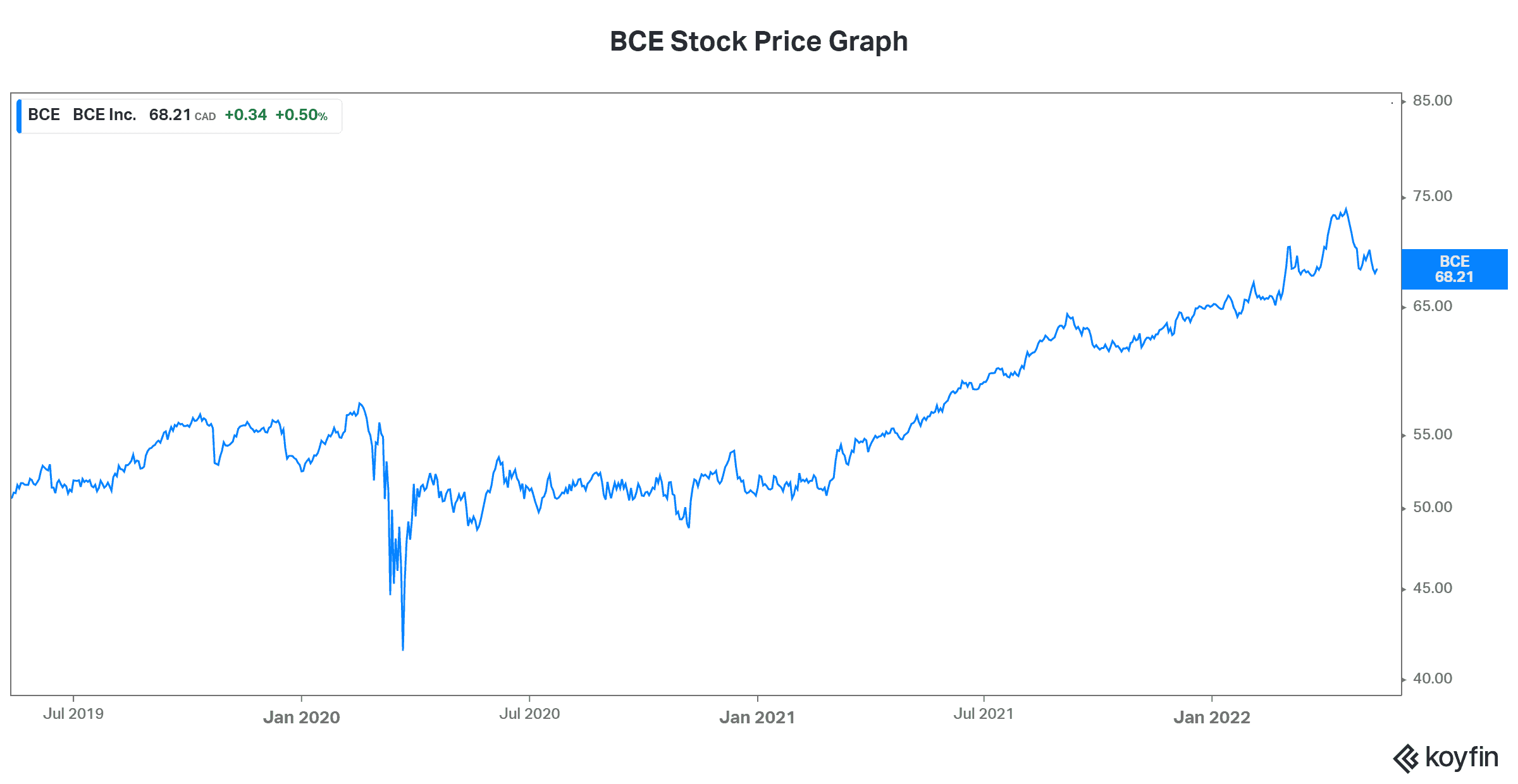

BCE: The picture of stability for beginner investors

BCE is Canada’s largest telecom services company. It has a history of steady growth, strong cash flow generation, and solid shareholders returns. It’s on my list as a top stock for beginner investors for these very reasons.

Remember, when we begin investing, we need safety more than anything else. We need predictability and we need downside protection. You can get all of this with BCE stock. Last year, BCE raked in over $3 billion in free cash flow. Also, returns are high and it has plenty of liquidity. In fact, its ROE is above 15%, and its dividend yield is 5.34%. It’s a defensive business that offers protection as well as steady returns.

All of this ensures a strong, well-capitalized future for BCE, as it continues to build out its best-in-class network. In short, BCE is laying the foundation for 5G and fibre optic networks. It has a leading competitive position in its quest to connect rural networks and to give all Canadians the fastest speeds. BCE stock is the picture of stability.

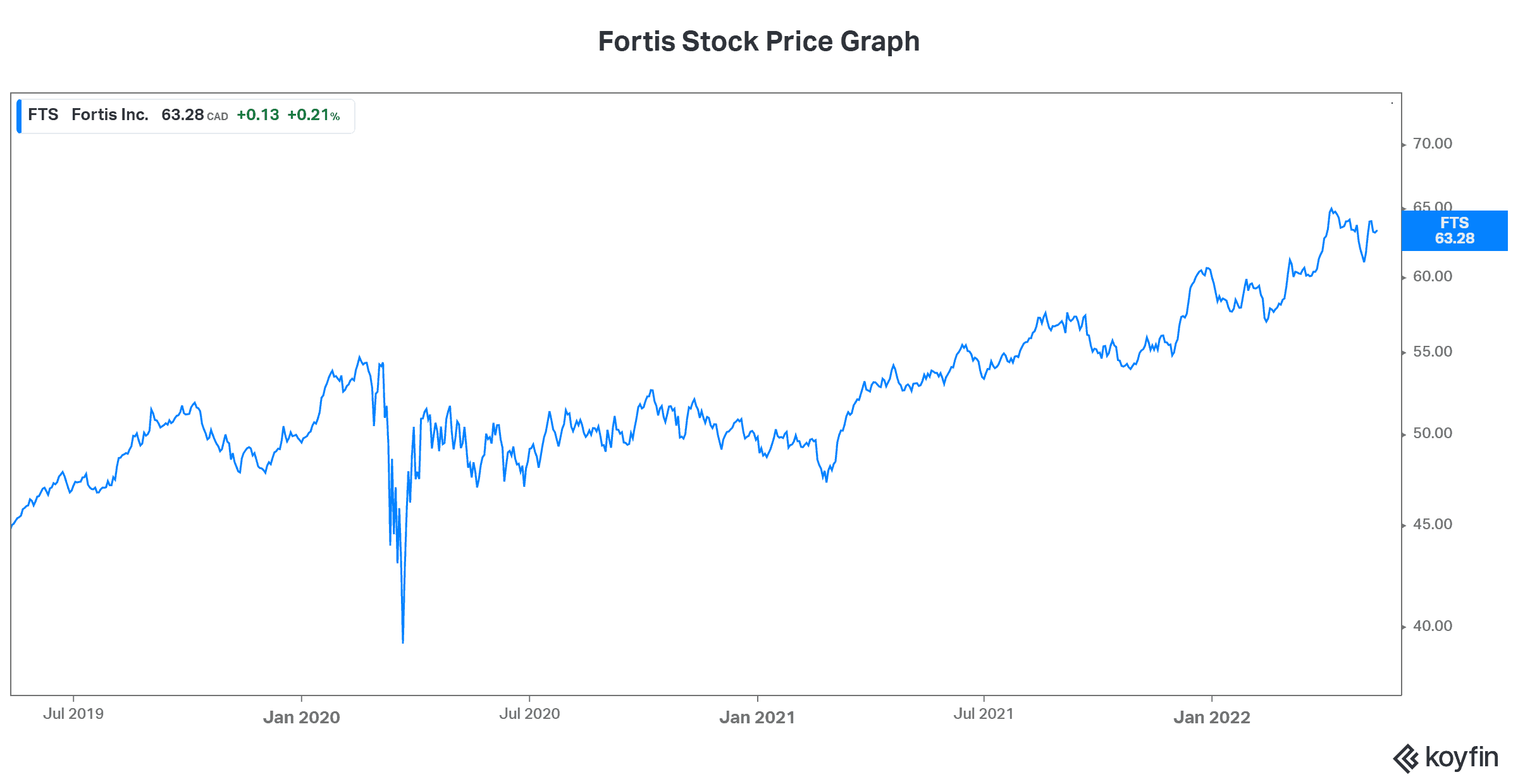

Beginner investors can rest easy with Fortis

Fortis is a leading North American regulated gas and electric utility company. It’s a highly defensive business with a highly predictable return profile. This profile has enabled Fortis to raise its dividend for 48 consecutive years. It’s also allowed investors to rest easy owning Fortis stock. It won’t blow the lights out in the short term, but it can provide steady dividend growth and capital appreciation over time.

Fortis stock is strong on all metrics — cash flow generation, financial stability, and growth outlook. This makes it a perfect stock for beginner investors, because there’s little risk of losing money. In fact, if you hold it for the long term, you will almost certainly be happy with your entrance into stock market investing.