After the first half of the year, which was filled with tonnes of uncertainty in both the stock market and economy, this earnings season has been crucial to watch in order to find the best Canadian stocks you can buy.

When companies face challenging environments such as what we’re seeing today, the best and most resilient businesses will continue to find new ways to grow.

So, if you’re looking to find high-quality Canadian stocks to buy, here are three that posted impressive earnings this week and are performing well in this environment.

One of the best Canadian stocks to buy in the green energy industry

For years, Northland Power (TSX:NPI) has been one of the most impressive stocks in the green energy industry, and this week, it posted strong earnings again.

The stock reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $335.2 million for the second quarter, which is well ahead of the consensus estimate of $234.9 million. In addition, free cash flow per share of $0.63 was also an impressive result.

Northland had an excellent quarter, particularly thanks to strong performance from its renewable assets in Spain, which it acquired in August of last year. In addition, rising power prices across Europe drove a significant increase in revenue for Northland.

And thanks to this impressive quarter, the company increased its guidance for the full year, with EBITDA now expected to be between $1.25 billion and $1.35 billion. Plus, its free cash flow per share is now expected to be between $1.40 and $1.60 a share.

Northland has long been an incredible long-term growth stock to own, and this quarter was more evidence that it continues to be one of the best Canadian stocks to buy in the renewable energy industry.

A rapidly growing digital media company

Another Canadian stock that posted extremely strong earnings was VerticalScope Holdings (TSX:FORA).

VerticalScope is a digital media company that operates over 1,000 online communities that, in total, have over 100 million monthly active users. The company then uses these communities to generate advertising revenue and drive e-commerce sales.

This is a business with a tonne of potential in the medium and long term but has some uncertainty in the current high inflation and high interest rate environment. However, after VerticalScope significantly beat earnings this week, the stock is showing it can continue to operate in this environment.

Consolidated revenue in the quarter was $21.8 million compared to an estimate of $21.1 million. Even more impressive, though, was that it managed to continue reporting strong e-commerce sales, which accounted for $7.6 million of its consolidated revenue.

This all led to the stock reporting adjusted EBITDA of $9.3 million compared to the $8.6 million expected — a beat of more than 8%.

Therefore, if you’re looking for a micro-cap growth stock with a tonne of long-term potential, VerticalScope is one of the best Canadian stocks to buy now.

A top long-term growth stock

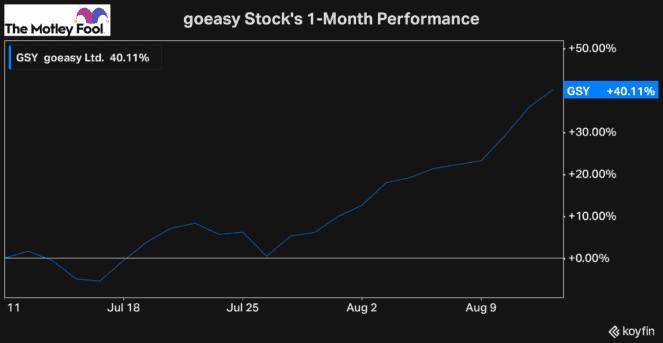

Lastly, one of the best Canadian growth stocks you can buy that’s been significantly undervalued for some time is goeasy (TSX:GSY). However, after again posting strong earnings and thanks to a bullish market environment, in just the last month, the stock has gained over 40%.

goeasy is a stock that offers many types of loans and financial services, primarily to borrowers who have below prime credit scores. This is a business with great long-term growth potential and excellent economics in normal operating environments.

However, when the economy is suffering, there is certainly the risk of increased charge-offs and significant hits to profitability. Therefore, it’s not necessarily surprising that the stock has been cheap for some time.

Despite this risk, though, and the current operating environment, goeasy continues to remind investors that it’s one of the best Canadian stocks you can buy.

In the second quarter, its earnings per share came in at $2.83 compared to expectations of $2.74. In addition, the stock saw record loan growth in the quarter while managing to continue to keep its charge-off rate within the range set out in its guidance.

Therefore, if you’re looking for high-quality Canadian growth stocks to buy and hold for years, goeasy continues to show investors what an impressive business it is.