It’s no secret that after the impressive bull market that followed the pandemic sell-off in early 2020, 2022 has been a much more challenging year for investors. However, anytime markets are impacted by uncertainty, it’s a great time to buy attractively valued stocks while they are cheap, such as InterRent REIT (TSX:IIP.UN).

InterRent is a residential real estate stock that owns properties in Ontario, Quebec and B.C. It’s a real estate investment fund that operates in one of the most defensive industries there is, but also a stock that has significant long-term growth potential.

So if you have cash sitting on the sidelines, and are looking to take advantage of this opportune environment, here are three reasons InterRent is one of the best stocks to buy now.

InterRent REIT is one of the best long-term growth stocks you can buy

First off, InterRent is one of the choice stocks you can buy now due to the fact that it’s such an incredible long-term growth stock. Not only does it have an impressive track record, growing its revenue and funds from operations by 45% and 62%, respectively, over the last five years, but the stock continues to focus on rapidly growing its operations.

InterRent is constantly looking at how it can grow both its income and net asset value for investors.

This includes acquiring new properties which it deems to be undervalued but also investing in upgrading the assets it already owns to maximize their value.

It’s no secret that 2022 has been a tough environment for residential real estate as interest rates have been rising rapidly.

However, InterRent is committed to its growth strategy and will even take short-term hits to its occupancy rate in order to ensure that it continues to grow its average monthly rents at an attractive pace.

Therefore, it’s one of the safer stocks that you can buy now due to its incredible growth potential combined with the fact that even if its occupancy rate declines slightly, the stock is still incredibly defensive.

The stock pays a growing and sustainable dividend distribution

Because InterRent is constantly growing its business, it should be no surprise that it’s also constantly increasing the dividend distribution that it pays to investors.

In fact, over the last five years, the distribution has increased at a compounded annual growth rate of 4.7%.

With that being said, though, in general, the yield it offers is still lower than that of the majority of its peers. However, while that may not sound ideal, it’s due to the fact that the REIT keeps more of its funds to invest in growth.

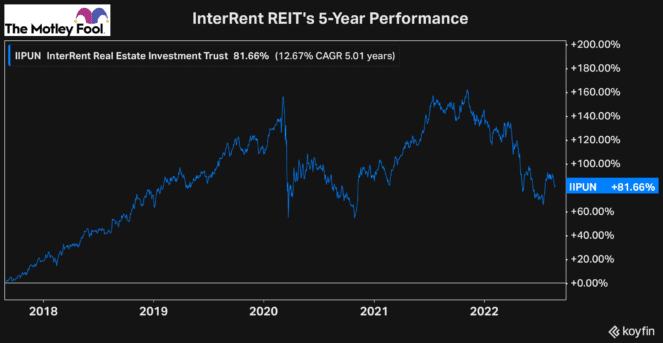

And given the fact that investors have earned a total return of over 80% in the last five years, even after its significant sell-off in 2022, it’s certainly one of the best stocks you can buy now.

It’s one of the cheapest stocks you can buy now

As you can see by the chart above, InterRent has sold off significantly this year, making it an opportune time for investors to buy the high-quality growth stock. But just looking at the chart doesn’t show how cheap InterRent actually is.

To get an idea of just how cheap InterRent is today and why it’s one of the best stocks you can buy now, we can see just how undervalued it trades relative to its historical valuations.

As of Wednesday’s close, the stock was trading at a forward price-to-funds-from-operations ratio of just 22.1 times. That’s extremely cheap for a high-quality growth stock like InterRent and well below its five-year average of 26.8 times.

Furthermore, the REIT is trading at roughly 0.8 times its net asset value. Meanwhile, just a little over a year ago, it traded at more than 1.1 times its estimated net asset value.

So while one of the best growth stocks in the real estate sector is trading at such an attractive discount, there’s no question that if you’ve been watching this stock, you may want to buy now.