The years since the pandemic hit have seen a digital explosion. Like it or not, the world is digitizing at a rapid pace. And it’s bringing all sorts of benefits. The energy industry has made many technological advancements over the years. But the digitization of the oilfield has just begun.

Pason Systems (TSX:PSI) is the leader in this area. It’s brimming with advancements. It’s also providing the oil patch with the many benefits of the digital age.

Pason Systems: Not your ordinary energy stock

The oil and gas industry is increasingly using web-based digitalization platforms. These platforms enable companies to manage, measure and track data coming in from the entire oilfield. This allows them to make predictive operational decisions in real time.

The technology includes sensors, telecommunications networks, simulation, and optimization. It also includes robotics. It enables advanced monitoring and computational processing capacity. The efficiencies provided by these digital technologies and the advanced analytics provided are significant. It gives management and operators unprecedented views into operations. It increases agility and supports better strategic decision making.

Pason is the leader in this area. Its Electronic Drilling Recorder (EDR) is a network of sensors, software, and displays. They provide real-time drilling data to rig site personnel. The data is transmitted from underground wells and reservoirs, giving operators invaluable information. This increases productivity, efficiencies, and lowers costs.

A top-notch company with a top-notch product

As good as Pason System’s products are, its operational and financial management are just as exemplary. While the company definitely suffered along with the rest during the difficult times, it’s well on its way to bigger and better things.

Today, Pason Systems has a market capitalization of $1.1 billion. It remains the market leader in its industry. Also, Pason has a very strong balance sheet, with no debt and $187 million in cash. Last quarter, revenue increase 59%. Also, margins are soaring. Simply put, automation and analytics are increasingly being used. It makes sense — it’s the natural progression of things.

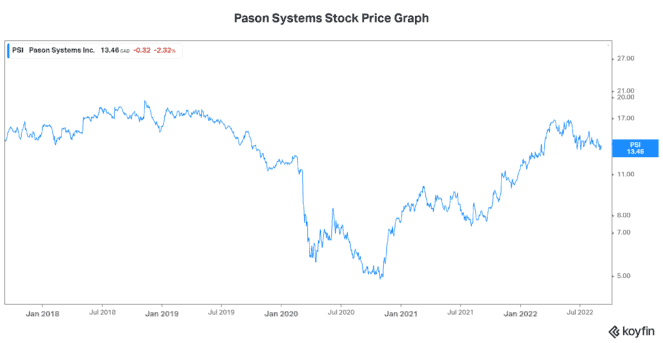

So, why has Pason Systems stock been slower to rise versus the rest of the energy stocks? And does this actually make it so much more compelling at this point? Well, I think Pason is lesser known than some of the other energy stocks. This is probably one reason why the stock has underperformed. But also, it’s taken some time for Pason to benefit from rising oil and gas prices — the relationship is not as immediate.

Earnings estimates are a good place to look to get a sense of the future. They’re not perfect, but they do reflect the experts’ opinions. Looking at Pason’s earnings estimates, I see that good things are expected for the company. For example, this year’s earnings per share (EPS) estimate is $0.97. That’s versus its 2021 EPS of $0.41 — more than doubling! Moreover, analysts’ EPS estimate for 2023 is $1.17 for a further 21% growth rate.

An attractive valuation makes Pason an attractive energy stock

Now, let’s move on to Pason’s valuation. The stock is actually looking quite attractive from a valuation perspective. The company achieves margins, cash flow growth, and return on equity that are far superior to other energy stocks. All of this implies that it should trade at a big premium valuation relative to its peers. In actuality, Pason’s price-to-earnings ratio is below that of its peers. Also, in my view, Pason’s price-to-book ratio of just over three times doesn’t accurately reflect its outperformance.