The recent tech and growth stock correction has been brutal for the FAANG (Or FANGMA) cohort. Once leading the market capitalization of many notable stock indexes, these stocks have fallen steadily year to date, dragged down by rising interest rates and inflation, and, in some cases, missed earnings reports and slowing growth.

- Meta Platforms (Facebook): -42% YTD

- Amazon: -28% YTD

- Netflix: -67% YTD

- Alphabet (Google): -19% YTD

- Microsoft: -19% YTD

- Apple: -18% YTD

Investors looking to buy the dip can exchange CAD for USD, but this approach comes with high fees and currency risk. A better way is to buy an exchange-traded fund (ETF) that can offer you instant, capital-efficient, and cheap exposure to the FANGMA cohort. Consider Evolve FANGMA Index ETF (TSX:TECH).

What’s under the hood?

As an ETF, TECH holds an underlying “basket” of stocks — in this case, the six FANGMA stocks. When you buy a share of TECH, you’re therefore buying the underlying FANGMA stocks.

If the FANGMA stocks increase in value overall, TECH’s share price will also increase. Conversely if they fall, TECH will also fall.

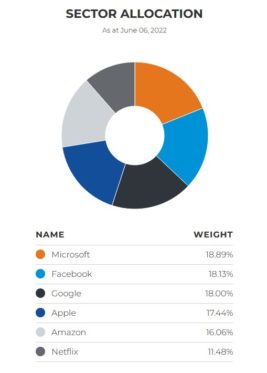

TECH currently holds all six FANGMA stocks in the following proportions:

The index is intended to be equal weighted, but between the periodic re-balancing periods each stock may drift based on its performance. For instance, because Netflix fell heavily recently, it’s allocation in TECH dropped, too.

Things to be aware of

TECH currently has a management expense of 0.40%, which is high but typical for a thematic fund. The management expense ratio (MER) is yet unknown, as trading, tax, and turnover costs haven’t been determined yet.

For now, we can approximate TECH’s annual fee on a $10,000 portfolio to be around $40. Once again, this will change, as the fund manager releases the MER after sufficient performance data is gathered.

The ETF is relatively new, so assets under management (AUM) is low at just $47 million, and volume isn’t too high. However, liquidity and bid-ask spreads shouldn’t a problem, as the underlying six FANGMA stocks are heavily traded. In any case, using limit orders is a good idea.

Finally, TECH is currency hedged, as the underlying stocks all trade in USD. Theoretically, this means that TECH’s value will not be affected by fluctuations between Canadian and U.S. dollars. In practice, there will be some tracking error between TECH and a self-managed portfolio of six FANGMA stocks.

The Foolish takeaway

Investors wanting to buy FANGMA stocks but unwilling to convert CAD to USD can buy TECH as a managed one-ticker portfolio. For a 0.40% management fee, the fund provider takes care of the re-balancing, purchases, and currency hedging for you. A share of TECH also trades at around just $8, making it a capital-efficient way of buying otherwise pricey FANGMA stocks for investors with smaller account sizes.