Let’s do a round up, shall we? Today, I’m going to cover five TSX stocks that are actually beating the market right now, and that’s saying something. The TSX today remains down by 6% year to date and 9.5% since mid-April. While the TSX is now climbing back up (it’s now up by 9% since July 14), there are other TSX stocks climbing even higher.

These are the ones I’d focus on.

Energy stocks

When it comes to energy stocks, there has been a solid recovery this year. Oil and gas prices are climbing, and this has led to energy stocks doing quite well among TSX stocks.

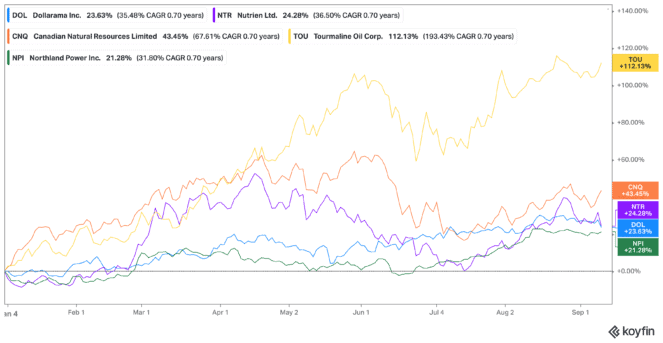

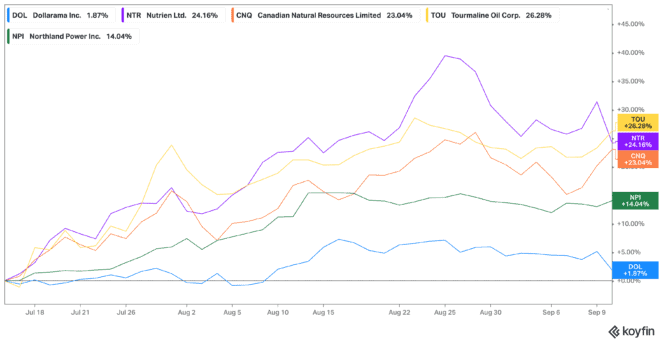

Some examples are Tourmaline Oil and Canadian Natural Resources. These companies are up by 26% and 23%, respectively, since July 14. Furthermore, Tourmaline stock is up by 114%, with CNQ stock up 43% year to date! This comes from a strong growth strategy for both companies, including acquisitions. That is why I would consider them above the other energy TSX stocks.

But then there’s also clean energy stocks like Northland Power that are doing well, too. This company should be on your radar, with shares up 21% year to date and 14% since the drop on July 14. As the company heads towards more deals and acquisitions in the clean energy sector, I would consider buying the stock.

Consumer products

I’ll cover two TSX stocks here — both for very different reasons. First, there’s Nutrien (TSX:NTR)(NYSE:NTR), which has had quite a year for its investors. It soared to all-time highs with sanctions against potash in Russia then dropped during the market correction. But now it’s a great buy yet again.

Nutrien stock is one of the TSX stocks that is growing through both acquisitions and organic growth. It’s buying up company after company to consolidate the fractured crop nutrient sector. Meanwhile, it’s growing its e-commerce business as well — all while making more deals with countries no longer using Russian products. And trading at 7.29 times earnings with shares up 24% since the fall, it’s a great buy today.

Then there’s Dollarama (TSX:DOL), which is always an excellent buy to fight back inflation. Dollarama stock manages to do well during downturns, as consumers look to cheaper products. But Dollarama stock has also upped its game, providing its always cheap products mixed with some higher-value ones. And with more same-store sales and growth, it’s a great buy with shares up by a steady 24% year to date.

Foolish takeaway

These are the top five TSX stocks I would consider right now that offer market-beating growth. But if I’m choosing two for long-term investing, it has to be Northland Power and Nutrien stock. Both these companies are set up for long-term growth far beyond today’s market downturn. Meanwhile, the other three may give investors a correction they didn’t bargain for.