As volatility has picked up this year, and many stocks have lost value, naturally, many Canadians have been looking to add defence to their portfolios. In addition, with capital gains hard to come by in this environment, dividend stocks and ETFs that can return passive income are some of the best to buy.

There are several safe and reliable stocks that pay a dividend for investors to buy now. But no matter how resilient a stock is, there is never no risk.

That’s why buying ETFs in this environment can be such a great idea. By gaining exposure to a whole portfolio of stocks, the diversification helps to reduce risk immensely. And if you look to buy ETFs that are made up of highly resilient stocks in the first place, these will be some of the best investments to buy for passive income.

So, if you’re looking for investment ideas ahead of 2023, here are two of the best ETFs to buy for passive-income seekers today.

One of the top ETFs that can protect your capital

In this environment, with inflation soaring and a potential recession on the horizon, earning passive income is highly attractive. However, first and foremost, we also want to make sure our capital is protected until the market and economy can start growing again.

That’s why some investors may want to consider one of the best ETFs to buy now: BMO Low Volatility Canadian Equity ETF (TSX:ZLB).

ZLB is one of the safest investments you can make, considering it has a diversified portfolio of some of the most resilient stocks on the market. And, of course, it pays a dividend yield. However, with a yield of just 2.65% today, the primary reason to buy this ETF is for safety.

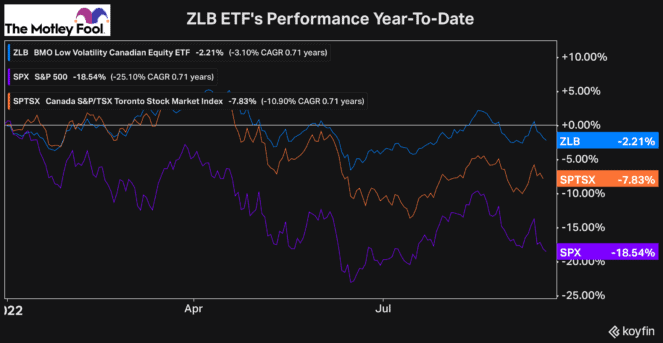

So far, throughout 2022, as the TSX has declined by almost 8%, the S&P 500 south of the border has lost over 18%, yet the ZLB is down less than 3%. This goes to show how well it protects investors’ capital and why it’s one of the best ETFs to buy in this market environment.

With exposure to some of the safest sectors, such as financial services, utilities, and consumer defensives, it’s no wonder why the ETF has been so resilient all year long.

Plus, the fact that it pays a dividend while also protecting your capital makes it one of the best ETFs to buy in this environment.

One of the best ETFs to buy now for passive income

Another ETF to buy now is BMO Canadian Dividend ETF (TSX:ZDV), which is slightly less resilient, yet it’s still incredibly safe. Furthermore, for investors looking to earn a tonne of passive income, this is one of the best ETFs to buy, as it currently offers a yield of roughly 4.3%.

The reason that the ZDV offers a higher yield than the low-volatility ETF is that the fund owns more dividend payers with higher yields. This is why it can’t be considered as reliable, even though it’s still one of the safest and best ETFs you can buy today.

And so far this year, the ZDV ETF has performed just as well and actually slightly better than the ZLB ETF, with a total return that’s roughly flat. This is due to the significant increase in demand for dividend stocks in 2022 as well as the fact that many of the holdings are quite similar.

Financial services, utilities, and consumer staples are, again, three of the largest sectors the ETF is allocated to, although it also has significant exposure to high-potential energy stocks.

Therefore, if you’re looking to boost your passive income and find ETFs that you can rely on through this market environment, there’s no question that the ZDV is one of the best ETFs that you can buy now.