Air Canada (TSX:AC) has taken on its share of problems in the last couple of years. Today, Air Canada has seen its stock price sink to pandemic lows once again – and back to 2007 levels. This has dashed the hopes of many investors who have been looking to enter the stock market. Many have been waiting for a post-pandemic bounce in Air Canada stock. What they got instead was losses upon losses. Maybe it’s time to cut and run. Maybe it’s time to look elsewhere.

Here are two stocks to buy instead of Air Canada stock. These are the ideal stocks to begin your investing journey. They have stability and predictability on their side.

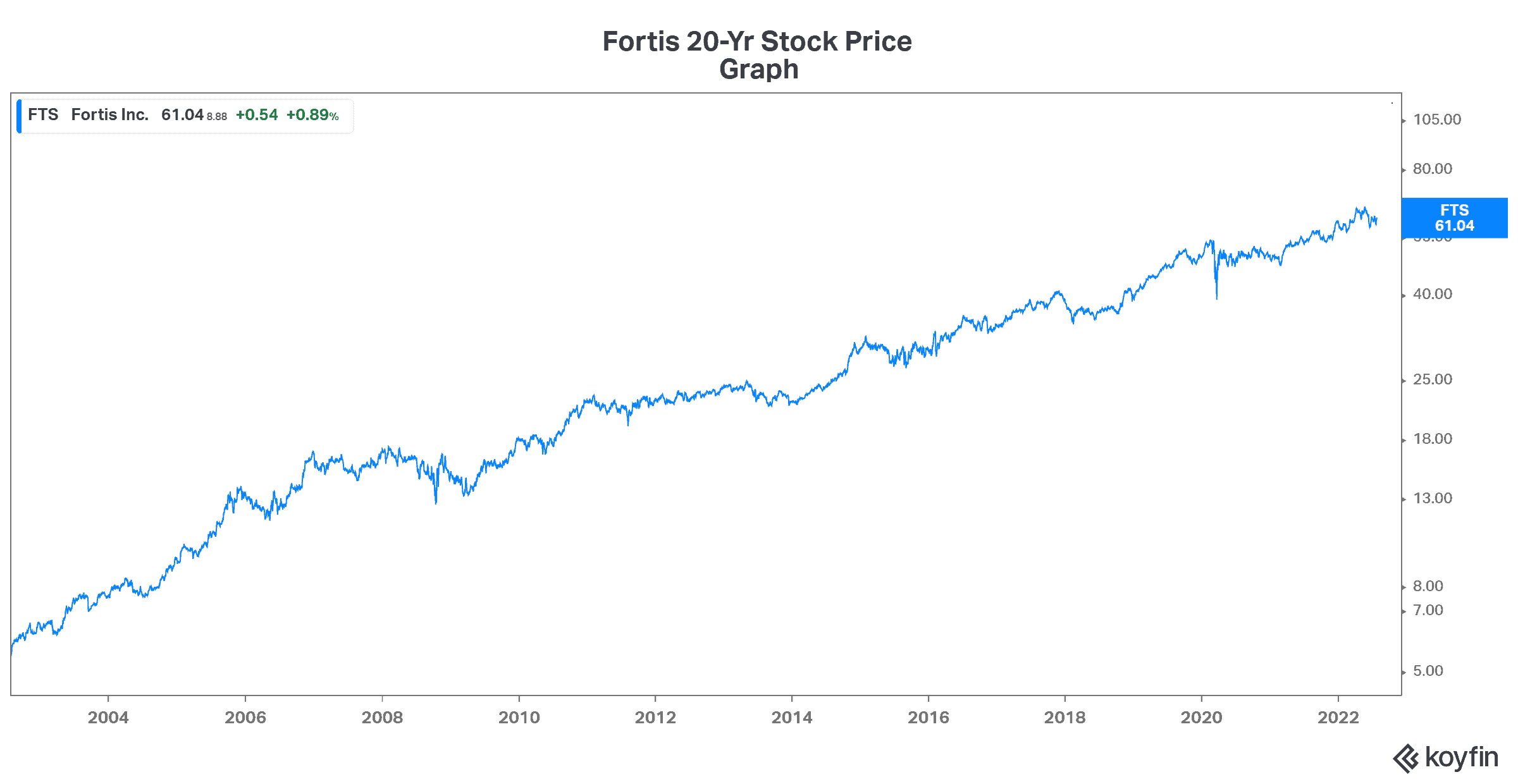

Fortis rewards investors for the long haul – Air Canada stock can’t compete

Unlike Air Canada stock, which has been super volatile, Fortis Inc. (TSX:FTS)(NYSE:FTS) is the exact opposite. Fortis is a leading North American regulated gas and electric utility company. As such, it’s extremely defensive. Fortis is unphased by the economic woes of the times. Clearly, demand for utilities is less economically sensitive than travel plans.

m

Also, Fortis has a very strong long-term track record. In fact, the company has consistently and reliably raised its dividends over many decades – for 48 years to be exact. How’s that for reliability and predictability? This is a big part of what makes Fortis the ideal stock for investors to ride out the storm that we’re facing today. In short, unlike Air Canada stock, it’s the ideal stock for beginner investors.

Going forward, Fortis expects continued dividend growth. The stock is currently yielding a respectable 3.51% and its dividend keeps growing. The company expects a 6% annual dividend growth rate through 2025.

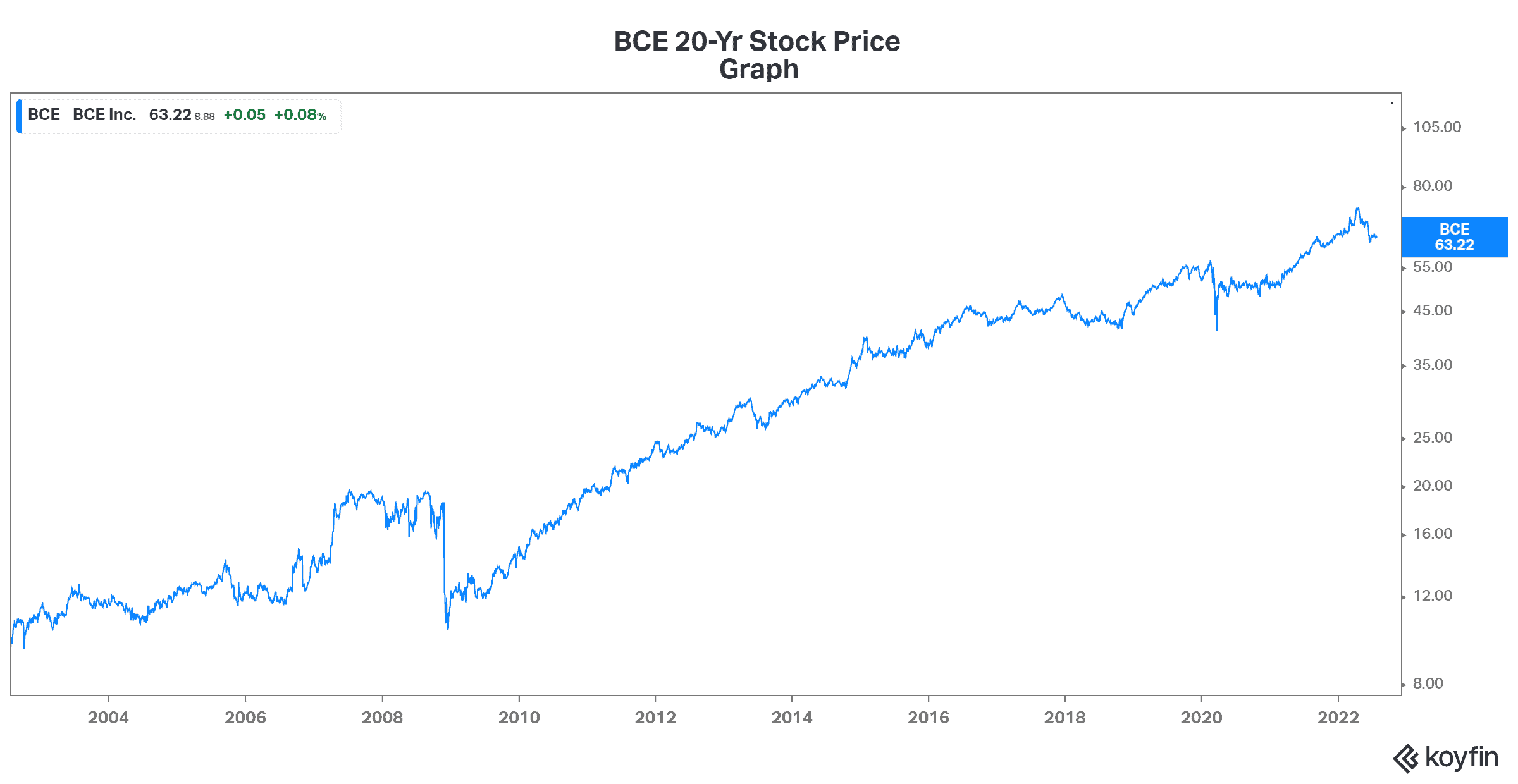

BCE has been connecting Canadians for decades … and rewarding its shareholders handsomely in the process

The second stock worth a look is BCE Inc. (TSX:BCE)(NYSE:BCE). BCE is Canada’s largest telecom company with world-class wireless and fibre networks. It has approximately 22 million subscribers. Also, its wireless footprint serves 99% of Canadians. This is a real competitive advantage that’s driven by its extensive reach.

BCE stock also behaves very differently than Air Canada stock. Air Canada has tumbled in the last two years, and it’s been volatile over the last few decades. On the contrary, BCE stock is steady. It has been steady for decades – shareholder returns in the form of dividends and capital gains have been phenomenal. See BCE’s stock price graph below for more colour on the magnitude of the capital gains that I’m referring to.

In short, BCE stock rose 140% in the last 20 years PLUS grew its dividend at a compound annual growth rate of 5.8% during this time.

Today, BCE is yielding a very generous 5.82%. This stock has been a great example of a low-risk stock that has generated solid shareholder returns over the years without the stressful volatility that we have seen in stocks like Air Canada.

The bottom line

A few months ago, I considered the question that had been and still is on many investors’ minds since pandemic restrictions were being lifted. Is Air Canada setting up for its stock price to take off? Even back then, I concluded that it was not. I feared that pandemic pressures were being replaced by economic and inflation pressures. All would serve to keep Air Canada stock down, in my view.

Instead, start dipping your toes in the stock market with the two top stocks listed in this article. Slow and steady wins the day – especially in uncertain times like we’re seeing today.