The TSX has been battered in 2022. This has provided investors with many opportunities. But it’s also given us cause for concern, as rampant inflation drives the market down. Add in rising interest rates, and we may be in for rough times ahead. Are there any solid picks on the TSX right now?

The answer is a resounding yes! There’s always an attractive buy somewhere on the TSX. Here are three of my top picks.

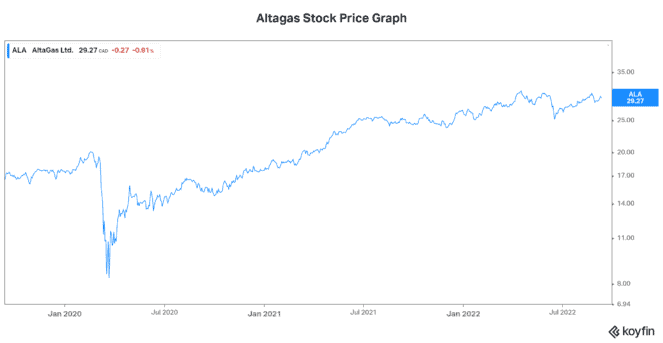

AltaGas: buy this TSX stock for its booming natural gas export business

AltaGas Ltd. (TSX:ALA) is an $8.2 billion North American energy infrastructure company. Its EBITDA (earnings before interest, taxes, depreciation, and amortization) is derived from two major segments, the utilities and midstream segments, both of which are benefitting from inflation.

Half of AltaGas’ EBITDA comes from its utilities segment. It’s highly regulated, therefore, its earnings are stable and predictable. The other half of the company’s EBITDA comes from its midstream segment. This segment owns the infrastructure that’s required to export Canadian natural gas and its by-products globally. This business is booming.

To illustrate the strength of AltaGas’ business, let’s look at its most recent quarterly results. EBITDA increased 7% and free funds from operations increased 8%. This quarter, the utilities segment was the main driver of growth. EBITDA in this segment increased 17% as a result of rate increases and new customers.

AltaGas’ midstream segment has also been very profitable in the last few years. It’s booming because of Asian demand for liquified petroleum gas. In the last three years, volumes have increased from zero to over 100,000 barrels per day (bpd). In the latest quarter, volumes increased 27% to a record 111,000bpd.

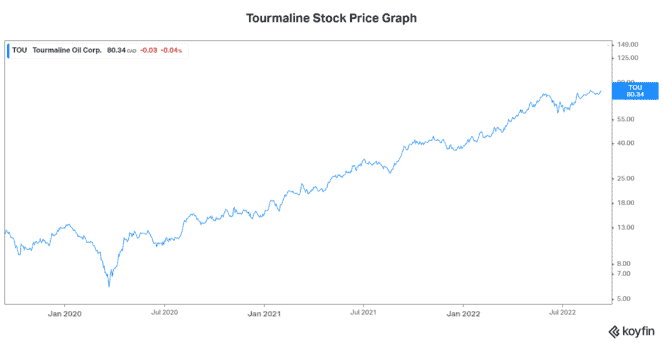

Tourmaline: the largest natural gas producer in Canada

Tourmaline Oil Corp. (TSX:TOU) is a Canadian mid-tier natural gas producer. It’s also the largest natural gas producer in Canada. Natural gas prices have been on an upswing for the better part of the last two years. In fact, they’ve risen more than 255% to over $8. This has taken natural gas producers like Tourmaline to a new level as they benefit from inflation.

Record cash flows and higher dividend payments have characterized Tourmaline’s results. Last quarter, Tourmaline reported operating cash flow of $1.35 billion, 137% higher versus last year. But the good news doesn’t stop here. The North American natural gas industry is finally opening up to global demand. This is possible due to export infrastructure, like that belonging to AltaGas.

Tourmaline has taken steps to benefit from expanding infrastructure and the soaring global demand for natural gas. For example, the company has a liquified natural gas (LNG) deal with the biggest LNG exporter in the U.S. This provides it with access to the Gulf Coast LNG export market. The deal gives Tourmaline exposure to JKM prices (the Northeast Asian LNG price), which remain very high (over $14).

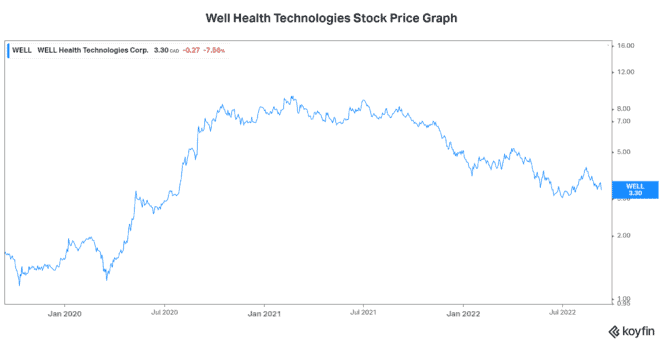

WELL Health Technologies: this stock is a bargain

The last stock to buy right now is WELL Health Technologies Corp. (TSX:WELL), an omni-channel digital health company. This stock differs quite a bit from the others I’m recommending. It was a high-flyer during the pandemic, but it has fallen hard since. Therein lies the opportunity: while the stock is 55% lower compared to one year ago, cash flows are soaring.

For example, in its latest quarter, WELL Health posted record revenue and cash flow. Revenue increased almost 130% to $140 million. Even more impressively, operating cash flow increased 450% to $33 million. These results illustrate the strong demand for digital health services. The drive to digitize the health care sector is a long time coming and it’s not going away anytime soon. WELL Health benefits from its leadership position in the industry, so I see good things ahead for this stock.

The Foolish takeaway

The TSX has fallen 7.4% in 2022, with many experts predicting more downside. The three TSX stocks that I think you should buy right now are relatively sheltered from this volatility and high inflation due to their strong fundamentals.