Gold is typically known as a safe-haven asset, and gold stocks like B2Gold (TSX:BTO)(NYSE:BTG) often see a significant price increase when uncertainty picks up, as it did at the start of the pandemic.

However, in 2022, although there is certainly a tonne of risk and uncertainty, the complex economic situation has seen gold prices, and, consequently, gold stocks actually lose value throughout the year.

For example, B2Gold stock is down roughly 10% year to date. However, since the stock peaked in mid-April, it’s down closer to 30%.

B2Gold’s selloff unsurprisingly has followed a selloff in gold prices, as does essentially every gold stock.

Both the price of gold and B2Gold stock started the year gaining value, but after several significant interest rate increases, the appetite for gold has weakened, allowing many gold stocks to trade ultra-cheaply.

Eventually, though, the price of gold has to bottom. At a certain point, it will become unprofitable for companies to produce gold, which would cause them to slow down their production, creating a major shortage of supply, which would cause the price of gold to rise.

So, we know that these stocks can’t fall forever. Furthermore, B2Gold is one of the lowest-cost producers you can buy. This is crucial because it allows the company to be highly profitable and pay a significant dividend when the price of gold is still reasonable. However, it also allows B2Gold to continue earning a profit longer than many competitors as the price of gold falls.

So, let’s look at just how cheap B2gold stock is today, where its price can go from here, and how much value it offers investors.

Just how cheap is B2Gold stock today?

As of Tuesday’s close, B2Gold stock was trading just under $4.50 a share, giving it a market cap of roughly $4.7 billion and, due to its significant net cash position, an enterprise value (EV) of just $4.2 billion.

The stock was trading roughly 30% off its highs and just about 15% off its 52-week low that it reached back on September 1.

This is the lowest that the stock has traded since the pandemic began. In addition, B2Gold stock trades at a more than 45% discount to its average analyst target price. And with its dividend now yielding upwards of 4.6%, that’s one of the highest yields it’s ever offered.

There’s no question that B2Gold is still attractive, but is the stock worth a buy at this price, or could it continue to sell off?

How much lower can gold and gold stocks fall?

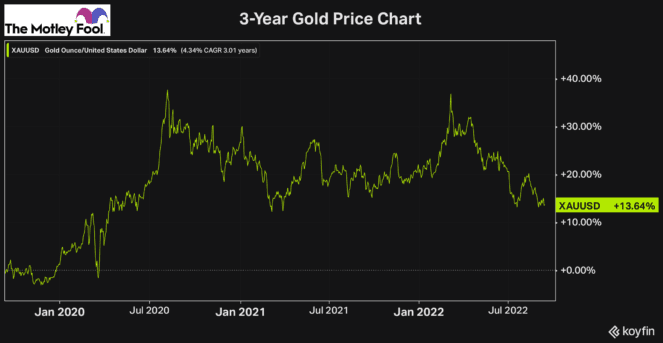

Predicting where gold prices can go from here is not that straightforward, particularly in this economic environment. However, with gold prices now at roughly US$1,700, this is essentially the bottom of gold’s trading range over the last two-and-a-half years.

In addition, we know that the most significant headwind gold faces today is rapidly rising interest rates. And eventually, the pace of these interest rates should slow, as inflation begins to come under control.

This could suggest that gold prices are close to bottoming. But even if they did fall further, does B2Gold stock offer enough value at this price to warrant a long-term investment?

Is B2Gold stock worth a buy at this price?

Predicting how any stocks will move in the short run, let alone gold stocks, is challenging. That’s why it’s much better to look for high-quality businesses that you can own for the long haul and buy them when they trade at attractive prices.

And when looking for a long-term investment, B2gold is one of the best stocks to buy now. I already mentioned how B2gold is one of the lowest-cost producers, which gives it a substantial competitive advantage.

Plus, at $4.50 a share, B2Gold trades at a forward EV to earnings before interest, taxes, depreciation and amortization (EBITDA) ratio of just 2.8 times. That’s unbelievably cheap and lower than its five- and 10-year averages of 4.8 and 6.6 times, respectively.

In addition, its dividend is only expected to have a payout ratio of just 44% this year, and B2Gold has more than $500 million of net cash on its balance sheet, making it ultra-safe.

Therefore, regardless of how the price of gold may trade over the next few months, B2Gold stock certainly looks like a compelling investment today.