Dividend stocks are great assets to hold during times of stock market volatility. While the market might be going down, you can at least collect a stream of quarterly or monthly dividends to offset any temporary losses in your portfolio.

Who knows what will happen with interest rates, geopolitics, or the economy? However, these three Canadian dividend stocks are pretty safe bets if you just want a reliable stream of income.

An energy stock for dividends

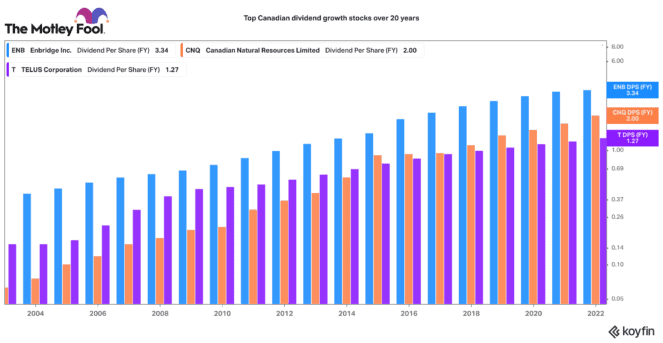

While Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) operates in the cyclical oil and gas industry, it has been a dividend rock star for years. For the past 22 years, CNQ has grown its dividend on average by 22% a year! Not many Canadian stocks have that history.

CNQ stock has pulled back recently, as has the price of oil. Fortunately, CNQ can still fund its dividends and operations, even if oil trades at US$30 per barrel. It is an incredibly efficient energy operator, and its assets are long term and sustainable.

That means its current 4.71% dividend yield should be reliable, safe, and likely growing for several years ahead.

A top infrastructure stock with an outsized dividend

If you aren’t comfortable with direct oil pricing risk, Enbridge (TSX:ENB)(NYSE:ENB) could be a stock with relatively lower risk but a higher yield. After declining 8.8%, its stock is yielding a 6.7% dividend. It has raised its annual dividend for 27 consecutive years. That’s a pretty good track record.

Despite the price of oil declining, Enbridge’s portfolio of pipelines, export terminals, and utilities are mostly contracted. 80% of its businesses have inflation indexation. Likewise, it gets volume upside when energy demand is high (like it is today).

Enbridge has a healthy growth pipeline of natural gas, utility, and renewable power projects. This sets it up perfectly for the coming energy transition, and that is why it’s a great dividend stock to own now and long into the future.

A top telecom for steady income and growth

TELUS (TSX:T)(NYSE:TU) is another great Canadian dividend-growth stock. It has grown its dividend by an 8.6% annual rate for the past 15 years. After an 11% decline this month, it is trading with a 4.77% dividend yield.

TELUS is one of Canada’s leading telecommunications service providers. Yet it is also making strong in-roads into various digital services like virtual health, agriculture technology, and digital customer experience/artificial intelligence.

The company continues to post market leading customer additions and above average earnings and dividend growth. After completing an outsized capital spend, TELUS is expecting to earn very high levels of spare cash.

With that it plans to boost its dividend by 7-10% annually for several years ahead. For a combination of income, growth, and an attractive valuation, TELUS is a great dividend stock to buy today.

The dividend stock takeaway

If you are looking for passive income, now is the perfect time to load up on dividend stocks. These three all have strong business models, well-covered dividends, and dividend growth ahead. They are perfect stocks to weather the recent stock market and economic storm.