The Tax-Free Savings Account (TFSA) was introduced back in 2009, and since then, it’s unsurprisingly become an ultra-popular tool that Canadians use to save and invest their hard-earned capital.

According to Statistics Canada, as of 2019, 15.2 million Canadians had a TFSA, and over 22.3 million TFSAs exist because some investors have multiple accounts.

What’s noteworthy and slightly worrying is that of those 22.3 million TFSAs, 6.5 million holders did not contribute to their TFSAs in 2019. What’s even more interesting is that nearly 10 million TFSAs saw zero transactions in 2019.

There may be years that you don’t contribute, especially if you’re making a big purchase. But typically, if you’re using your TFSA to invest, you’ll likely want to make at least a few investments throughout the year, even if it’s just to reinvest dividend income.

Everyone’s preferences, risk tolerances, and financial situations are different. But generally speaking, the TFSA is an incredible tool that Canadians should maximize.

Yet many Canadians use TFSAs simply to hold cash or as a high-interest savings account. This is a crucial mistake. We only have so much contribution room in our TFSAs, and that’s because they should be used to invest your money.

Tax is one of the biggest investment-related considerations, and one of the main factors impacting profits. So when you can invest and grow your money tax-free, it’s a golden opportunity you’ll want to take advantage of.

Here are a couple of incredible long-term companies that Canadian investors have made a fortune on by simply buying and holding in their TFSAs.

Two of the top long-term Canadian stocks to own in your TFSA

One of the best long-term growth stocks that you can buy today at a massive discount is InterRent REIT (TSX:IIP-UN), a residential real estate stock that’s focused on growth.

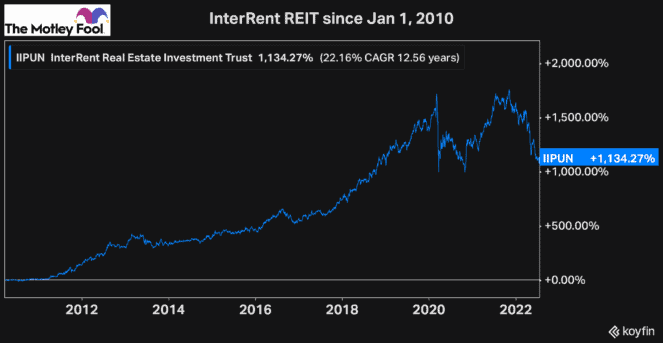

From 2010 to 2020, the price of InterRent REIT increased by over 1,400% or a compounded annual growth rate (CAGR) of more than 31%. And even after its massive selloff in the last few months, the REIT is still up by over 1,130% or a CAGR of more than 22%.

This demonstrates what a high-quality stock InterRent is, and how much potential it has if you own it long-term in a registered account like a TFSA.

The reason InterRent is such an exceptional stock is that it’s committed to consistently growing the value of its units and the cash flow they generate. The REIT pays a very small distribution and retains the rest of the cash to invest in growth.

It’s crucial to find high-quality stocks like InterRent for your TFSA and put your hard-earned capital to work.

In addition to InterRent, another high-quality, long-term stock to own in your TFSA is Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM).

Since 2010, Brookfield stock has risen over 650%, at a CAGR of more than 17%, which includes the significant pullback it experienced throughout 2022.

This massive financial manager is one of the best and most consistent companies you can buy. When Brookfield is trading cheap in this economic environment, not only is the stock attractive to buy, but it’s also getting more attractive by making high-value investments itself.

It’s crucial that Canadians use their TFSAs to invest rather than as savings accounts. More importantly, ensure you’re buying for the long haul and focusing on finding top-notch stocks like Brookfield and InterRent.