Over the last few months, there have been several factors and headwinds that the economy is now facing that are causing a lot of worry in the market today. Even some of the best Canadian stocks have been selling off, as investors grow increasingly fearful of a recession.

And any time fears of a recession grow, it understandably causes investors to want to keep their cash on the sidelines. However, not only is trying to time the market difficult, but with inflation so high right now, holding cash is not the best idea either.

In these situations, the best thing you can do is ensure your stocks are high quality and have the long-term potential to continue growing for years. That may sound obvious, but it can lead to significant opportunities for investors.

To be successful, we all need to invest for the long run. What the stock market is doing right now or over the next year doesn’t necessarily matter.

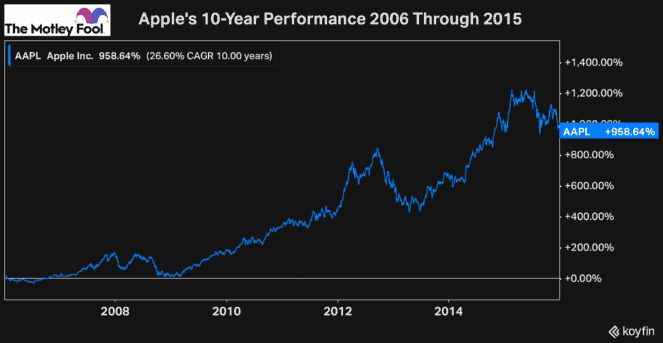

We know that we cannot avoid a market selloff. They’re naturally going to happen. For example, look at how Apple (NASDAQ:APPL) performed during the last major financial crisis.

Owning a high-quality stock for the long haul is the best way to deal with uncertainty

Leading up to the stock market volatility that began in 2007 and the major recession that followed in the United States in 2008 and through to 2009, Apple was a high-quality stock with an incredible potential for growth.

Its computers were becoming more in demand; its iPods were extremely popular; and the company was on the verge of releasing its first iPhone, which would change its business trajectory forever.

Although there was a tonne of stock market volatility over the next two years, and the United States went through the longest economic downturn since World War II, investors who owned Apple could have confidence in its long-term potential.

The recession may have impacted sales temporarily, but, over the long run, Apple has been one of the best businesses you can own and continued to innovate and find new and creative ways to expand its operations.

Regardless of what’s going on with the stock market or the increase in chatter about the potential for a recession, investors must focus on finding the best Canadian stocks to buy that you can plan to hold for years.

One of the best Canadian stocks to buy now

In today’s environment, finding a high-quality Canadian stock to commit to for the long run will help you to avoid impulsive mistakes. However, it will also help you mitigate short-term volatility if you’re buying stocks now that you know you will own years down the line.

This way, in case these stocks continue to lose value in the short run, you could even consider buying more and lowering your average cost.

If you’re looking for high-quality companies that you can have confidence in, one of the best to buy now is Cargojet (TSX:CJT).

Cargojet likely won’t have as significant of a long-term rally as Apple had in the past. With that being said, though, it’s an incredible growth stock with tonnes of long-term growth potential that you can have confidence buying and holding today.

The stock is perfectly positioned to take advantage of a continuous long-term trend that’s seeing more consumers shop online and more overnight time-sensitive air delivery services needed.

The pandemic, of course, gave Cargojet and the e-commerce industry a significant boost. And while some of those sales have slowed down, as pandemic restrictions have eased, and shoppers return to brick and mortar, over the long haul, there is still a massive runway for growth for the entire industry.

With Cargojet now trading more than 30% off its high and at a forward enterprise value-to-EBITDA ratio of just 8.3 times, it’s certainly undervalued especially considering all the long-term potential it has.

In fact, Cargojet’s average target price from analysts is over $250 a share, a more than 50% premium to today’s market price.

Therefore, whether or not you’re concerned about the potential for a recession in the near term, Cargojet is one of the best Canadian stocks to buy now and a business you can have confidence holding for years.