Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

Canadian investors looking to reduce their portfolio’s risk in a rising interest rate environment often opt for money market instruments, which hold ultra-short term, highly safe deposits. Fund managers like Purpose Investments, CI Global Asset Management, and Horizons ETFs provide a set of low-cost, high-liquidity ETFs that offer exposure to a portfolio of money market instruments.

The three tickers up for consideration today are Purpose High Interest Savings ETF (TSX:PSA). CI High Interest Savings ETF (TSX:CSAV), and Horizons Cash Maximizer ETF (TSX:HSAV). Which one is the better option? Keep reading to find out.

PSA vs. CSAV vs. HSAV: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time and calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

PSA and CSAV both have an MER of 0.16% vs. 0.13% for HSAV — a difference of $3 in a $10,000 portfolio. The MER on money market ETFs is very important due to their low yield — a small percentage can detract significantly from the payouts. For this reason, HSAV is the winner here, but by a small margin.

PSA vs. CSAV vs. HSAV: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

PSA currently has AUM of $1.9 billion, CSAV has $2.7 billion, and HSAV has $2.1 billion. All three are more than sufficient for a buy-and-hold investor, but CSAV is the most popular at this time.

PSA vs. CSAV vs. HSAV: Holdings

When selecting a money market ETF, investors should pay attention to two considerations. First, check the underlying deposits. The holdings should be cash in high-interest savings accounts, guaranteed investment certificates, or short-term U.S. Treasury bills. In this case, all three ETFs hold deposits with Canadian banks in cash accounts.

All three ETFs currently have a gross yield of around 1.95%, which is based on the overnight rate plus about 45 basis points. The net yield of each ETF is therefore 1.95% minus each one’s MER, hence why minimizing fees is critical here.

PSA vs. CSAV vs. HSAV: Historical performance

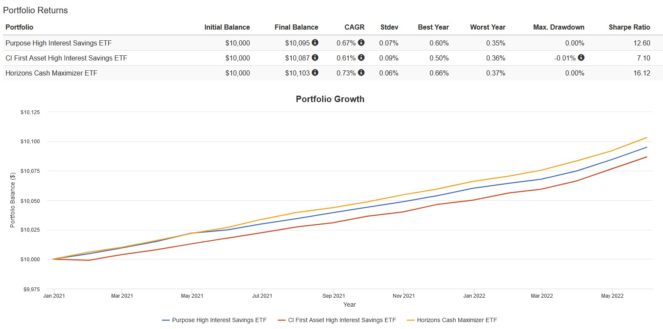

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

Here are the trailing returns from 2021 to present:

Here are the annual returns from 2021 to present:

All three ETFs performed very closely, with HSAV taking the lead in both years. I attribute this to its lower MER thanks to the fee waivers implemented by Horizons ETFs.

The Foolish takeaway

If I had to choose one ETF to buy and hold, it would be HSAV for its lower MER. For low-yielding money market instruments, fees can make or break things. Keeping this low is the best way to maximize the yield. That being said, CSAV would be a great pick too due to its higher AUM and liquidity.