HEXO (TSX:HEXO)(NASDAQ:HEXO) is one of the largest licensed cannabis companies in Canada. It’s okay to be bullish on the Canadian cannabis industry, but HEXO stock is not for cautious investors.

The promise of wealth in the marijuana market was fully realized just a few years ago. But after this came the COVID-19 pandemic, supply chain issues, and the disappointing rollout of Cannabis 2.0 (edibles, vapes, etc.). Among the cannabis stocks hardest hit during the decline of the cannabis industry was HEXO, a once-promising competitor in the market.

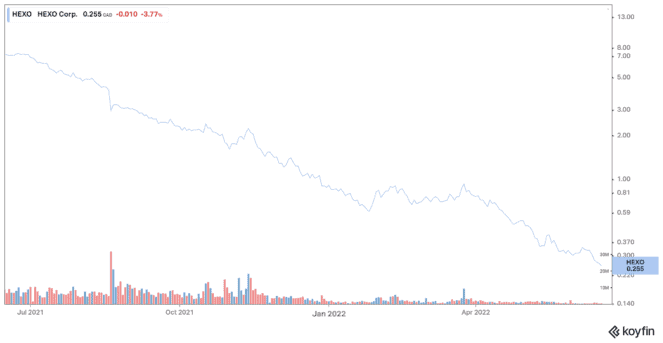

HEXO shares, valued at around $7 a year ago, can’t even stay above $1 lately. Not so long ago, the stock hovered around $0.26.

Meanwhile, HEXO’s market capitalization fell below $100 million.

Delisting may be a possibility, as the Nasdaq stock exchange has occasionally issued delisting warnings when stocks trade below $1 for an extended period.

HEXO reports huge losses

Meanwhile, HEXO’s financial results are in shambles. During the company’s last quarter, Hexo suffered a net loss of approximately $146.6 million. That figure was around $21 million a year earlier.

The cannabis producer said third-quarter revenue rose 101% to $45.6 million from a year earlier but fell by 14% compared to the previous quarter in a context of continued competition in the Canadian market.

HEXO reported adjusted EBITDA of $18.4 million — a sharp decline from the $10.8 million loss reported in the prior-year quarter.

Clearly, HEXO is not on the right fiscal path. We can ask ourselves if the company is doing what it takes to get out of this financial misery.

To help answer this crucial question, we can check out what HEXO has been up to lately.

HEXO said its restructuring plan to streamline its structure and cut costs included cutting 450 jobs.

In financial documents, the Quebec company indicated that this staff reduction would result in annual savings of $30.6 million and aims to simplify its organizational structure so that costs are more closely aligned with the business’s size.

The company’s latest management discussion and analysis document indicates that most of the reductions will be achieved with less reliance on external consultants, a new information technology platform, and synergies discovered through recent acquisitions.

HEXO will close a processing and manufacturing facility in Belleville, Ontario by the end of July.

Unfortunately, approximately 230 employees will lose their jobs at this factory.

So, what else did HEXO do? Of course, the company is launching a stock market program that will allow HEXO to issue and sell up to $40 million (or the equivalent in Canadian currency) of stock. The obvious concern here is stock dilution.

What to do with HEXO stock

Overall, HEXO is in dire financial straits, and issuing stock is unlikely to be an effective long-term solution. Ultimately, HEXO will have to prove its viability as a business. The road to recovery, if it actually happens, will not be easy.

As HEXO stock could continue its incessant fall, potential investors should simply avoid it altogether and look for a better risk/reward profile elsewhere.