Canadian energy stocks have seriously outperformed in 2022. However, that trend could be unravelling. Oil prices have fallen 33% from US$120 per barrel to US$80 per barrel today.

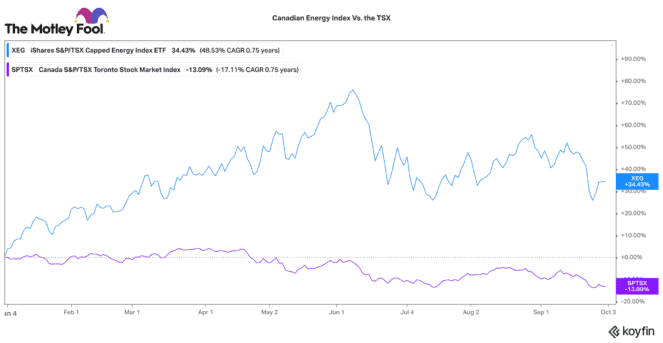

So far, many Canadian energy stocks have held up relatively well. The S&P/TSX Capped Energy Index remains up 34.4% this year. That is compared to the broader S&P/TSX Composite Index, which is down -13%.

Forget the pullback – Here are reasons to be bullish on Canadian energy stocks

Despite the recent pullback, Canadian energy stocks continue to look attractive for several reasons. Firstly, oil supply is very tight right now. Years of underinvestment in energy production is leading to a structural deficit globally. Factors like the war in Ukraine, geopolitical tensions, and ESG activism only make this worse.

Secondly, years of low oil prices have forced Canadian energy companies to drastically lower their cost structure, increase efficiencies, and reduce debt. Many top energy companies can sustain their operating plans and maintain their dividends for US$40 per barrel or less. Anything above that is excess cash that the company can use to reinvest or give back to shareholders.

Pointing to the fact that Canadian energy stocks are earning a mountain of cash even at current prices, Canadian energy bull, Eric Nuttall recently Tweeted, “Every day above $80WTI is a great day.” Given the dynamic of sustained energy prices, strong cash flows, and improving balance sheets, Canadian energy stocks look like a great place to invest.

CNQ: A top Canadian dividend stock

If you are looking for smart, low-risk exposure to the sector, Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is the ideal stock. With a market cap of $74 billion, it the largest Canadian energy company.

Despite operating in a cyclical industry, CNQ has an incredible track record of paying growing dividends to shareholders. For 22 years, it has grown its base dividend by an average annual rate of 22%!

Right now, its stock pays a $0.75 quarterly dividend that equals a 4.67% dividend yield. That doesn’t factor in the $1.50 per share special dividend it paid in August either.

CNQ has exceptional, long-life assets, an extremely efficient operating model, and a market-leading management team. All these factors combine to make it a real contender for larger dividend payouts and stock upside if strong oil prices persist.

Tamarack Valley: A cheap Canadian energy stock with upside torque

With a market cap of only $1.8 billion, Tamarack Valley Energy (TSX:TVE) is an interesting small-cap Canadian energy stock. It is higher risk, but also has higher torque for capital upside. Its stock is down -1.6% in 2022, but up 18.8% over the past 52-weeks.

Tamarack trades with a 3.17% dividend today. However, it plans to increase its base dividend 25% after completing the Deltastream acquisition in November. After the acquisition, Tamarack will be a production leader in one of the most economic and efficient plays in Western Canada.

Right now, this Canadian energy stock is cheap. CNQ is trading for only 3.4 times free cash flow and earnings. If oil prices recover over the winter, it could have some serious upside ahead.

The bottom line

Canadian energy stocks are incredibly cheap and gushing tonnes of spare cash. Buy large-cap names for solid dividend growth or smaller cap stocks for significant capital upside. The recent oil pullback might be the perfect chance to dip your feet.