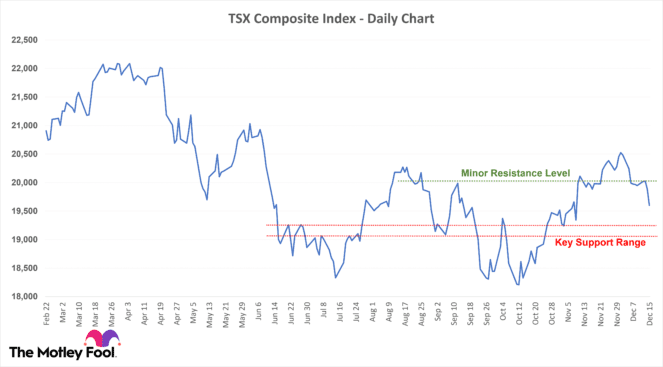

The market selloff in Canada gained steam on Thursday, as investors feared that the Federal Reserve’s continued monetary tightening next year would probably push the economy into a recession. Also, much weaker-than-expected latest monthly retail sales and manufacturing numbers from the U.S. market added pessimism.

As a result, the S&P/TSX Composite Index tanked by 291 points, or 1.5%, from its previous closing to settle at 19,601, posting its biggest single-day losses in five weeks. While recession fears drove a massive selloff in healthcare, technology, industrial, and consumer noncyclical sectors, shares of mining and energy companies also tumbled with sharp declines in the commodity market.

Top TSX movers and active stocks

Shares of TransAlta Renewables (TSX:RNW) crashed by 17% for the session to $11.91 per share after announcing its dismal 2023 outlook and an update on its long-term growth plans. The Canadian renewable power firm expects its 2023 adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) to witness a minor rise over its 2022 guidance to be in the range of $495 to $535 million. TransAlta Renewables also cautioned investors that rapidly rising interest rates and growing competition is increasingly making it challenging for it to pursue assertive transactions. After this sharp selloff, RNW stock now trades with 36.5% year-to-date losses.

First Quantum Minerals, Ivanhoe Mines, and Canopy Growth were also among the worst-performing stocks on the Toronto Stock Exchange yesterday, as they tanked by more than 7% each.

On the positive side, NFI Group, Algonquin Power & Utilities, Denison Mines, and Northland Power rose by at least 2.4% each, making them the top-performing TSX stocks for the day.

Based on their daily trade volume, Suncor Energy, Algonquin Power & Utilities, Barrick Gold, and Bank of Nova Scotia were the most active stocks on the exchange.

TSX today

Early Friday morning, commodity prices across the board extended their yesterday’s losses, pointing to a lower open for the main TSX index today. While no key economic releases are due this morning, investors may continue to react to recent macroeconomic developments, including the U.S. Fed’s hawkish statement, indicating more rate hikes in 2023 and growing concerns about a looming recession. Although these factors are likely to keep stocks volatile with a downward bias, long-term investors may want to hunt for value-buying opportunities in fundamentally strong TSX stocks amid the ongoing selloff.