There are a lot of cheap stocks out there right now, but not all of them are considered growth stocks. These are stocks that have potential for massive growth, and have already seen growth this year. So when it comes to these stocks, here are the three I’m going to keep buying over and over again.

Cameco

Cameco (TSX:CCO)(NYSE:CCJ) is a growth stock that became the centre of attention among Canadians when meme investors started paying attention to uranium stocks. But while all uranium stocks have climbed, Cameco stock deserves more attention than the others.

That’s because Cameco is one of the largest uranium producers in the world. What’s more, cheap Russian uranium hasn’t been available due to sanctions against the country. So this provides even more growth opportunity for Cameco as the world shifts to clean energy production.

Interest in nuclear energy as an alternative to oil is climbing. So much so, that a few months ago, the EU officially changed its rules for designating nuclear energy as “green energy,” citing the energy crisis. Adopted by 50 countries, nuclear energy is already one of the biggest power sources in the world, supplying 10% of global electricity generation.

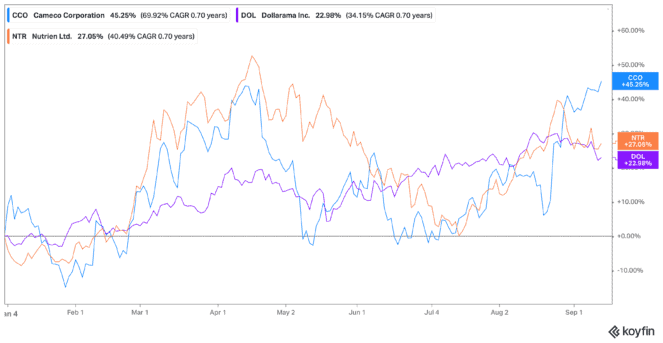

Shares of Cameco stock are up 44% year-to-date, with analysts believing the stock will continue to be one of the growth stocks that warrants attention for the next decade.

Dollarama

Dollarama (TSX:DOL) is another company I would consider among top growth stocks. It’s always been a great defensive play during times of peak inflation, and is a top performer in the consumer discretionary sector. Beyond that, the company has been actively expanding through new store locations, and acquisitions in Latin America.

Dollarama has also increased and diversified its product offerings as of late. The company has secured partnerships with brand names that customers know and love. Plus, it also now offers more “high end” items that cost more than a dollar, but are still cheap in comparison. Customers are responding favourably to this unique value proposition, and revenue continues to climb for Dollarama stock.

With shares up 23% year-to-date, a modest but safe 0.26% dividend, and analysts predicting more growth to come during this stressful market period, I would keep buying up Dollarama stock.

Nutrien

Finally, Nutrien (TSX:NTR)(NYSE:NTR) is the best deal for the best price, with some of the most impressive growth this year. Nutrien is a $61.5 billion fertilizer behemoth that plans to produce 18 million tonnes of fertilizer by 2025. While it’s come down from all-time highs, Nutrien stock is still an excellent choice for long-term investors, and the company has proven this over the last three years.

Arable land is becoming less and less available, and during the pandemic, farmers needed crop nutrients but lacked the means to purchase them. As a result, Nutrien expanded its e-commerce operations. With sanctions against Russia firmly intact, Nutrien has further expanded its operations through numerous acquisitions.

Crop nutrients will continue to be a long-term necessity in our increasingly globalized world. So with Nutrien stock trading at just 7.47 times earnings, and shares up 27% year-to-date, it’s a perfect consideration for your portfolio among growth stocks.