Every market sell-off has historically been an opportunity to buy high-quality stocks at discounted prices, but the current bear market feels like a crisis. And it’s psychologically hard to buy stocks during a crisis. However, some defensive, high dividend growth stocks offer strong value propositions that may boost the “buy-the-dip” confidence right now, and TELUS Corporation (TSX:T)(NYSE:TU) stock looks more exciting today after a recent decline.

Following a recent 8% drop in TELUS stock during the past month, the dividend yield on this growing telecommunications giant has been reset higher. It’s now at levels last seen during the height of the pandemic when investors panic-sold financial assets. But that’s not all.

TELUS is a growth stock with valuable defensive assets and a growing quarterly dividend that is increased on a bi-annual basis. This stock should belong to any long-term-oriented retirement savings plan and investment portfolio, and fits into any investing strategy. Here’s why.

TELUS is still a growth stock

TELUS Corporation is leveraging its legacy telecommunications assets and 5G network rollouts to grow some formidable businesses on the side. Innovative business lines have become a source of new growth opportunities, while legacy telecom operations provide stable cash flows for dividend growth, share repurchase, and accretive acquisitions.

The company’s 7.1% revenue growth reported for the second quarter may seem just average. However, TELUS’s investments in healthcare (TELUS Health), its forays into IT services, and its establishment of an agriculture and consumer goods segment are new growth drivers that investors shouldn’t ignore or discount.

For example, TELUS Health added 1.4 million new subscribers to its virtual care services in just 12 months leading up to June 2022 – a 63% annual growth. The company’s healthcare programs covered 22.4 million people at the end of the second quarter of this year, a growth of 4.3 million in the year. The recent $2.3 billion acquisition of LifeWorks should add new growth opportunities to the health business line.

TELUS International’s operating revenue surged 22% and the segment’s adjusted earnings before interest, taxes, depreciation, and amortization (Adjusted EBITDA) increased 37% year-over-year during the second quarter due to higher customer adoption rates, and new client wins.

Most noteworthy, the company’s agriculture and consumer goods business line grew revenue by 40% year-over-year during the second quarter. Revenue from this segment is largely in United States dollars, and the current strength in USD currency could lift sales higher during the second half of 2022.

Growth in TELUS’s revenue is accompanied by strong double-digit earnings growth and expansions in Adjusted EBITDA. Wall Street analysts expect TELUS to grow revenue by 9.7% during the next year, and they estimate a strong earnings growth of 15.3% annually over the next five years.

Watch the juicy dividend

TELUS is a dependable dividend growth stock that has been a valuable income provider to several pension portfolios in Canada. The stock’s current dividend yield rarely surpasses the 5% mark during normal economic times.

In the past 10 years, the dividend yield received a bump after the pandemic-induced market sell-off, but it didn’t stay higher for long. However, due to consistent bi-annual dividend growth, and a recent drop in share price, shares spot a 5.03% annualized dividend yield right now.

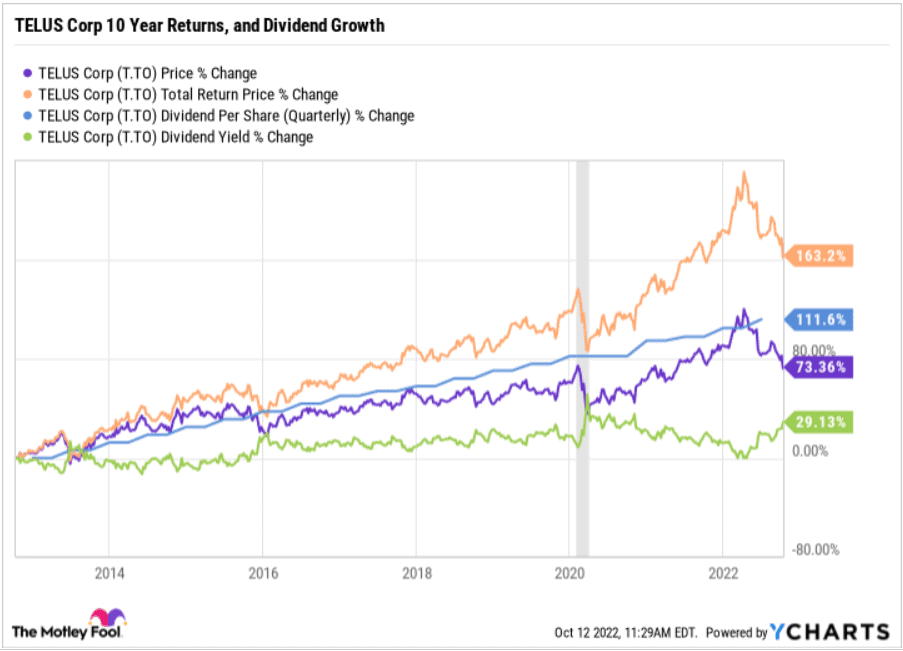

Historically, dividend yields this high on T stock have been bonus offerings to long-term-oriented dividend growth investors who wished to deploy new capital. Over the past decade, the TELUS dividend increased by 111%, and shareholder returns increased from 73% to more than 163%.

Any future dips on TELUS stock will be exciting buying opportunities on a defensive stock that consistently grows its dividends.